3883 Oakbrook Ln Unit 3883 Powell, OH 43065

Liberty Township NeighborhoodEstimated Value: $322,000 - $365,948

3

Beds

3

Baths

1,597

Sq Ft

$213/Sq Ft

Est. Value

About This Home

This home is located at 3883 Oakbrook Ln Unit 3883, Powell, OH 43065 and is currently estimated at $339,987, approximately $212 per square foot. 3883 Oakbrook Ln Unit 3883 is a home located in Delaware County with nearby schools including Scioto Ridge Elementary School, Olentangy Liberty Middle School, and Olentangy Liberty High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2004

Sold by

Sproul David E

Bought by

Jakimowicz Patricia A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Outstanding Balance

$58,059

Interest Rate

4.75%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$281,928

Purchase Details

Closed on

Jul 27, 2001

Sold by

Vaneman Rosemary

Bought by

Sproul David E

Purchase Details

Closed on

Sep 3, 1999

Sold by

Edwards David S

Bought by

Vaneman Rosemary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.59%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 24, 1994

Sold by

Trst Donald R Kenney

Bought by

Edwards David S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,500

Interest Rate

8.72%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jakimowicz Patricia A | $160,800 | Title First Agency Inc | |

| Sproul David E | $135,000 | -- | |

| Vaneman Rosemary | $126,500 | -- | |

| Edwards David S | $107,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jakimowicz Patricia A | $125,000 | |

| Previous Owner | Vaneman Rosemary | $100,000 | |

| Previous Owner | Edwards David S | $106,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,645 | $88,660 | $19,780 | $68,880 |

| 2023 | $4,664 | $88,660 | $19,780 | $68,880 |

| 2022 | $4,691 | $70,710 | $14,110 | $56,600 |

| 2021 | $4,720 | $70,710 | $14,110 | $56,600 |

| 2020 | $4,743 | $70,710 | $14,110 | $56,600 |

| 2019 | $3,567 | $55,440 | $12,250 | $43,190 |

| 2018 | $3,583 | $55,440 | $12,250 | $43,190 |

| 2017 | $3,278 | $48,370 | $9,450 | $38,920 |

| 2016 | $3,328 | $48,370 | $9,450 | $38,920 |

| 2015 | $3,010 | $48,370 | $9,450 | $38,920 |

| 2014 | $3,051 | $48,370 | $9,450 | $38,920 |

| 2013 | $3,049 | $47,250 | $9,450 | $37,800 |

Source: Public Records

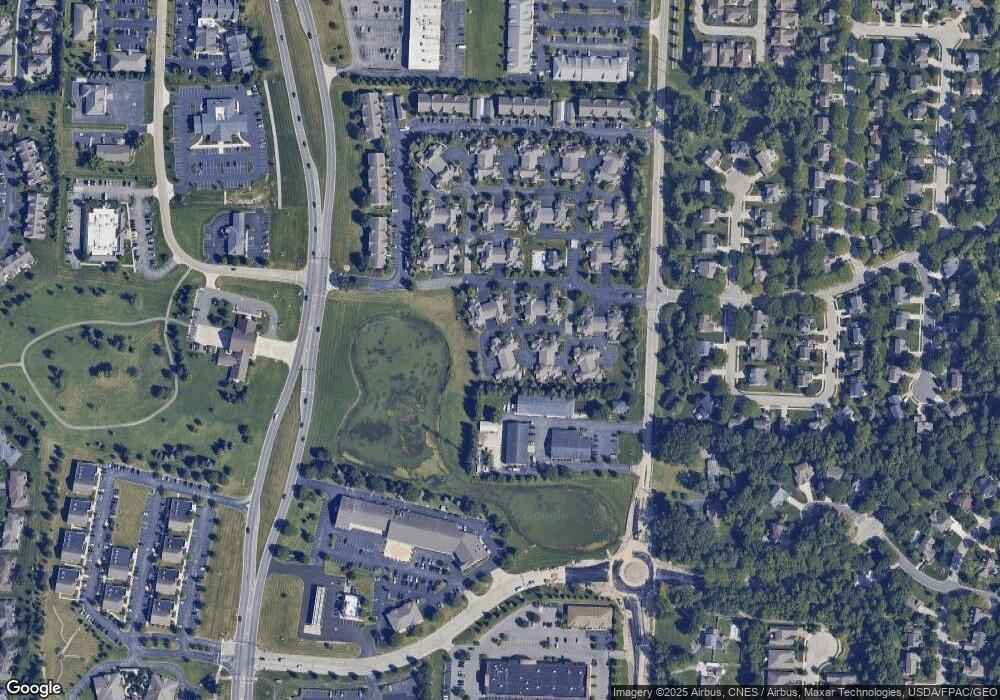

Map

Nearby Homes

- 255 Winter Hill Place

- 10053 Juliana Cir Unit 10053

- 524 Commons Dr Unit 524

- 10010 Beckford Ct

- 87 Murphys Oval Unit N87

- 261 Andover Dr

- 274 Stamford Dr

- 11 Murphys View Place

- 9458 Clermont Blvd

- 91 Tiller Dr

- 3899 Hampshire Ave

- 9406 Cadogan Ct

- 67 Traditions Way

- 4933 Emerald Lakes Blvd Unit 4903

- 9529 Wayne Brown Dr

- 4162 Pyke Dr

- 1937 Liberty St

- 2020 Liberty St

- 4840 Paddington Way

- 55 Timber Oak Ct

- 3881 Oakbrook Ln

- 3885 Oakbrook Ln Unit 3885

- 3887 Oakbrook Ln Unit 3887

- 3893 Oakbrook Ln

- 3895 Oakbrook Ln

- 3873 Oakbrook Ln Unit 3873

- 3874 Oakbrook Ln

- 3891 Oakbrook Ln

- 3897 Oakbrook Ln

- 3871 Oakbrook Ln Unit 3871

- 3876 Oakbrook Ln

- 3875 Oakbrook Ln

- 3872 Oakbrook Ln Unit 3872

- 3870 Oakbrook Ln Unit 3870

- 3861 Oakbrook Ln Unit 3861

- 3863 Oakbrook Ln

- 3853 Oakbrook Ln

- 3865 Oakbrook Ln Unit 3865

- 3851 Oakbrook Ln

- 3932 Sandstone Cir