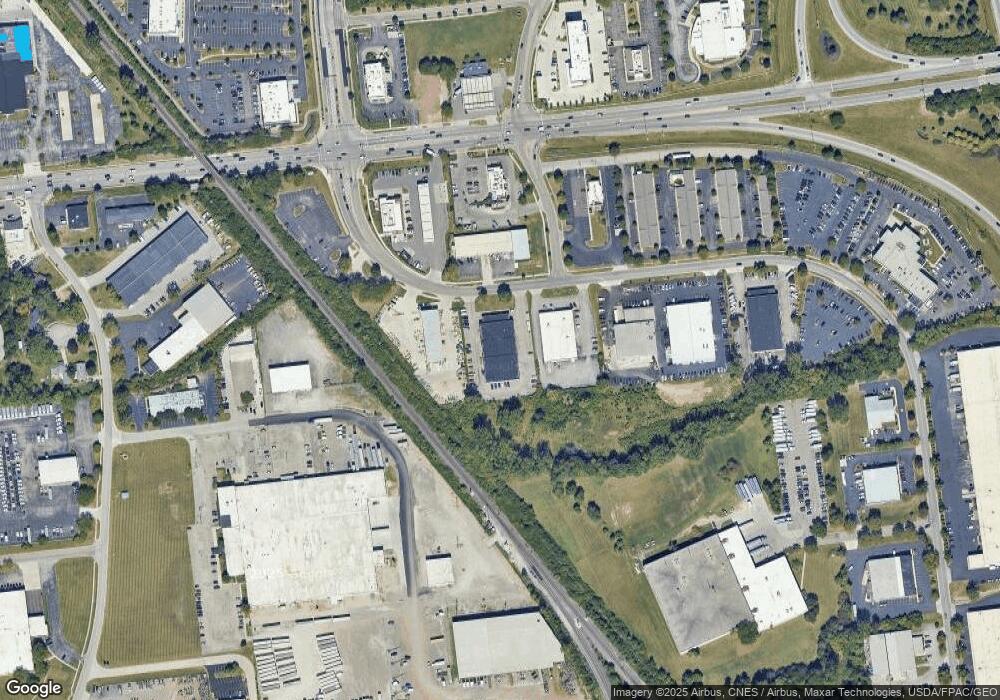

3999 Parkway Ln Unit 2 Hilliard, OH 43026

--

Bed

--

Bath

17,500

Sq Ft

1.38

Acres

About This Home

This home is located at 3999 Parkway Ln Unit 2, Hilliard, OH 43026. 3999 Parkway Ln Unit 2 is a home located in Franklin County with nearby schools including Beacon Elementary School, Hilliard Tharp Sixth Grade Elementary School, and Hilliard Weaver Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2025

Sold by

3999 Parkway Th Llc

Bought by

1869 Holdings Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,100,000

Outstanding Balance

$2,100,000

Interest Rate

6.58%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jun 13, 2025

Sold by

James H & Dolores K Day Family Llc

Bought by

3999 Parkway Th Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,267,500

Interest Rate

6.76%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Oct 16, 2014

Sold by

Day James H and Day Dolores K

Bought by

James H And Dolores K Day Family Llc

Purchase Details

Closed on

Feb 12, 1982

Bought by

Day James H and Day Dolores K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 1869 Holdings Llc | -- | Fireland Title | |

| 3999 Parkway Th Llc | -- | Fireland Title Group Llc | |

| James H And Dolores K Day Family Llc | -- | None Available | |

| Day James H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | 1869 Holdings Llc | $2,100,000 | |

| Previous Owner | 3999 Parkway Th Llc | $1,267,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $35,143 | $371,460 | $72,450 | $299,010 |

| 2023 | $30,379 | $371,455 | $72,450 | $299,005 |

| 2022 | $28,413 | $312,900 | $86,940 | $225,960 |

| 2021 | $28,618 | $312,900 | $86,940 | $225,960 |

| 2020 | $28,327 | $312,900 | $86,940 | $225,960 |

| 2019 | $26,775 | $260,750 | $72,450 | $188,300 |

| 2018 | $25,824 | $260,750 | $72,450 | $188,300 |

| 2017 | $26,736 | $260,750 | $72,450 | $188,300 |

| 2016 | $26,078 | $238,350 | $72,450 | $165,900 |

| 2015 | $25,013 | $238,350 | $72,450 | $165,900 |

| 2014 | $25,138 | $238,350 | $72,450 | $165,900 |

| 2013 | $12,408 | $238,350 | $72,450 | $165,900 |

Source: Public Records

Map

Nearby Homes

- 4695 Cemetery Rd

- 1774 Zucchina Dr

- 3643 Carriage Run Dr

- 3820 Falls Circle Dr

- 3828 Falls Circle Dr Unit 22

- 4863 Berry Leaf Place

- 3832 Falls Circle Dr Unit 22

- 4933 Travers Ct

- 3622 Fishinger Mill Dr Unit 3622

- 4967 Carroll Ct

- 3409 Eastwoodlands Trail Unit 3409

- 3427 Eastwoodlands Trail Unit 3427

- 3434 Eastwoodlands Trail Unit 3434

- 3674 Ravens Glen Dr

- 4473 Addison Ln S

- 3705 Hilliard Station Rd Unit 3705

- 4862 Stoneybrook Blvd Unit 24E

- 4843 Stoneybrook Blvd Unit 30E

- 4857 Stoneybrook Blvd Unit 29E

- 4622 Family Dr Unit 53

- 3981 Parkway Ln

- 3979 Parkway Ln

- 3979 Parkway Ln Unit 979

- 3959 Parkway Ln

- 3810 Lacon Rd

- 3919 Parkway Ln Unit 8

- 3919 Parkway Ln Unit 7

- 3919 Parkway Ln Unit 1A

- 3919 Parkway Ln Unit 3

- 3919 Parkway Ln Unit 8 & 9

- 3919 Parkway Ln Unit 2

- 3919 Parkway Ln Unit 4

- 3919 Parkway Ln Unit 4

- 4280 Hilliard Cemetery Rd

- 3720 Lacon Rd

- 3830 Lacon Rd

- 3800 Lacon Rd

- 4399 Cemetery Rd

- 3840 Lacon Cir

- 3827 Lacon Rd