3882 S 1605 W Unit 205 West Valley City, UT 84119

Redwood NeighborhoodEstimated Value: $413,000 - $455,721

3

Beds

3

Baths

2,145

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 3882 S 1605 W Unit 205, West Valley City, UT 84119 and is currently estimated at $428,180, approximately $199 per square foot. 3882 S 1605 W Unit 205 is a home located in Salt Lake County with nearby schools including Granger Elementary School, Valley Junior High School, and Granger High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 18, 2022

Sold by

Alexandria Vargas

Bought by

Vargas Alexandria and Fiorelli Antony

Current Estimated Value

Purchase Details

Closed on

Dec 5, 2019

Sold by

Walden Oscar D and Walden Tina

Bought by

Vargas Alexandria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$282,783

Interest Rate

3.75%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 15, 2016

Sold by

Walden Oscar D

Bought by

Walden Oscar D and Walden Tina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,260

Interest Rate

3.75%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vargas Alexandria | -- | Old Republic Title | |

| Vargas Alexandria | -- | Metro National Title | |

| Walden Oscar D | -- | Magellan Title Insurance Age |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Vargas Alexandria | $282,783 | |

| Previous Owner | Walden Oscar D | $216,260 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,758 | $446,800 | $59,500 | $387,300 |

| 2024 | $2,758 | $422,600 | $56,600 | $366,000 |

| 2023 | $2,718 | $398,600 | $54,400 | $344,200 |

| 2022 | $2,678 | $393,900 | $53,300 | $340,600 |

| 2021 | $2,360 | $312,000 | $41,000 | $271,000 |

| 2020 | $2,179 | $271,800 | $37,300 | $234,500 |

| 2019 | $2,189 | $263,400 | $37,300 | $226,100 |

| 2018 | $2,094 | $242,800 | $37,300 | $205,500 |

| 2017 | $1,868 | $220,300 | $36,000 | $184,300 |

| 2016 | $796 | $94,100 | $46,200 | $47,900 |

Source: Public Records

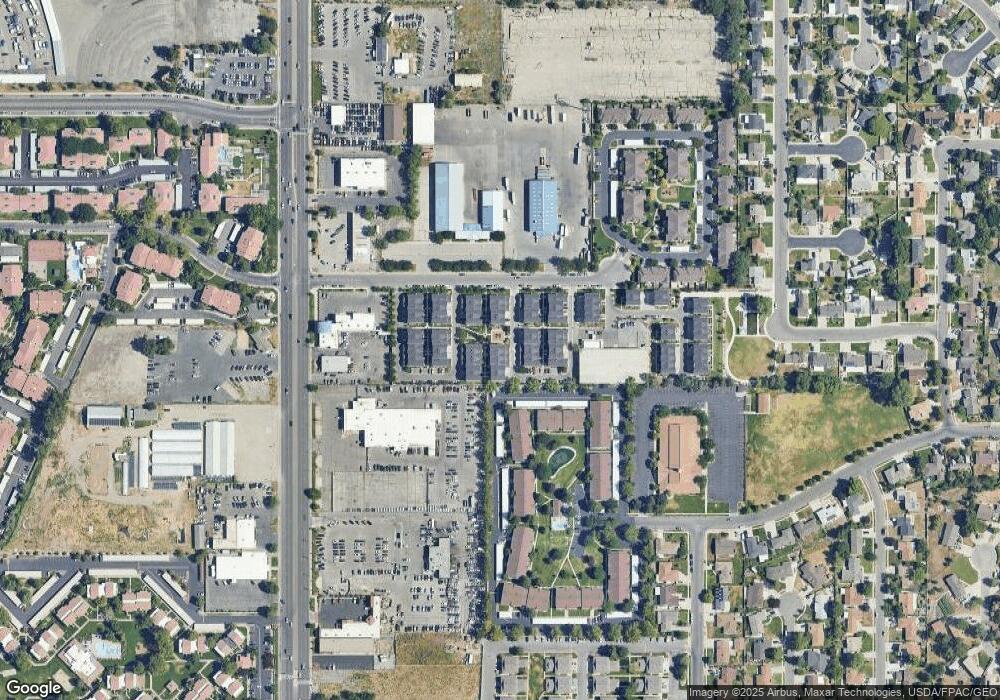

Map

Nearby Homes

- 3883 S 1605 W

- 3888 S 1530 W Unit 240

- 3821 S Kingsbury Ln Unit B2

- 3987 S 1500 W

- 1461 W Parliament Ave

- 3858 Congress Dr

- 1651 Calvo Dr Unit 28

- 1657 Calvo Dr Unit 29

- 3694 S Crespi Ct #F S

- 3973 S Pharaoh Rd

- 3699 Angelico Ct Unit D

- 1854 W 4100 S

- 1513 W Kingsbarn Way

- 4148 S Oak Meadows Dr Unit 31

- 1587 W Kinloch Way

- 1573 W Kinloch Way

- 1472 Olive St

- 1547 W Kinloch Way

- 1284 Canary St Unit 221

- 1268 W Chickadee St Unit 61

- 3884 S 1605 W Unit 206

- 3884 S 1605 W

- 3882 S 1605 W

- 3888 S 1605 W Unit 207

- 3888 S 1605 W

- 3890 S 1605 W Unit 208

- 3892 S 1605 W Unit 209

- 3885 S 1630 W

- 3887 S 1630 W Unit 126

- 3883 S 1630 W

- 3883 S 1605 W Unit 211

- 3887 S 1605 W Unit 210

- 3881 S 1605 W Unit 212

- 3881 S 1605 W

- 3889 S 1630 W Unit 127

- 1579 W 3860 S

- 3891 S 1630 W

- 3874 S 1605 W Unit 204

- 3879 S 1605 W Unit 213

- 3877 S 1605 W Unit 214