3915 Kimberly Dr Pearland, TX 77581

Estimated Value: $407,000 - $446,000

4

Beds

3

Baths

2,384

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 3915 Kimberly Dr, Pearland, TX 77581 and is currently estimated at $423,833, approximately $177 per square foot. 3915 Kimberly Dr is a home located in Brazoria County with nearby schools including Rustic Oak Elementary School, Pearland Junior High School East, and Alexander Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2017

Sold by

Domerofski Matthew C and Domerofski Kim M

Bought by

Downend Nathan R and Downend Elizabeth Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,405

Outstanding Balance

$244,834

Interest Rate

4.1%

Mortgage Type

VA

Estimated Equity

$178,999

Purchase Details

Closed on

Apr 14, 2008

Sold by

Mills Charolette A and Mills Leonard

Bought by

Domerofski Matthew C and Domerofski Kim M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

6.11%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 30, 1999

Sold by

D R Horton Texas Ltd

Bought by

Mills Leonard and Mills Charolette A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,700

Interest Rate

7.58%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Downend Nathan R | -- | Chicago Title | |

| Domerofski Matthew C | -- | Texas American Title Company | |

| Mills Leonard | -- | Stewart Title | |

| Mills Leonard | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Downend Nathan R | $294,405 | |

| Previous Owner | Domerofski Matthew C | $185,000 | |

| Previous Owner | Mills Leonard | $156,000 | |

| Previous Owner | Mills Leonard | $174,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,002 | $401,310 | $55,930 | $345,380 |

| 2023 | $8,002 | $413,699 | $55,930 | $365,350 |

| 2022 | $9,047 | $376,090 | $55,930 | $330,020 |

| 2021 | $8,809 | $341,900 | $55,930 | $285,970 |

| 2020 | $8,421 | $337,160 | $55,930 | $281,230 |

| 2019 | $7,657 | $283,730 | $55,930 | $227,800 |

| 2018 | $7,498 | $279,040 | $55,930 | $223,110 |

| 2017 | $6,994 | $259,000 | $55,930 | $203,070 |

| 2016 | $6,994 | $259,000 | $55,930 | $203,070 |

| 2015 | $6,056 | $229,230 | $55,930 | $173,300 |

| 2014 | $6,056 | $217,670 | $55,930 | $161,740 |

Source: Public Records

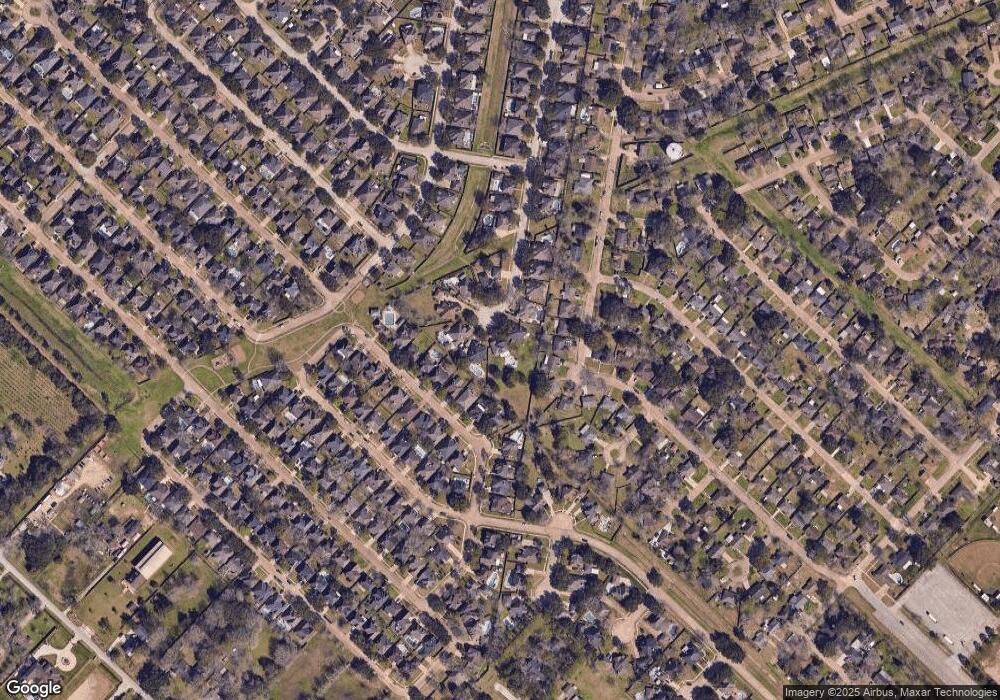

Map

Nearby Homes

- 514 Bellmar Ln

- 3910 Kimberly Dr

- 511 Bellmar Ln

- 3901 Kimberly Dr

- 502 Bellmar Ln

- 415 Bellmar Ln

- 515 Brandywyne Dr

- 1013 Chesterwood Dr

- 1003 Glenview Dr

- 307 Bellmar Ln

- 1107 Chesterwood Dr

- 510 Portage Ln

- 1040 Glenview Dr

- 1108 Chesterwood Dr

- 401 Castlelake Dr

- 1211 Woodchase Dr

- 808 Merribrook Ln

- 409 Linda Ln

- 405 Linda Ln

- 301 Brandywyne Dr

- 3916 Kimberly Dr

- 710 Stoneledge Dr

- 3913 Kimberly Dr

- 710 Stoneledge Ldr

- 1003 Linkwood Dr

- 708 Stoneledge Dr

- 1001 Linkwood Dr

- 1005 Linkwood Dr

- 1007 Linkwood Dr

- 706 Stoneledge Dr

- 516 Stadium Ln

- 1009 Linkwood Dr

- 3911 Kimberly Dr

- 3901 Blue Heron Dr

- 704 Stoneledge Dr

- 3914 Kimberly Dr

- 804 W Stadium Ct

- 702 Stoneledge Dr

- 512 Stadium Ln

- 1011 Linkwood Dr