3926 NW 25th Cir Unit 10 Gainesville, FL 32606

Estimated Value: $351,381 - $417,000

2

Beds

2

Baths

1,185

Sq Ft

$317/Sq Ft

Est. Value

About This Home

This home is located at 3926 NW 25th Cir Unit 10, Gainesville, FL 32606 and is currently estimated at $375,095, approximately $316 per square foot. 3926 NW 25th Cir Unit 10 is a home located in Alachua County with nearby schools including Littlewood Elementary School, Westwood Middle School, and F.W. Buchholz High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 12, 2024

Sold by

Ryals & Ryals Llc

Bought by

Gregory Aaron and Gregory Mary

Current Estimated Value

Purchase Details

Closed on

Aug 24, 2021

Sold by

Ryals Michael S and Ryals Jane S

Bought by

Ryals & Ryals Llc

Purchase Details

Closed on

Mar 31, 2020

Sold by

Everett Kimball B

Bought by

Ryals Michael S and Ryals Jane S

Purchase Details

Closed on

Aug 11, 2005

Bought by

Blount Charlotte Gravely Life Est

Purchase Details

Closed on

Mar 1, 2004

Sold by

Hendon Jane R Mckinney and Mckinney Jane R

Bought by

Blount Charlotte Gravely

Purchase Details

Closed on

Jun 19, 1992

Bought by

Blount Charlotte Gravely Life Est

Purchase Details

Closed on

Dec 1, 1988

Bought by

Blount Charlotte Gravely Life Est

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gregory Aaron | $350,000 | None Listed On Document | |

| Ryals & Ryals Llc | -- | Accommodation | |

| Ryals Michael S | $226,000 | Attorney | |

| Blount Charlotte Gravely Life Est | $100 | -- | |

| Everett Kimball B | -- | -- | |

| Blount Charlotte Gravely | $165,000 | -- | |

| Blount Charlotte Gravely Life Est | $95,000 | -- | |

| Blount Charlotte Gravely Life Est | $89,500 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,553 | $258,847 | $130,000 | $128,847 |

| 2023 | $4,553 | $233,472 | $130,000 | $103,472 |

| 2022 | $3,713 | $167,050 | $75,000 | $92,050 |

| 2021 | $4,592 | $202,911 | $75,000 | $127,911 |

| 2020 | $4,675 | $207,168 | $85,000 | $122,168 |

| 2019 | $4,854 | $209,099 | $85,000 | $124,099 |

| 2018 | $1,848 | $122,630 | $0 | $0 |

| 2017 | $1,844 | $120,110 | $0 | $0 |

| 2016 | $1,825 | $117,640 | $0 | $0 |

| 2015 | $1,849 | $116,830 | $0 | $0 |

| 2014 | $1,843 | $115,910 | $0 | $0 |

| 2013 | -- | $116,100 | $15,000 | $101,100 |

Source: Public Records

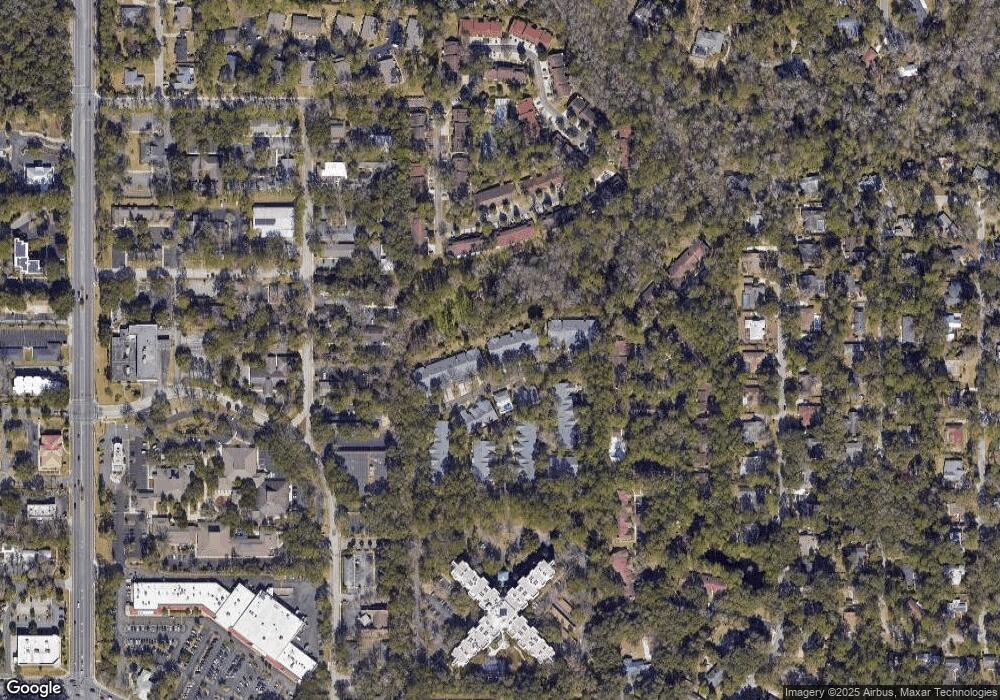

Map

Nearby Homes

- 3952 NW 25th Cir

- 3958 NW 27th Ln

- 2820 NW 39th Terrace Unit 2820

- 3962 NW 29th Ln

- 3907 NW 23rd Cir

- 3960 NW 30th Place

- 3741 NW 23rd Place

- 3625 NW 24th Place

- 3635 NW 30th Blvd

- 4510 NW 31st Ave

- 1836 NW 40th Terrace

- 3925 NW 35th Place

- 3901 NW 35th Place

- 4634 NW 30th Ave

- 2585 NW 48th Terrace

- 2627 NW 48th Terrace

- 1904 NW 36th Terrace

- 3701 NW 16th Blvd

- 2006 NW 35th Terrace

- 3511 NW 33rd Place

- 3928 NW 25th Cir Unit 9

- 3924 NW 25th Cir

- 3922 NW 25th Cir

- 3934 NW 25th Cir

- 3920 NW 25th Cir

- 3936 NW 25th Cir

- 3918 NW 25th Cir Unit 14

- 3938 NW 25th Cir

- 3940 NW 25th Cir Unit 5

- 3940 NW 25th Cir

- 3925 NW 25th Cir

- 3912 NW 25th Cir

- 3923 NW 25th Cir

- 3942 NW 25th Cir Unit 4

- 3937 NW 25th Cir

- 3910 NW 25th Cir

- 3944 NW 25th Cir

- 3939 NW 25th Cir Unit 24

- 3908 NW 25th Cir Unit 17

- 3908 NW 25th Cir