4013 Upper Lake Cir Granbury, TX 76049

Estimated Value: $450,533 - $555,000

4

Beds

2

Baths

2,079

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 4013 Upper Lake Cir, Granbury, TX 76049 and is currently estimated at $503,133, approximately $242 per square foot. 4013 Upper Lake Cir is a home located in Hood County with nearby schools including Acton Elementary School, Acton Middle School, and Granbury High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2024

Sold by

Blake Lester

Bought by

Blake Crystal

Current Estimated Value

Purchase Details

Closed on

May 20, 2015

Sold by

Reeson Homes Llc

Bought by

Blake Lester

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

3.68%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 16, 2013

Sold by

Blevins Brian

Bought by

Reeson Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,438

Interest Rate

3.45%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 5, 2013

Sold by

Premiere Southern Customs Inc

Bought by

Blake Lester

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,438

Interest Rate

3.45%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 24, 2006

Sold by

Latc Partners Ltd

Bought by

Blake Lester

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blake Crystal | -- | None Listed On Document | |

| Blake Lester | -- | Stonewall Title Company | |

| Reeson Homes Llc | -- | Central Texas Title Luton | |

| Blake Lester | -- | -- | |

| Blake Lester | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Blake Lester | $180,000 | |

| Previous Owner | Reeson Homes Llc | $145,438 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,918 | $420,520 | $60,000 | $360,520 |

| 2024 | $3,890 | $404,690 | $60,000 | $368,530 |

| 2023 | $3,895 | $492,850 | $60,000 | $432,850 |

| 2022 | $4,050 | $380,680 | $40,000 | $340,680 |

| 2021 | $4,668 | $304,050 | $20,000 | $284,050 |

| 2020 | $4,433 | $285,420 | $20,000 | $265,420 |

| 2019 | $4,248 | $261,290 | $20,000 | $241,290 |

| 2018 | $4,005 | $246,330 | $20,000 | $226,330 |

| 2017 | $3,845 | $229,950 | $20,000 | $209,950 |

| 2016 | $3,845 | $229,950 | $20,000 | $209,950 |

| 2015 | -- | $195,150 | $20,000 | $175,150 |

| 2014 | -- | $195,000 | $20,000 | $175,000 |

Source: Public Records

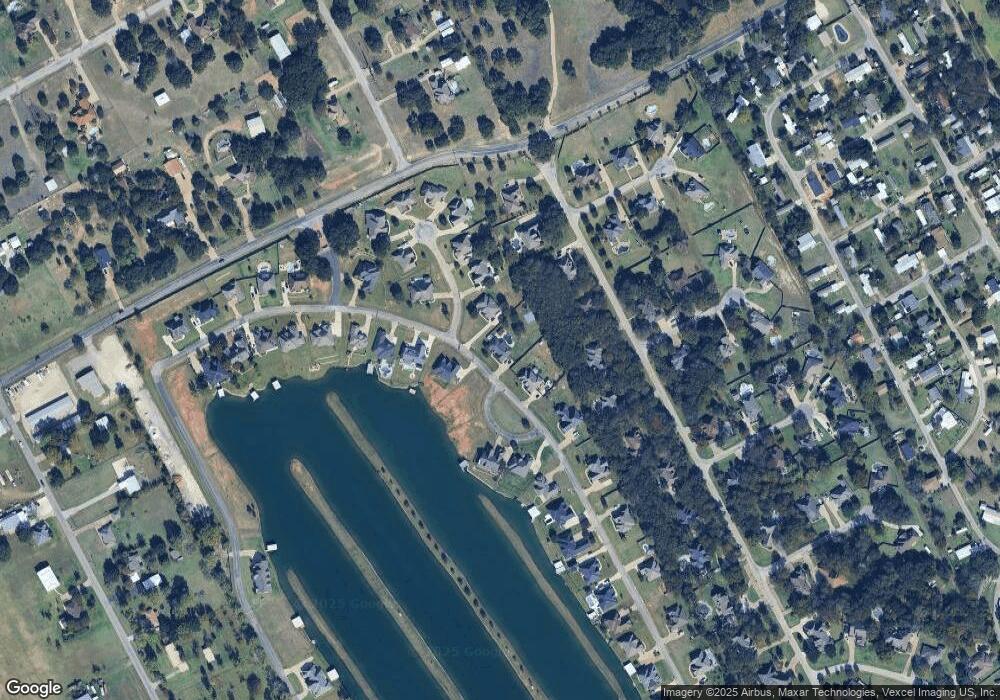

Map

Nearby Homes

- 4012 Upper Lake Cir

- 3606 Upper Lake Cir

- 3609 Upper Lake Cir

- 4312 Rhea Rd

- 3901 Upper Lake Cir

- 3207 Hummingbird Ct

- 3625 Montego Blvd

- 3620 Montgomery Dr

- 3905 Montgomery Dr

- 3119 Bob White Dr

- 3521 Nassau Ct

- 4900 Del Rio Ct

- 4504 E Kenwood Ct

- 4506 E Kenwood Ct

- Lot 189 E Kenwood Ct

- 5040 Santa Elena Ct

- 3722 Cove Timber Ave

- 5041 Santa Elena Ct

- 4505 Cove Timber Ct

- 4902 Boquillas Ct E

- 4401 Twin Oak Ct

- 4011 Upper Lake Cir

- 3506 Big Timber Ln

- 3504 Big Timber Ln

- 4403 Twin Oak Ct

- 3508 Big Timber Ln

- 4007 Upper Lake Cir

- 4402 Twin Oak Ct

- 4405 Twin Oak Ct

- 4016 Upper Lake Cir

- 3502 Big Timber Ln

- 3510 Big Timber Ln

- 4008 Upper Lake Cir

- 4018 Upper Lake Cir

- 4006 Upper Lake Cir

- 4407 Twin Oak Ct

- 4404 Twin Oak Ct

- 4400 Tall Timber Ct

- 4401 Shallow Creek Ct

- 3500 Big Timber Ln