3891 Inverness Cir Unit 3891 Dublin, OH 43016

Estimated Value: $312,000 - $326,000

2

Beds

3

Baths

1,426

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 3891 Inverness Cir Unit 3891, Dublin, OH 43016 and is currently estimated at $319,685, approximately $224 per square foot. 3891 Inverness Cir Unit 3891 is a home located in Franklin County with nearby schools including Albert Chapman Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 20, 2024

Sold by

Village At Inverness Condominium

Bought by

City Of Dublin Ohio

Current Estimated Value

Purchase Details

Closed on

Oct 17, 2012

Sold by

6685 Sawmill Road Llc Co

Bought by

Whittingham Capital Llc Co

Purchase Details

Closed on

Dec 9, 1999

Sold by

Rinehart Sharon L and Rinehart Jeffrey S

Bought by

Wiley Walter R T and Wiley Linda R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,200

Interest Rate

7.87%

Purchase Details

Closed on

May 30, 1996

Sold by

Nevin William G

Bought by

Sharon L Rinehart

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

7.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 14, 1994

Sold by

Bell James J

Bought by

Nevin William G and Nevin Rebecca A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

8.44%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| City Of Dublin Ohio | $150,600 | None Listed On Document | |

| Whittingham Capital Llc Co | $1,875,000 | None Available | |

| Wiley Walter R T | $146,500 | -- | |

| Sharon L Rinehart | $132,800 | -- | |

| Nevin William G | $132,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wiley Walter R T | $117,200 | |

| Previous Owner | Sharon L Rinehart | $75,000 | |

| Previous Owner | Nevin William G | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,995 | $92,270 | $14,530 | $77,740 |

| 2023 | $5,912 | $92,260 | $14,525 | $77,735 |

| 2022 | $4,365 | $62,270 | $8,860 | $53,410 |

| 2021 | $4,375 | $62,270 | $8,860 | $53,410 |

| 2020 | $4,411 | $62,270 | $8,860 | $53,410 |

| 2019 | $4,337 | $54,150 | $7,700 | $46,450 |

| 2018 | $3,975 | $54,150 | $7,700 | $46,450 |

| 2017 | $3,804 | $54,150 | $7,700 | $46,450 |

| 2016 | $3,571 | $44,980 | $7,810 | $37,170 |

| 2015 | $3,594 | $44,980 | $7,810 | $37,170 |

| 2014 | $3,599 | $44,980 | $7,810 | $37,170 |

| 2013 | $1,831 | $44,975 | $7,805 | $37,170 |

Source: Public Records

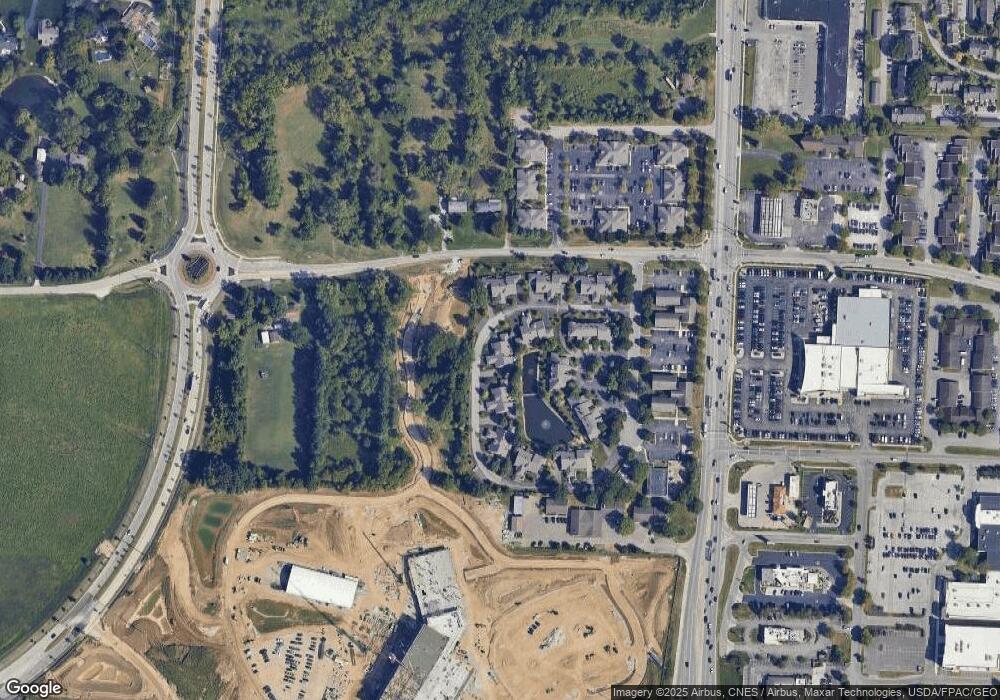

Map

Nearby Homes

- 3915 Inverness Cir Unit 3915

- 7871 Thornfield Ln

- 7917 Meadowhaven Blvd Unit 11

- 4171 Tuller Rd Unit Lot 1101

- 4175 Tuller Rd Unit Lot 1102

- 4179 Tuller Rd Unit Lot 1103

- 7385 Cimmaron Station

- 4183 Tuller Rd Unit Lot 1104

- 4191 Tuller Rd Unit Lot 1106

- 4168 Mccune Ave Unit Lot 1401

- 4164 Mccune Ave Unit Lot 1402

- 4156 Mccune Ave Unit Lot 1404

- 2620 Cedar Lake Dr Unit 2620

- 2469 Sandstrom Dr

- 2456 Sanford Dr

- 2488 Dunstan Dr

- 4231 Troutbrook Dr

- 2392 Dunsworth Dr

- 2423 Sutter Pkwy

- 7373 Palmleaf Ln

- 3895 Inverness Cir Unit 3895

- 3887 Inverness Cir

- 3883 Inverness Cir

- 3879 Inverness Cir Unit 3879

- 3875 Inverness Cir Unit 3875

- 3907 Inverness Cir

- 7215 Inverness Ct Unit 7215

- 7215 Inverness Ct Unit F

- 3892 Inverness Cir Unit 3892

- 7203 Inverness Ct

- 7207 Inverness Ct

- 7211 Inverness Ct Unit 7211

- 3865 Bright Rd

- 3892 Inverness Ct

- 3880 Inverness Cir

- 3880 Inverness Ct

- 7223 Inverness Ct

- 3911 Inverness Cir Unit 3911

- 7223 Inverness Cir

- 7227 Inverness Ct Unit 7227