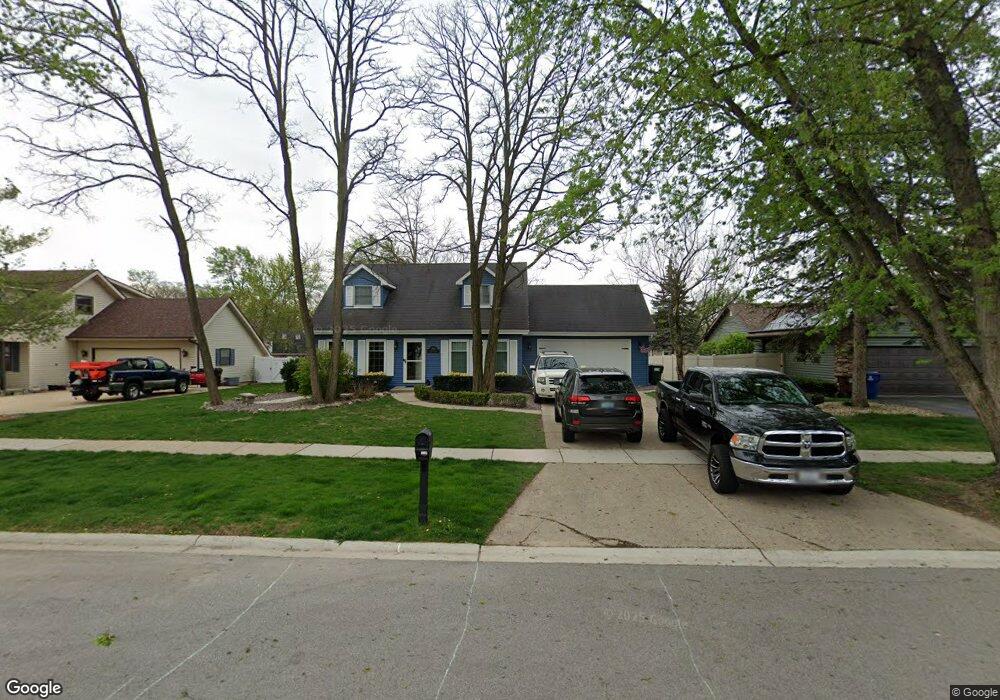

390 Aspen Dr New Lenox, IL 60451

Estimated Value: $388,000 - $428,000

--

Bed

--

Bath

--

Sq Ft

10,019

Sq Ft Lot

About This Home

This home is located at 390 Aspen Dr, New Lenox, IL 60451 and is currently estimated at $409,427. 390 Aspen Dr is a home located in Will County with nearby schools including Oster-Oakview School, Haines Elementary School, and Lincoln Way West.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 10, 2013

Sold by

Katcher Michael S and Katcher Renee S

Bought by

Green James E and Green Sabrina R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,272

Outstanding Balance

$141,575

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$267,852

Purchase Details

Closed on

Apr 22, 1998

Sold by

Potts Judith L

Bought by

Katcher Michael S and Katcher Renee S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,000

Interest Rate

7.26%

Purchase Details

Closed on

Feb 8, 1996

Sold by

Potts Kenneth R

Bought by

Potts Judith L

Purchase Details

Closed on

Oct 25, 1990

Bought by

Katcher Michael

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Green James E | $220,000 | Fidelity National Title | |

| Katcher Michael S | $177,000 | Intercounty Title | |

| Potts Judith L | -- | -- | |

| Katcher Michael | $157,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Green James E | $190,272 | |

| Previous Owner | Katcher Michael S | $77,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,921 | $130,253 | $36,367 | $93,886 |

| 2023 | $9,921 | $118,735 | $33,151 | $85,584 |

| 2022 | $8,945 | $109,383 | $30,540 | $78,843 |

| 2021 | $8,490 | $102,871 | $28,722 | $74,149 |

| 2020 | $8,247 | $99,200 | $27,697 | $71,503 |

| 2019 | $7,892 | $96,124 | $26,838 | $69,286 |

| 2018 | $7,709 | $92,811 | $25,913 | $66,898 |

| 2017 | $7,324 | $90,143 | $25,168 | $64,975 |

| 2016 | $7,108 | $87,730 | $24,494 | $63,236 |

| 2015 | $6,846 | $84,969 | $23,723 | $61,246 |

| 2014 | $6,846 | $83,920 | $23,430 | $60,490 |

| 2013 | $6,846 | $85,051 | $23,746 | $61,305 |

Source: Public Records

Map

Nearby Homes

- 217 Aspen Dr

- 1231 Town Crest Dr Unit E

- 224 Hauser Ct

- 200 Redwood Ave

- 208 Redwood Ave

- 1344 N Cedar Rd

- 133 Barbara Ln

- 203 Fir St

- 125 Kimber Dr

- 807 Picardy Place

- 1261 S Regan Rd

- 338 Willow St

- 331 Old Hickory Rd

- 202 Hickory St

- 328 E Lincoln Hwy

- 416 Manor Ct Unit B

- 315 S Pine St

- 1125 Georgias Way

- Vacant W Maple St

- 117 Walona Ave