Estimated Value: $296,000 - $403,000

5

Beds

3

Baths

2,025

Sq Ft

$178/Sq Ft

Est. Value

About This Home

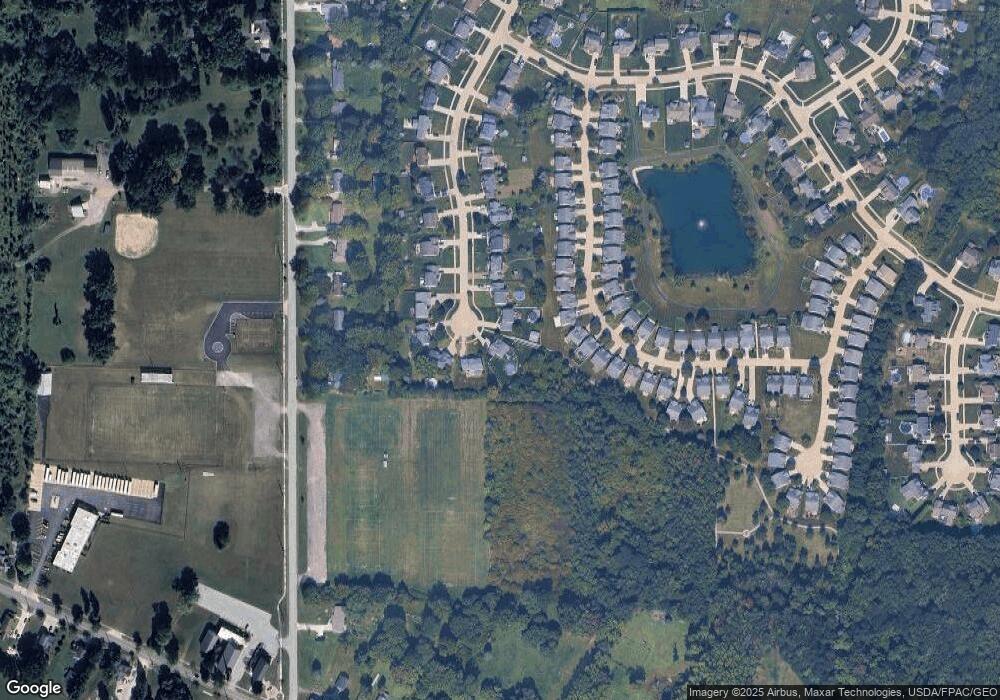

This home is located at 3945 Dugan Farms, Perry, OH 44081 and is currently estimated at $361,145, approximately $178 per square foot. 3945 Dugan Farms is a home located in Lake County with nearby schools including Perry Middle School, Perry High School, and New Life Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2010

Sold by

Citimortgage Inc

Bought by

Larson Gene B and Larson Tina M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,423

Outstanding Balance

$121,678

Interest Rate

4.6%

Mortgage Type

VA

Estimated Equity

$239,467

Purchase Details

Closed on

May 3, 2010

Sold by

Lampert Dean

Bought by

Citimortgage Inc

Purchase Details

Closed on

Jan 11, 2007

Sold by

Lampert Dean and Lampert Melissa

Bought by

Lampert Dean and Lampert Melissa

Purchase Details

Closed on

Jun 22, 2001

Sold by

Johnson & Sons Builders Inc

Bought by

Lampert Dean and Lampert Melissa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$222,482

Interest Rate

7.18%

Purchase Details

Closed on

Aug 17, 2000

Sold by

Loreto Development Perry Company

Bought by

Johnson & Son Builders Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,500

Interest Rate

8.26%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Larson Gene B | $182,500 | None Available | |

| Citimortgage Inc | $152,000 | None Available | |

| Lampert Dean | -- | Attorney | |

| Lampert Dean | $226,100 | Chicago Title Agency | |

| Johnson & Son Builders Inc | $46,000 | Chicago Title Insurance Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Larson Gene B | $186,423 | |

| Previous Owner | Lampert Dean | $222,482 | |

| Previous Owner | Johnson & Son Builders Inc | $166,500 | |

| Closed | Johnson & Son Builders Inc | $11,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $116,560 | $30,250 | $86,310 |

| 2024 | -- | $116,560 | $30,250 | $86,310 |

| 2023 | $8,118 | $97,260 | $24,160 | $73,100 |

| 2022 | $4,412 | $97,260 | $24,160 | $73,100 |

| 2021 | $4,132 | $97,260 | $24,160 | $73,100 |

| 2020 | $3,785 | $80,500 | $21,010 | $59,490 |

| 2019 | $3 | $80,500 | $21,010 | $59,490 |

| 2018 | $3,790 | $70,380 | $16,850 | $53,530 |

| 2017 | $3,520 | $70,380 | $16,850 | $53,530 |

| 2016 | $3,498 | $70,380 | $16,850 | $53,530 |

| 2015 | $3,372 | $70,380 | $16,850 | $53,530 |

| 2014 | $3,309 | $70,380 | $16,850 | $53,530 |

| 2013 | $3,307 | $70,380 | $16,850 | $53,530 |

Source: Public Records

Map

Nearby Homes

- V/L Tarpon Cove

- L 203 S Hidden Village Dr

- L 205 S Hidden Village Dr

- L 224 S Hidden Village Dr

- L 202 S Hidden Village Dr

- L 194 S Hidden Village Dr

- Aruba Bay Plan at Hidden Village

- Eden Cay Plan at Hidden Village

- Grand Bahama Plan at Hidden Village

- Grand Cayman Plan at Hidden Village

- Dominica Spring Plan at Hidden Village

- 4401 Oak Ave

- 4241 Hidden Village Dr

- 4360 Dogwood Ave

- 4370 Dogwood Ave

- 4371 Oak Ave

- 4409 Oak Ave

- 4426 Oak Ave

- Water Lily Plan at Booth Farm

- Oleander Plan at Booth Farm

- 3935 Dugan Farms

- 3960 Dugan Farms

- 3925 Dugan Farms

- 3924 Dugans Landing Unit 14

- 3918 Dugans Landing Unit 13

- 3950 Dugan Farms

- 3916 Dugans Landing Unit 12

- 3926 Dugans Landing Unit 15

- 3915 Dugan Farms

- 3910 Dugans Landing

- 3910 Dugan's Landing

- 3940 Dugan Farms

- 3932 Dugans Landing Unit 16

- 3930 Dugan Farms

- 3904 Dugans Landing

- 3934 Dugans Landing

- 3921 Dugans Landing

- 3920 Dugan Farms

- 3905 Dugan Farms

- 3898 Dugans Landing Unit 9