3905 Dexter Meadows Grove Granby, CO 80446

Estimated Value: $1,822,000 - $5,079,000

4

Beds

4

Baths

4,013

Sq Ft

$976/Sq Ft

Est. Value

About This Home

This home is located at 3905 Dexter Meadows Grove, Granby, CO 80446 and is currently estimated at $3,915,035, approximately $975 per square foot. 3905 Dexter Meadows Grove is a home located in Grand County with nearby schools including Middle Park High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2025

Sold by

Rancho Feliz Llc

Bought by

Craig M Smith Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Oct 29, 2018

Sold by

Jdr Investments Llc

Bought by

Rancro Feljz Llc

Purchase Details

Closed on

Apr 28, 2016

Sold by

Hilbert Michael G

Bought by

Jdr Investments Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$629,000

Interest Rate

3.71%

Mortgage Type

Commercial

Purchase Details

Closed on

Nov 8, 2005

Sold by

Clazy U Land Company Llc

Bought by

W L Family Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$750,000

Interest Rate

6.04%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Craig M Smith Revocable Trust | $5,091,831 | None Listed On Document | |

| Rancro Feljz Llc | $1,250,000 | Title Company Of The Rockies | |

| Jdr Investments Llc | $650,000 | None Available | |

| W L Family Trust | $1,250,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jdr Investments Llc | $629,000 | |

| Previous Owner | W L Family Trust | $750,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $15,223 | $278,320 | $8,190 | $270,130 |

| 2023 | $15,223 | $278,320 | $8,190 | $270,130 |

| 2022 | $10,996 | $185,020 | $5,630 | $179,390 |

| 2021 | $9,248 | $153,820 | $5,850 | $147,970 |

| 2020 | $3,458 | $66,410 | $5,060 | $61,350 |

| 2019 | $49 | $960 | $960 | $0 |

| 2018 | $49 | $920 | $920 | $0 |

| 2017 | $53 | $920 | $920 | $0 |

| 2016 | $46 | $860 | $860 | $0 |

| 2015 | $42 | $860 | $860 | $0 |

| 2014 | $42 | $810 | $810 | $0 |

Source: Public Records

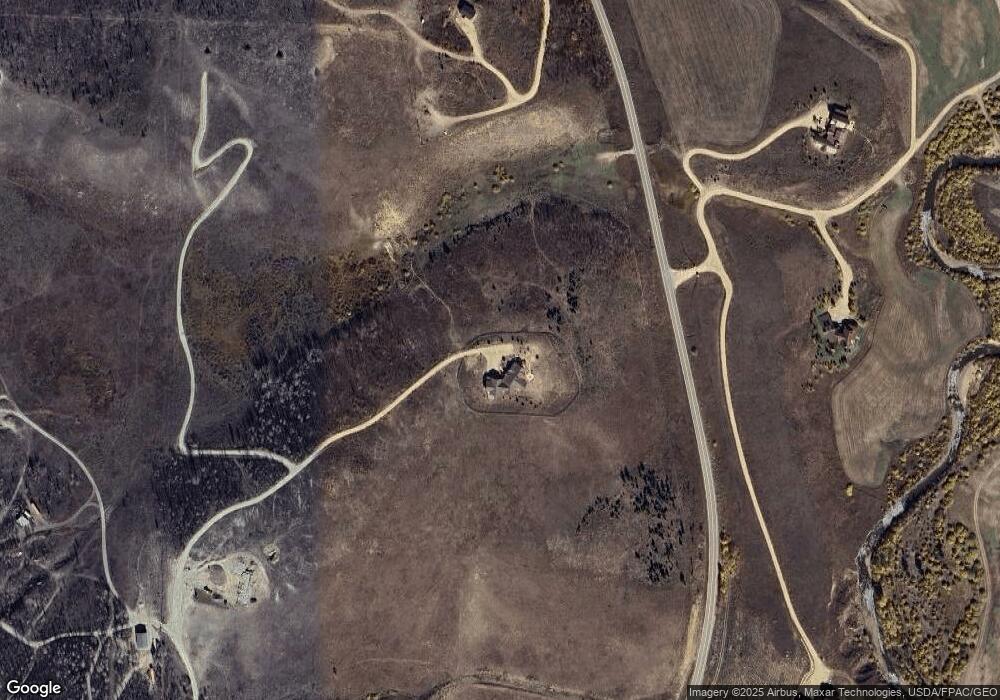

Map

Nearby Homes

- 569 Gcr 408

- 0 Tbd Gcr 4081 Unit 25-1020

- 5276 Csh 125

- 5363 Gcr 40

- 5188 Csh 125

- 5188 Csh County Rd 40

- 135 Gcr 4110

- 4848 Gcr 40

- 1893 Csh 125

- 6168 County Road 40

- 420 Gcr 412

- 988 Gcr 2192

- 5404 County Road 41

- 7763 Us Hwy 34

- 250 Gcr 640 Unit 36

- 34 Grand County Road 640 Unit 19

- 34 Grand County Road 640

- 34 Gcr 640 Unit 21

- 29 Grand County Road 6419

- 1051 Summit Trail Unit V36

- 3920 Dexter Dr

- 0 Tbd Gcr 408 Lot 8 Unit 3341738

- 3915 County Road 407e

- 0 Tbd Gcr 408 Lot 2 Unit 2681382

- 0 Tbd Gcr 408 Lot 1 Unit 2598795

- TBD Gcr 408

- 3910 Evergreen Dr

- 0 Tbd Gcr 408 Lot 9 Unit 2111893

- 4690 125

- 0 Tbd Gcr 408 Lot 6

- 0 Tbd Gcr 408 Unit S1038640

- 0 Tbd Gcr 408 Unit 22-1085

- 0 Tbd Gcr 408 Unit LOT 1 21-1480

- 0 Tbd Gcr 408 Unit 6369382

- 0 Tbd Gcr 408 Unit 21-801

- 0 Tbd Gcr 408 Unit 21-803

- 0 Tbd Gcr 408 Unit 21-800

- 0 Tbd Gcr 408 Unit 21-804

- 0 Tbd Gcr 408 Unit 21-797

- 0 Tbd Gcr 408 Unit 21-802