402 Charleston St Friendswood, TX 77546

Estimated Value: $694,000 - $839,000

4

Beds

5

Baths

4,170

Sq Ft

$181/Sq Ft

Est. Value

About This Home

This home is located at 402 Charleston St, Friendswood, TX 77546 and is currently estimated at $753,343, approximately $180 per square foot. 402 Charleston St is a home located in Galveston County with nearby schools including Westwood Elementary School, Zue S. Bales Intermediate School, and Friendswood Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2025

Sold by

Labate Demetrio and Laezza Fernanda

Bought by

Labate-Laezza Mangement Trust and Labate

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2009

Sold by

Tracey Sean Patrick and Tracey Kari D

Bought by

Labate Demetrio and Laezza Fernanda

Purchase Details

Closed on

Mar 6, 1998

Sold by

Brady Donnie G

Bought by

Tracey Sean Patrick and Tracey Kari D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,750

Interest Rate

7.13%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Labate-Laezza Mangement Trust | -- | None Listed On Document | |

| Labate Demetrio | -- | Chicago Title Friendswood | |

| Tracey Sean Patrick | -- | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tracey Sean Patrick | $250,750 | |

| Closed | Tracey Sean Patrick | $14,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,420 | $650,000 | $106,990 | $543,010 |

| 2024 | $11,420 | $748,090 | $134,190 | $613,900 |

| 2023 | $11,420 | $690,643 | $0 | $0 |

| 2022 | $13,829 | $627,857 | $0 | $0 |

| 2021 | $13,332 | $611,770 | $134,190 | $477,580 |

| 2020 | $12,501 | $518,890 | $134,190 | $384,700 |

| 2019 | $14,144 | $557,000 | $55,540 | $501,460 |

| 2018 | $13,648 | $633,700 | $55,540 | $578,160 |

| 2017 | $12,615 | $633,700 | $55,540 | $578,160 |

| 2016 | $11,468 | $441,580 | $55,540 | $386,040 |

| 2015 | $3,794 | $417,590 | $55,540 | $362,050 |

| 2014 | $9,434 | $379,880 | $55,540 | $324,340 |

Source: Public Records

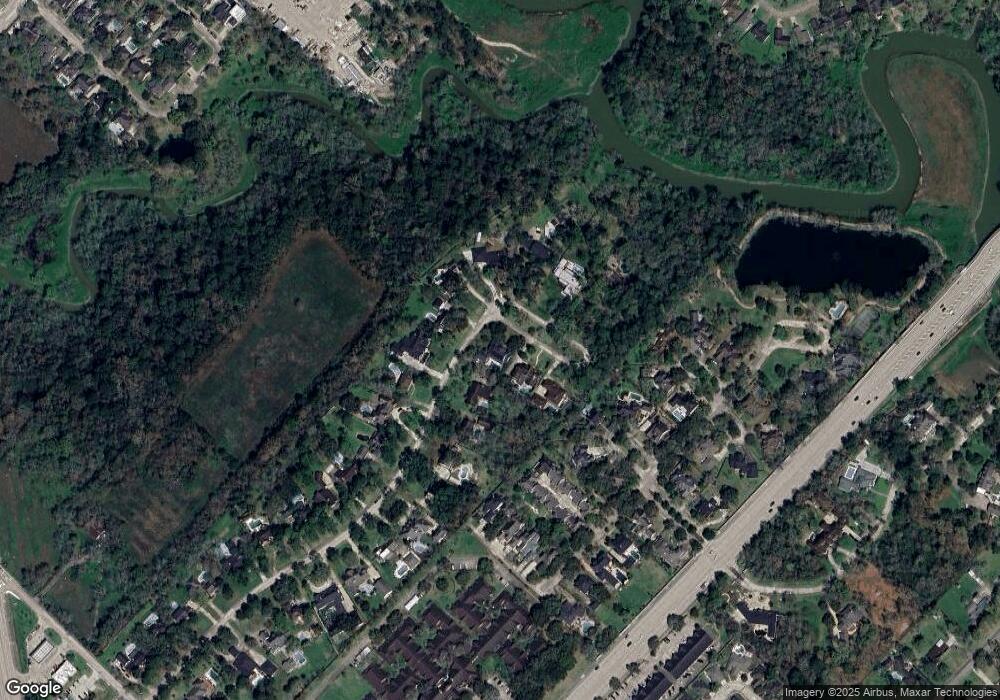

Map

Nearby Homes

- 210 Victoria Way

- 1303 Deepwood Dr

- 417 Forest Pines Ct

- 604 N Clear Creek Dr

- 4430 Peridot Ln

- 4426 Saffron Ln

- 314 Parkwood Village Dr

- 1201 Arbre Ln

- 42 Hideaway Dr Unit D1

- 8 Hideaway Dr

- 52 Hideaway Dr

- 64 Hideaway Dr

- 4315 Ravine Dr

- Magnolia Plan at Beamer Villas

- 1408 S Friendswood Dr Unit 101

- 5498 Apple Blossom Ln

- 303 Regency Ct

- 16903 Paint Rock Rd

- 402 Windsor Dr

- 1904 Candlelight Ct

- 404 Charleston St

- 306 Charleston St

- 307 Charleston St

- 406 Charleston St

- 305 Charleston St

- 309 Charleston St

- 304 Charleston St

- 303 Charleston St

- 401 Charleston St

- 403 Charleston Dr

- 302 Charleston St

- 403 Charleston St

- 1500 Rosewood Ct

- 206 Victoria Way

- 301 Charleston St

- 205 Victoria Way

- 1502 Rosewood Ct

- 207 Victoria Way

- 407 Charleston St

- 1501 Rosewood Ct