3926 Sarah Ln New Albany, IN 47150

Estimated Value: $325,700 - $385,000

3

Beds

2

Baths

2,139

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 3926 Sarah Ln, New Albany, IN 47150 and is currently estimated at $355,925, approximately $166 per square foot. 3926 Sarah Ln is a home located in Floyd County with nearby schools including Grant Line School, Nathaniel Scribner Middle School, and New Albany Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 8, 2013

Sold by

Mossler Calise

Bought by

Pearcy Carl E and Pearcy Janice G

Current Estimated Value

Purchase Details

Closed on

Feb 12, 2010

Sold by

Abplanalp Garry J and Abplanalp Laura

Bought by

Peden Betty L and Mossler Calise

Purchase Details

Closed on

Sep 2, 2009

Sold by

Stock Yards Bank And Trust Co

Bought by

Abplanalp Garry J and Abplanalp Laura J

Purchase Details

Closed on

Aug 28, 2009

Sold by

Winterheimer Mark M

Bought by

Stock Yards Bank & Trust Co

Purchase Details

Closed on

Mar 20, 2008

Sold by

Autumn Springs Llc

Bought by

Stock Yards Bank & Trust Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pearcy Carl E | $236,000 | -- | |

| Peden Betty L | -- | None Available | |

| Abplanalp Garry J | -- | None Available | |

| Stock Yards Bank & Trust Co | $82,000 | None Available | |

| Stock Yards Bank & Trust Co | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,729 | $226,200 | $36,200 | $190,000 |

| 2023 | $1,708 | $232,800 | $36,200 | $196,600 |

| 2022 | $1,828 | $237,300 | $36,200 | $201,100 |

| 2021 | $1,676 | $222,100 | $36,200 | $185,900 |

| 2020 | $1,679 | $224,200 | $36,200 | $188,000 |

| 2019 | $1,655 | $227,500 | $36,200 | $191,300 |

| 2018 | $1,694 | $234,000 | $36,200 | $197,800 |

| 2017 | $1,783 | $230,000 | $36,200 | $193,800 |

| 2016 | $1,644 | $229,900 | $36,200 | $193,700 |

| 2014 | $1,780 | $222,400 | $36,100 | $186,300 |

| 2013 | -- | $218,300 | $36,200 | $182,100 |

Source: Public Records

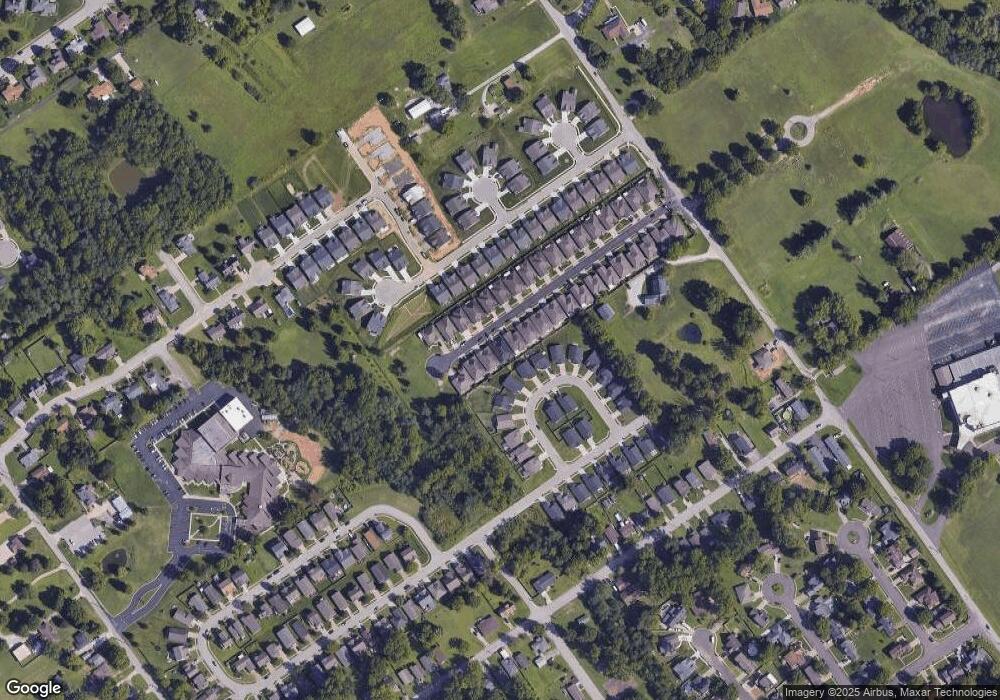

Map

Nearby Homes

- 3920 Windsor Creek Dr

- 4834 Ashbury Dr

- 3941 Carver St

- 3829 Fiske Ave

- 3810 Wayne St

- 4722 Timber Pine Dr Unit 99

- 4724 Timber Pine Dr Unit 100

- BERKSHIRE Plan at Jefferson Gardens

- AUBURN Plan at Jefferson Gardens

- 3617 Doe Run Way

- 4724 Black Pine Blvd Unit 73

- Dogwood Plan at Kamer Crossing

- Holly Plan at Kamer Crossing

- Maple Plan at Kamer Crossing

- Haylyn 48' Plan at Kamer Crossing

- Juliana Plan at Kamer Crossing

- Willow Plan at Kamer Crossing

- 525 Bald Knob Rd

- 4216 - LOT 130 Skylar Way

- 3517 Kamer Miller Rd