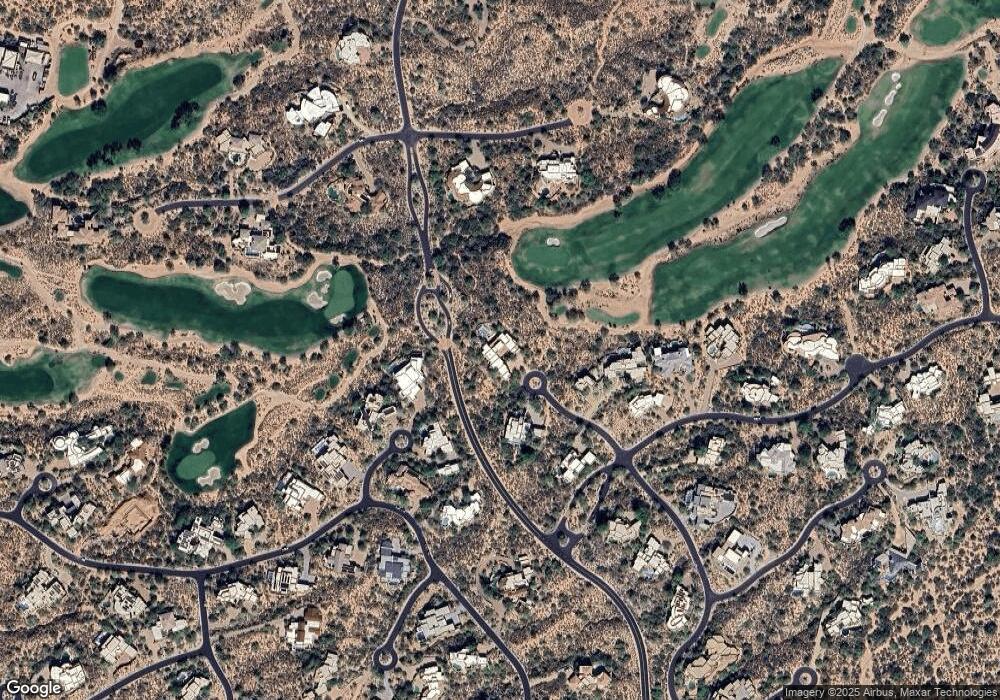

40102 N 103rd Way Scottsdale, AZ 85262

Desert Mountain NeighborhoodEstimated Value: $3,994,000 - $4,832,019

--

Bed

6

Baths

5,632

Sq Ft

$796/Sq Ft

Est. Value

About This Home

This home is located at 40102 N 103rd Way, Scottsdale, AZ 85262 and is currently estimated at $4,484,006, approximately $796 per square foot. 40102 N 103rd Way is a home located in Maricopa County with nearby schools including Black Mountain Elementary School, Cactus Shadows High School, and Sonoran Trails Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2015

Sold by

Christensen Ann S

Bought by

Christensen Bruce A and Christensen Ann S

Current Estimated Value

Purchase Details

Closed on

Dec 21, 2011

Sold by

Christensen Bruce A and Christensen Ann S

Bought by

Christensen Ann S

Purchase Details

Closed on

Feb 22, 2007

Sold by

Thomas Shea Properties Llc

Bought by

Christensen Bruce A and Christensen Ann S

Purchase Details

Closed on

Aug 15, 2005

Sold by

Mcgraw Kevin R and Mcgraw Jennifer

Bought by

Thomas Shea Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$580,000

Interest Rate

5.76%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 29, 1997

Sold by

Desert Mountain Properties Ltd Prtnrshp

Bought by

Mcgraw Kevin R and Mcgraw Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,750

Interest Rate

7.54%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Sep 1, 1994

Sold by

First American Title Insurance Company

Bought by

Desert Mountain Properties

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christensen Bruce A | -- | None Available | |

| Christensen Ann S | -- | None Available | |

| Christensen Bruce A | $799,000 | First American Title Ins Co | |

| Thomas Shea Properties Llc | $725,000 | First American Title Ins Co | |

| Mcgraw Kevin R | $703,750 | -- | |

| Desert Mountain Properties | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Thomas Shea Properties Llc | $580,000 | |

| Previous Owner | Mcgraw Kevin R | $500,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,950 | $180,663 | -- | -- |

| 2024 | $9,516 | $172,060 | -- | -- |

| 2023 | $9,516 | $258,330 | $51,660 | $206,670 |

| 2022 | $9,168 | $200,480 | $40,090 | $160,390 |

| 2021 | $9,954 | $202,210 | $40,440 | $161,770 |

| 2020 | $9,778 | $192,070 | $38,410 | $153,660 |

| 2019 | $9,485 | $189,620 | $37,920 | $151,700 |

| 2018 | $9,224 | $159,180 | $31,830 | $127,350 |

| 2017 | $8,883 | $153,010 | $30,600 | $122,410 |

| 2016 | $8,844 | $145,360 | $29,070 | $116,290 |

| 2015 | $8,363 | $124,560 | $24,910 | $99,650 |

Source: Public Records

Map

Nearby Homes

- 10216 E Venado Trail

- 40198 N 105th Place Unit 11

- 9962 E Groundcherry Ln

- 10260 E Filaree Ln

- 10320 E Filaree Ln

- 9887 E Palo Brea Dr

- 10308 E Filaree Ln Unit Grey Fox 32

- 10212 E Filaree Ln

- 10023 E Filaree Ln

- 10095 E Graythorn Dr

- 39878 N 105th Way

- 39954 N 98th Way Unit 47

- 9917 E Filaree Ln

- 10336 E Chia Way

- 39494 N 105th St Unit 74

- 10044 E Graythorn Dr

- 10626 E Palo Brea Dr

- 39254 N 104th Place

- 39089 N 102nd Way

- 9934 E Graythorn Dr

- 40066 N 103rd Way

- 10292 E Palo Brea Dr

- 40101 N 103rd Way

- 10241 E Palo Brea Dr

- 40065 N 103rd Way

- 40030 N 103rd Way

- 10240 E Palo Brea Dr

- 10408 E Palo Brea Dr

- 10189 E Palo Brea Dr

- 39919 N 102nd St

- 10253 E Venado Trail

- 10418 E Palo Brea Dr

- 39994 N 103rd Way

- 10188 E Palo Brea Dr Unit 90

- 10285 E Venado Trail

- 10221 E Venado Trail

- 39958 N 103rd Way

- 10433 E Palo Brea Dr

- 10433 E Palo Brea Dr Unit 42

- 10160 E Groundcherry Ln Unit 85