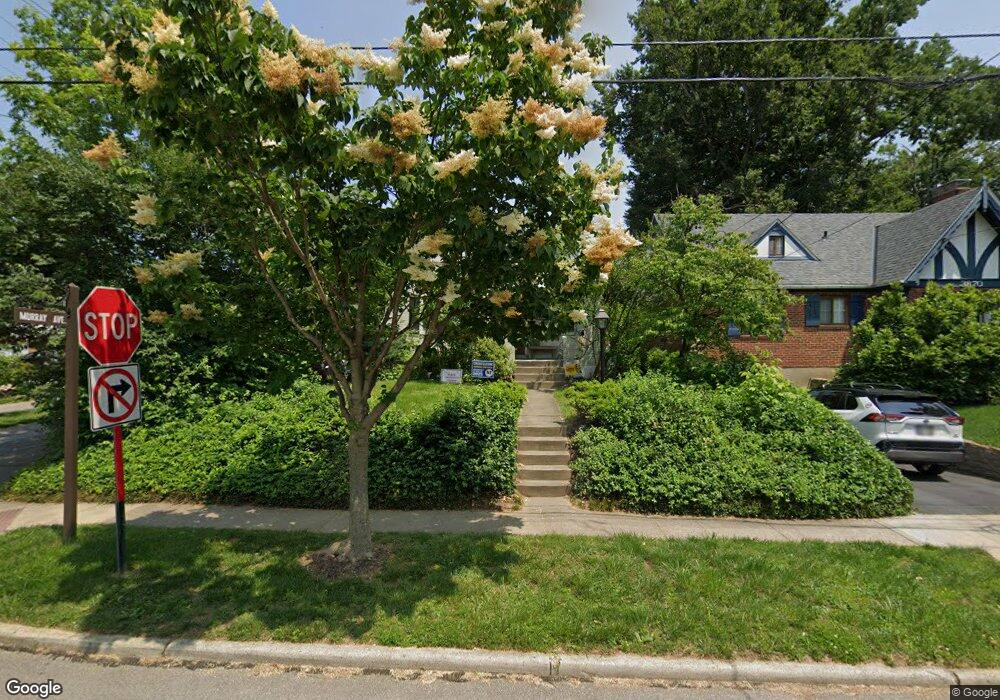

3886 Settle Rd Cincinnati, OH 45227

Estimated Value: $330,000 - $380,000

4

Beds

3

Baths

928

Sq Ft

$382/Sq Ft

Est. Value

About This Home

This home is located at 3886 Settle Rd, Cincinnati, OH 45227 and is currently estimated at $354,555, approximately $382 per square foot. 3886 Settle Rd is a home located in Hamilton County with nearby schools including Terrace Park Elementary School, Mariemont Elementary School, and Mariemont Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 12, 2002

Sold by

Lenihan Stephen B and Lenihan Judith A

Bought by

Collister Scott E and Collister Merret W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,160

Outstanding Balance

$60,296

Interest Rate

7.13%

Mortgage Type

Unknown

Estimated Equity

$294,259

Purchase Details

Closed on

Nov 26, 2001

Sold by

Haines Stephanie L

Bought by

Lenihan Stephen B and Lenihan Judith A

Purchase Details

Closed on

Oct 21, 1999

Sold by

Shelly Whitehead Bishop

Bought by

Haines Stephanie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,000

Interest Rate

7.37%

Purchase Details

Closed on

Mar 12, 1997

Sold by

Addicott Gertrude L

Bought by

Whitehead Bishop Shelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

7.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Collister Scott E | $185,200 | Ati Title Agency Of Ohio Inc | |

| Lenihan Stephen B | $136,500 | Technetitle Agency Inc | |

| Haines Stephanie L | $113,000 | -- | |

| Whitehead Bishop Shelly | $87,000 | Vintage Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Collister Scott E | $148,160 | |

| Closed | Haines Stephanie L | $72,000 | |

| Previous Owner | Whitehead Bishop Shelly | $75,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,510 | $92,379 | $41,979 | $50,400 |

| 2024 | $6,363 | $92,379 | $41,979 | $50,400 |

| 2023 | $5,869 | $92,379 | $41,979 | $50,400 |

| 2022 | $6,312 | $84,161 | $34,657 | $49,504 |

| 2021 | $6,161 | $84,161 | $34,657 | $49,504 |

| 2020 | $6,224 | $84,161 | $34,657 | $49,504 |

| 2019 | $5,984 | $73,826 | $30,401 | $43,425 |

| 2018 | $5,981 | $73,826 | $30,401 | $43,425 |

| 2017 | $5,091 | $73,826 | $30,401 | $43,425 |

| 2016 | $4,842 | $69,423 | $25,729 | $43,694 |

| 2015 | $4,892 | $69,423 | $25,729 | $43,694 |

| 2014 | $4,896 | $69,423 | $25,729 | $43,694 |

| 2013 | $4,060 | $60,368 | $22,372 | $37,996 |

Source: Public Records

Map

Nearby Homes

- 6208 Bancroft St

- 6576 Wooster Pike

- 4207 Simpson Ave

- 3645 Birkdale Ln

- St Martin Plan at Birkdale

- 3674 Birkdale Ln

- 3662 Birkdale Ln

- 6017 Bramble Ave

- 6022 Bramble Ave

- 4424 Simpson Ave

- 6001 Bramble Ave

- 4511 Homer Ave

- 6225 Roe St

- 6518 Roe St

- 3806 Southern Ave

- 4609 Winona Terrace

- 4003 Berwick Ave

- 4400 Whetsel Ave

- 5810 Arnsby Place

- 4610 Simpson Ave

- 3870 Settle Rd

- 3868 Settle Rd

- 3867 Homewood Rd

- 3865 Homewood Rd

- 3866 Settle Rd

- 3863 Homewood Rd

- 6502 Murray Ave

- 3871 Settle Rd

- 3869 Settle Rd

- 3859 Homewood Rd

- 4112 Settle St

- 3864 Settle Rd

- 3867 Settle Rd

- 6512 Murray Ave

- 4105 Settle St

- 3857 Homewood Rd

- 3865 Settle Rd

- 6520 Murray Ave

- 4109 Settle St

- 4116 Settle St