4020 NE 14th Ct Ocala, FL 34479

Northeast Ocala NeighborhoodEstimated Value: $288,000 - $432,000

4

Beds

3

Baths

2,080

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 4020 NE 14th Ct, Ocala, FL 34479 and is currently estimated at $361,465, approximately $173 per square foot. 4020 NE 14th Ct is a home located in Marion County with nearby schools including Oakcrest Elementary School, Howard Middle School, and Vanguard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 1, 2018

Sold by

Bowles Donald G

Bought by

Bowles Chase Anthony and Bowles Rachel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,000

Outstanding Balance

$83,363

Interest Rate

4.7%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$278,102

Purchase Details

Closed on

Dec 24, 2013

Sold by

Deutsche Bank National Trust Company

Bought by

Bowles Don G

Purchase Details

Closed on

Nov 1, 2013

Sold by

Oakwood Estates Property Owners Associat and Sylvain Sabrina C

Bought by

Deutsche Bank National Trust Company

Purchase Details

Closed on

Jan 25, 2008

Sold by

Sylvain Paule

Bought by

Sylvain Sabrina C

Purchase Details

Closed on

Aug 11, 2005

Sold by

A Plus Homes Inc

Bought by

Sylvain Paule

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,930

Interest Rate

5.71%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bowles Chase Anthony | $95,000 | Attorney | |

| Bowles Don G | $93,000 | Genesis Title Company | |

| Deutsche Bank National Trust Company | $100,200 | None Available | |

| Sylvain Sabrina C | $202,400 | Attorney | |

| Sylvain Paule | $49,900 | Superior Title Insurance Age | |

| A Plus Homes Inc | $28,400 | Superior Title Insurance Age |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bowles Chase Anthony | $95,000 | |

| Previous Owner | Sylvain Paule | $217,930 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,061 | $299,699 | -- | -- |

| 2023 | $4,899 | $272,454 | $0 | $0 |

| 2022 | $4,454 | $247,685 | $0 | $0 |

| 2021 | $3,984 | $225,168 | $35,000 | $190,168 |

| 2020 | $3,811 | $213,286 | $30,000 | $183,286 |

| 2019 | $3,522 | $193,390 | $25,000 | $168,390 |

| 2018 | $3,262 | $185,090 | $23,000 | $162,090 |

| 2017 | $3,233 | $182,780 | $23,000 | $159,780 |

| 2016 | $3,176 | $178,031 | $0 | $0 |

| 2015 | $3,045 | $167,389 | $0 | $0 |

| 2014 | $2,839 | $163,463 | $0 | $0 |

Source: Public Records

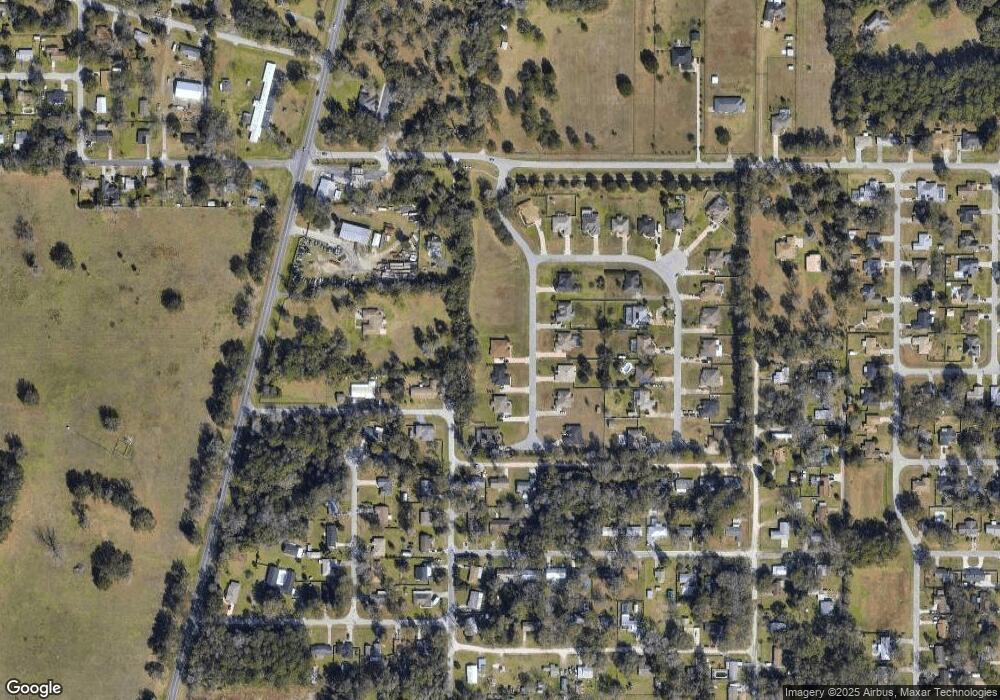

Map

Nearby Homes

- 4033 NE 15th Court Rd

- 4408 NE 13th Ave

- 1762 NE 39th St

- 3611 NE 15th Ave

- 3653 NE Jacksonville Rd

- 1760 NE 38th St

- 1200 NE 45th Place

- 3725 NE 18th Ave

- 1000 NE 45th St

- 3770 NE 19th Ave

- 4276 NE 19th Ave

- 3421 NE 16th Ct

- 3993 NE 19th Ave

- 4701 NE Jacksonville Rd

- 3401 NE 16th Ct

- 940 NE 35th St

- 3390 NE 17th Ave

- 3372 NE 17th Ave

- 1212 NE 33rd St

- 1066 NE 49th St

- 4020 NE 14 Ct

- 3960 NE 14th Ct

- 1331 NE 39th Ln

- 4055 NE 14 Ct

- 4025 NE 14th Ct

- 3995 NE 14th Ct

- 4055 NE 14th Ct

- 3930 NE 14th Ct

- 3965 NE 14th Ct

- 4085 NE 14th Ct

- 1360 NE 39th Ln

- 1321 NE 39th Ln

- 3935 NE 14th Ct

- 4055 NE Jacksonville Rd

- 1311 NE 39th Ln

- 3925 NE 13th Ave

- 1410 NE 39th St

- 1400 NE 39th St

- 1420 NE 39th St

- 3966 NE 15th Court Rd