392 E 700 S Unit i Vernal, UT 84078

Estimated payment $1,584/month

Highlights

- RV or Boat Parking

- Updated Kitchen

- Great Room

- RV Parking in Community

- Mountain View

- Granite Countertops

About This Home

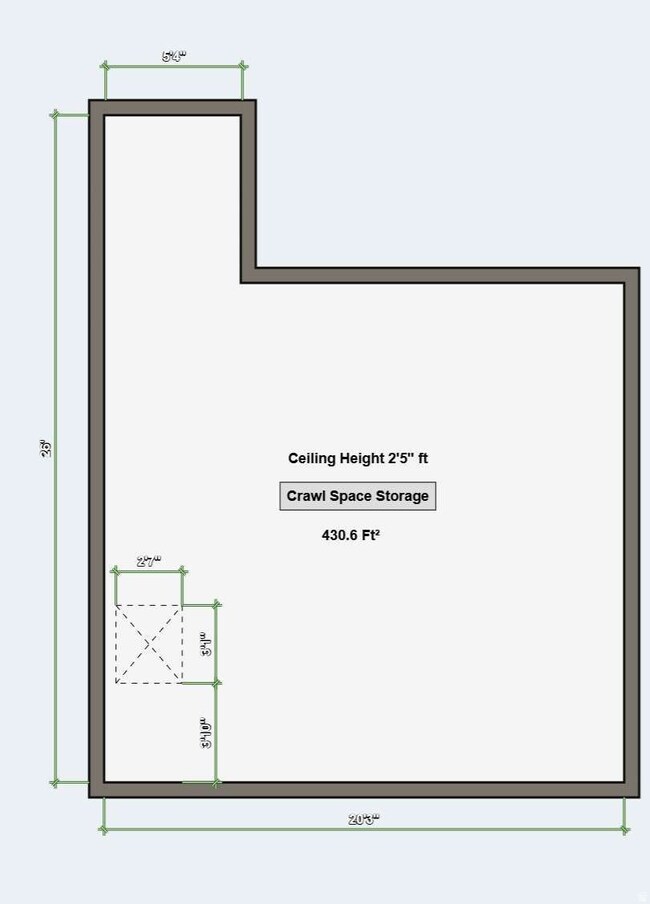

9ft ceilings downstairs, 8ft up. Newly remodeled KITCHEN with upgraded floor plan, ISLAND, BACKSPLASH, TONS of cabinet organizers and pull out drawers, spice organizers, corner blind slide-out organizer, new garbage disposal, Whirlpool high tech double oven, Kitchen Aid dishwasher, new built-in microwave, updated stainless steel appliances, new 10" deep Kraus branded sink with pop outs in front, and new GRANITE COUNTERTOPS! MUST SEE! Located off the cul-de-sac, facing East, so no neighbors directly in front with view from master bedroom. All new quality flooring and paint (Benjamin Moore Ultra Spec 500 & Advance) Custom-built shelves throughout Walk-in closets Large two-car garage w/ 10.5' ceilings. Massive crawl space storage with full 2.5ft ceilings. ~450 sqft Lots of storage shelves in garage (Removable) HOA includes Landscaping, Snow Removal, Water, Sewage, Basketball Court, and Trash services, optional RV parking & garden boxes

Townhouse Details

Home Type

- Townhome

Est. Annual Taxes

- $1,192

Year Built

- Built in 2006

Lot Details

- 2,614 Sq Ft Lot

- Cul-De-Sac

- Landscaped

- Sprinkler System

HOA Fees

- $195 Monthly HOA Fees

Parking

- 2 Car Garage

- RV or Boat Parking

Home Design

- Stone Siding

- Asphalt

- Stucco

Interior Spaces

- 1,674 Sq Ft Home

- 2-Story Property

- Self Contained Fireplace Unit Or Insert

- Double Pane Windows

- Blinds

- Great Room

- Den

- Mountain Views

- Electric Dryer Hookup

Kitchen

- Updated Kitchen

- Double Oven

- Free-Standing Range

- Microwave

- Granite Countertops

- Disposal

Flooring

- Carpet

- Vinyl

Bedrooms and Bathrooms

- 3 Bedrooms

- Walk-In Closet

Home Security

Outdoor Features

- Porch

Schools

- Naples Elementary School

- Vernal Mid Middle School

- Uintah High School

Utilities

- Forced Air Heating and Cooling System

- Natural Gas Connected

- Sewer Paid

Listing and Financial Details

- Exclusions: Dryer, Freezer, Refrigerator, Washer, Video Door Bell(s)

- Assessor Parcel Number 05:051:0169

Community Details

Overview

- Association fees include ground maintenance, sewer, trash, water

- Association Phone (801) 256-0465

- Split Mountain Subdivision

- RV Parking in Community

Recreation

- Snow Removal

Security

- Fire and Smoke Detector

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,128 | $135,387 | $1 | $135,386 |

| 2023 | $1,193 | $114,735 | $1 | $114,734 |

| 2022 | $849 | $78,594 | $0 | $78,594 |

| 2021 | $829 | $63,383 | $3,405 | $59,978 |

| 2020 | $725 | $56,956 | $3,405 | $53,551 |

| 2019 | $734 | $56,956 | $3,405 | $53,551 |

| 2018 | $735 | $56,956 | $3,405 | $53,551 |

| 2017 | $9 | $70,096 | $4,125 | $65,971 |

| 2016 | $907 | $77,426 | $4,125 | $73,301 |

| 2015 | $838 | $77,426 | $4,125 | $73,301 |

| 2014 | $827 | $77,426 | $4,125 | $73,301 |

| 2013 | $844 | $77,426 | $4,125 | $73,301 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 11/15/2025 11/15/25 | Price Changed | $245,900 | -1.6% | $147 / Sq Ft |

| 11/07/2025 11/07/25 | Price Changed | $249,900 | -5.3% | $149 / Sq Ft |

| 11/04/2025 11/04/25 | Price Changed | $264,000 | -1.9% | $158 / Sq Ft |

| 10/29/2025 10/29/25 | Price Changed | $269,000 | -1.1% | $161 / Sq Ft |

| 10/27/2025 10/27/25 | For Sale | $272,000 | -- | $162 / Sq Ft |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Special Warranty Deed | -- | None Listed On Document | |

| Special Warranty Deed | -- | None Listed On Document | |

| Special Warranty Deed | -- | Accommodation/Courtesy Recordi | |

| Special Warranty Deed | -- | -- | |

| Special Warranty Deed | -- | -- |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $184,639 | FHA |

Source: UtahRealEstate.com

MLS Number: 2119819

APN: 05:051:0169