40010 Cimarron Way Magnolia, TX 77354

Estimated Value: $710,000 - $887,000

4

Beds

5

Baths

3,661

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 40010 Cimarron Way, Magnolia, TX 77354 and is currently estimated at $820,968, approximately $224 per square foot. 40010 Cimarron Way is a home located in Montgomery County with nearby schools including Bear Branch Elementary School, Bear Branch Junior High School, and Magnolia High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2001

Sold by

Ritchey Charles P and Ritchey Paula J

Bought by

Vohra Mohammed and Vohra Betty

Current Estimated Value

Purchase Details

Closed on

Oct 23, 2000

Sold by

Vandoan Phu and Nguyen Nga

Bought by

Ritchey Charles P and Ritchey Paula J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,800

Interest Rate

7.89%

Mortgage Type

Construction

Purchase Details

Closed on

Sep 10, 1990

Sold by

Savings Of America

Bought by

Vohra Mohammed and Vohra Betty

Purchase Details

Closed on

Sep 1, 1982

Bought by

Vohra Mohammed and Vohra Betty

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vohra Mohammed | -- | -- | |

| Ritchey Charles P | -- | -- | |

| Vohra Mohammed | -- | -- | |

| Vohra Mohammed | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ritchey Charles P | $28,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,918 | $890,000 | $139,000 | $751,000 |

| 2024 | $10,954 | $830,050 | $139,000 | $691,050 |

| 2023 | $10,954 | $830,050 | $139,000 | $691,050 |

| 2022 | $11,161 | $632,500 | $147,050 | $609,480 |

| 2021 | $10,688 | $575,000 | $85,000 | $490,000 |

| 2020 | $11,672 | $576,760 | $85,000 | $575,980 |

| 2019 | $10,559 | $524,330 | $85,000 | $507,960 |

| 2018 | $8,777 | $476,660 | $85,000 | $474,090 |

| 2017 | $9,189 | $433,330 | $54,000 | $532,820 |

| 2016 | $8,354 | $393,940 | $54,000 | $557,070 |

| 2015 | $5,284 | $358,130 | $54,000 | $501,700 |

| 2014 | $5,284 | $325,570 | $54,000 | $432,480 |

Source: Public Records

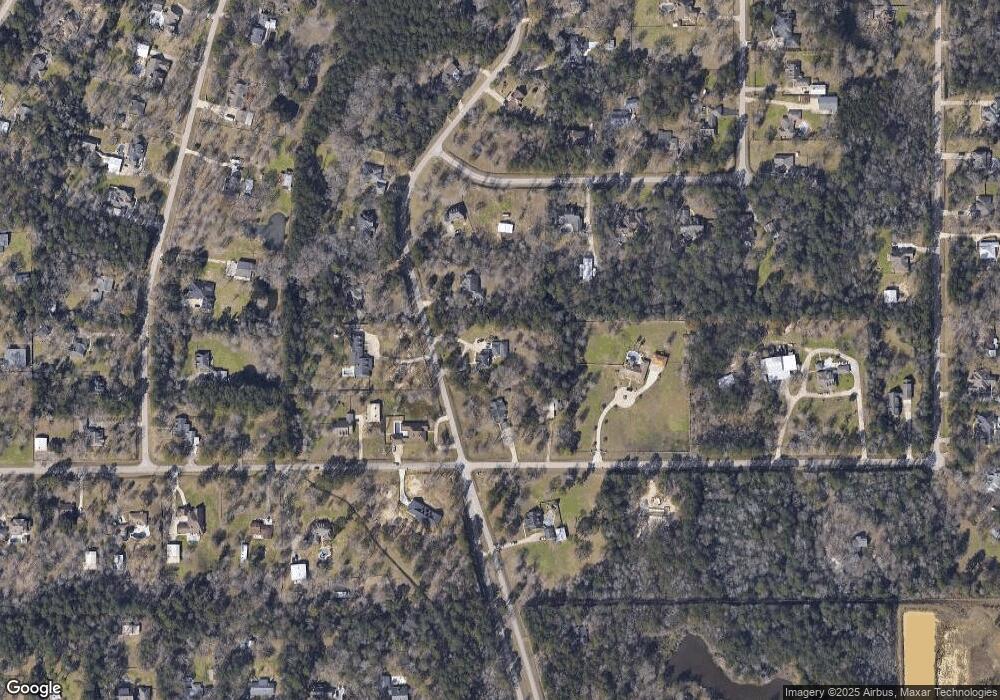

Map

Nearby Homes

- 40108 Cimarron Way

- 40207 Cimarron Way

- 39526 Cimarron Way

- 40317 De Sota Rd

- 8710 Linn Ln

- 7119 Durango Dr

- 40319 Three Forks Rd

- 7455 Durango Creek Dr

- 7010 Durango Dr

- 7022 Dillon Dr

- 00 Magnolia Cir

- 40206 Colfax Rd

- 6902 Woodland Oaks

- 39414 Lago Dr

- 6818 Woodland Oaks

- 6906 Grant Dr

- 40715 Pipestone Rd

- 247 Brazen Forest Trail

- 222 Brazen Forest Trail

- 203 Brazen Forest Trail

- 40002 Cimarron Way

- 40102 Cimarron Way

- 40003 Cimarron Way

- 8400 Deer Lodge Rd

- 0 Cimarron Way

- 40102 De Sota Rd

- 40011 Cimarron Way

- 40103 Cimarron Way

- 40106 De Sota Rd

- 39920 Cimarron Way

- 000 Cimarron Way

- 8510 Deer Lodge Rd

- Lot 161 Cimarron Way

- 3 Lot Deer Lodge Rd

- 40107 Cimarron Way

- 40114 De Sota Rd

- 40111 Cimarron Way

- 40019 De Sota Rd

- 40510 Cimarron Way

- 40206 Cimarron Way