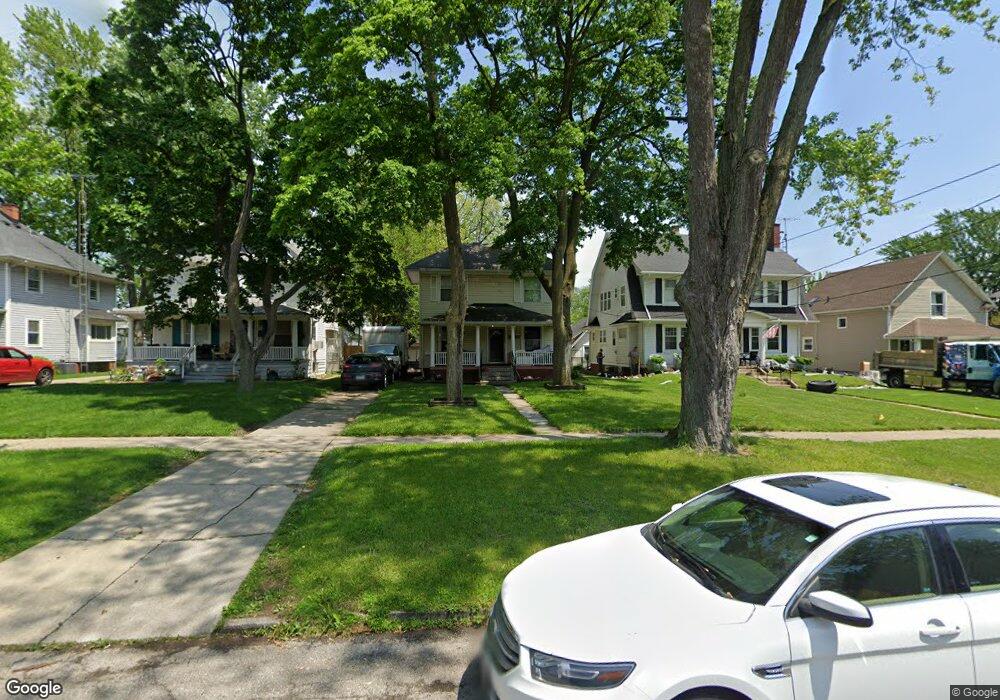

3910 Lockwood Ave Toledo, OH 43612

Five Points NeighborhoodEstimated Value: $110,812 - $129,000

3

Beds

2

Baths

1,528

Sq Ft

$80/Sq Ft

Est. Value

About This Home

This home is located at 3910 Lockwood Ave, Toledo, OH 43612 and is currently estimated at $121,703, approximately $79 per square foot. 3910 Lockwood Ave is a home located in Lucas County with nearby schools including Whittier Elementary School and Start High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2012

Sold by

Hall Lakeeta L and Hall Lakeeta

Bought by

Hall Lakeeta and Bryon Matthew Hall Trust

Current Estimated Value

Purchase Details

Closed on

Mar 28, 2011

Sold by

Secretary Of Housing & Urban Development

Bought by

Hall Lakeeta

Purchase Details

Closed on

Oct 1, 2010

Sold by

Robles John A and Robles Elizabeth A

Bought by

Abn Amro Mortgage Group Inc

Purchase Details

Closed on

Aug 9, 2010

Sold by

Citimortgage Inc

Bought by

Secretary Of Housing & Urban Development

Purchase Details

Closed on

Aug 13, 1999

Sold by

Santa Andrew L and Santa Christine M

Bought by

Robles John A and Robles Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,900

Interest Rate

7.77%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 22, 1996

Sold by

Hays Michael J

Bought by

Santa Andrew L and Santa Christine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,900

Interest Rate

8.31%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hall Lakeeta | -- | None Available | |

| Hall Lakeeta | $20,010 | Attorney | |

| Abn Amro Mortgage Group Inc | $74,897 | Attorney | |

| Secretary Of Housing & Urban Development | -- | None Available | |

| Robles John A | $84,000 | Northwest Title Agency Of Oh | |

| Santa Andrew L | $62,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Robles John A | $83,900 | |

| Previous Owner | Santa Andrew L | $58,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,692 | $19,285 | $4,340 | $14,945 |

| 2023 | $886 | $12,110 | $3,430 | $8,680 |

| 2022 | $882 | $12,110 | $3,430 | $8,680 |

| 2021 | $896 | $12,110 | $3,430 | $8,680 |

| 2020 | $948 | $11,270 | $3,290 | $7,980 |

| 2019 | $924 | $11,270 | $3,290 | $7,980 |

| 2018 | $856 | $11,270 | $3,290 | $7,980 |

| 2017 | $2,110 | $8,750 | $5,880 | $2,870 |

| 2016 | $4,513 | $25,000 | $16,800 | $8,200 |

| 2015 | $788 | $25,000 | $16,800 | $8,200 |

| 2014 | $825 | $8,750 | $5,880 | $2,870 |

| 2013 | $550 | $8,750 | $5,880 | $2,870 |

Source: Public Records

Map

Nearby Homes

- 3915 Lockwood Ave

- 3829 Drexel Dr

- 3713 Drexel Dr

- 3912 Martha Ave

- 3737 Lockwood Ave

- 3704 Willys Pkwy

- 4125 N Lockwood Ave

- 1016 Mallett St

- 4128 Thornton Ave

- 4112 Lewis Ave

- 3810 Hoiles Ave

- 3915 Hoiles Ave

- 3911 Hoiles Ave

- 3621 Willys Pkwy

- 1106 Martin Ave

- 1336 Laclede Rd

- 4112 Peak Ave

- 4228 N Lockwood Ave

- 4111 Carthage Rd

- 4244 N Lockwood Ave

- 3904 Lockwood Ave

- 3862 Lockwood Ave

- 3920 Lockwood Ave

- 3856 Lockwood Ave

- 3924 Lockwood Ave

- 3911 Drexel Dr

- 3915 Drexel Dr

- 3905 Drexel Dr

- 3919 Drexel Dr

- 3852 Lockwood Ave

- 3930 Lockwood Ave

- 3901 Drexel Dr

- 3909 Drexel Dr

- 3923 Drexel Dr

- 3855 Drexel Dr

- 3927 Drexel Dr

- 3846 Lockwood Ave

- 3936 Lockwood Ave

- 3931 Drexel Dr