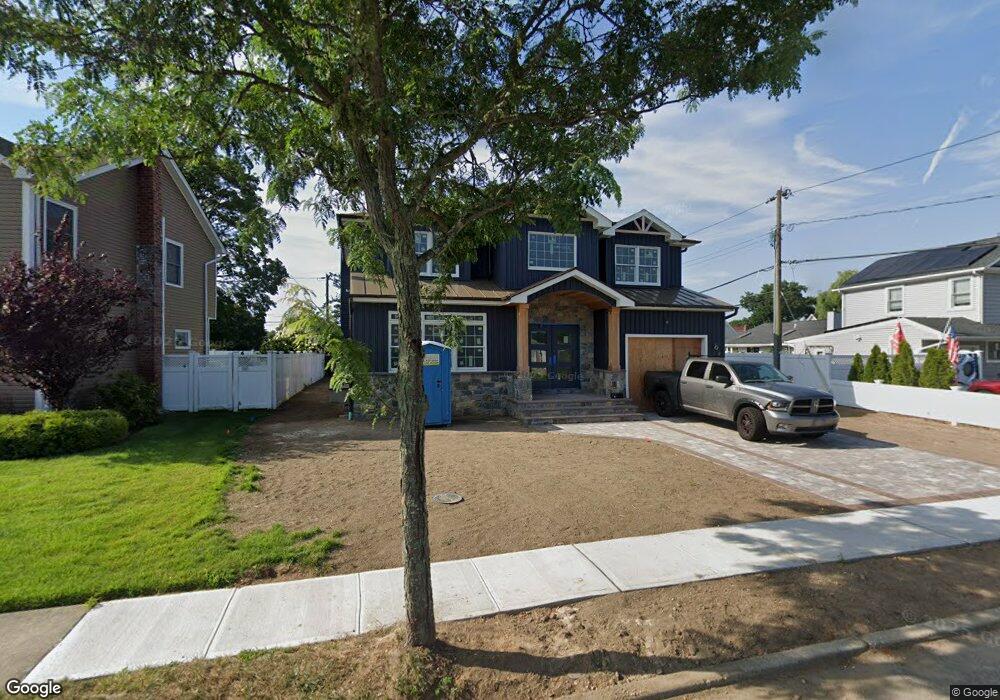

4 Elizabeth Dr Bethpage, NY 11714

Estimated Value: $624,000 - $748,248

--

Bed

3

Baths

1,342

Sq Ft

$511/Sq Ft

Est. Value

About This Home

This home is located at 4 Elizabeth Dr, Bethpage, NY 11714 and is currently estimated at $686,124, approximately $511 per square foot. 4 Elizabeth Dr is a home located in Nassau County with nearby schools including John H. West Elementary School, Plainedge Middle School, and Plainedge Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 1, 2024

Sold by

Mc Assets Llc

Bought by

Kumar Manisha and The Kumar 2023 Trust

Current Estimated Value

Purchase Details

Closed on

Dec 21, 2023

Sold by

Greco Dominic and Estate Of Dominic R Greco

Bought by

Bella Marie Properties Llc

Purchase Details

Closed on

Dec 13, 2006

Sold by

Bustillo Lisa

Bought by

Greco Dominic

Purchase Details

Closed on

May 13, 2004

Sold by

Pfaff Michael

Bought by

Bustillo Lisa

Purchase Details

Closed on

Apr 3, 2003

Sold by

Dorio Frank

Bought by

Pfaff Michael

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kumar Manisha | $599,000 | First American Title Ins Co | |

| Kumar Manisha | $599,000 | First American Title Ins Co | |

| Bella Marie Properties Llc | $490,000 | Judicial Title | |

| Mc Assets Llc | -- | Security Ttl Guarantee Corp | |

| Bella Marie Properties Llc | $490,000 | Judicial Title | |

| Greco Dominic | $475,000 | -- | |

| Greco Dominic | $475,000 | -- | |

| Bustillo Lisa | $425,000 | -- | |

| Bustillo Lisa | $425,000 | -- | |

| Pfaff Michael | $390,000 | -- | |

| Pfaff Michael | $390,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,315 | $504 | $268 | $236 |

| 2024 | $4,813 | $504 | $268 | $236 |

| 2023 | $18,544 | $504 | $268 | $236 |

| 2022 | $18,544 | $504 | $268 | $236 |

| 2021 | $13,304 | $483 | $257 | $226 |

| 2020 | $12,571 | $609 | $566 | $43 |

| 2019 | $11,532 | $609 | $461 | $148 |

| 2018 | $3,419 | $609 | $0 | $0 |

| 2017 | $1,355 | $747 | $471 | $276 |

| 2016 | $4,336 | $747 | $471 | $276 |

| 2015 | $3,069 | $897 | $566 | $331 |

| 2014 | $3,069 | $897 | $566 | $331 |

| 2013 | $2,784 | $897 | $566 | $331 |

Source: Public Records

Map

Nearby Homes