4025 W Mcnab Rd Unit E201 Pompano Beach, FL 33069

Palm Aire NeighborhoodEstimated Value: $201,000 - $239,000

3

Beds

2

Baths

1,170

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 4025 W Mcnab Rd Unit E201, Pompano Beach, FL 33069 and is currently estimated at $215,321, approximately $184 per square foot. 4025 W Mcnab Rd Unit E201 is a home located in Broward County with nearby schools including Cypress Elementary School, Pompano Beach Middle School, and Blanche Ely High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 2, 2008

Sold by

U S Bank Na

Bought by

Saenz Hector Alberto and Saenz Elynor Becerra

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 27, 2008

Sold by

Farahan Bijan

Bought by

U S Bank Na

Purchase Details

Closed on

May 26, 2006

Sold by

Bay Pompano Beach Llc

Bought by

Farahan Bijan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$231,920

Interest Rate

7.64%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Saenz Hector Alberto | $110,000 | Sunbelt Title Agency | |

| U S Bank Na | -- | None Available | |

| Farahan Bijan | $289,900 | Fenway Title & Escrow Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Saenz Hector Alberto | $80,000 | |

| Previous Owner | Farahan Bijan | $231,920 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $937 | $66,270 | -- | -- |

| 2024 | $935 | $64,410 | -- | -- |

| 2023 | $935 | $62,540 | $0 | $0 |

| 2022 | $831 | $60,720 | $0 | $0 |

| 2021 | $795 | $58,960 | $0 | $0 |

| 2020 | $782 | $58,150 | $0 | $0 |

| 2019 | $779 | $56,850 | $0 | $0 |

| 2018 | $752 | $55,790 | $0 | $0 |

| 2017 | $691 | $54,650 | $0 | $0 |

| 2016 | $664 | $53,530 | $0 | $0 |

| 2015 | $680 | $53,160 | $0 | $0 |

| 2014 | $680 | $52,740 | $0 | $0 |

| 2013 | -- | $69,060 | $6,910 | $62,150 |

Source: Public Records

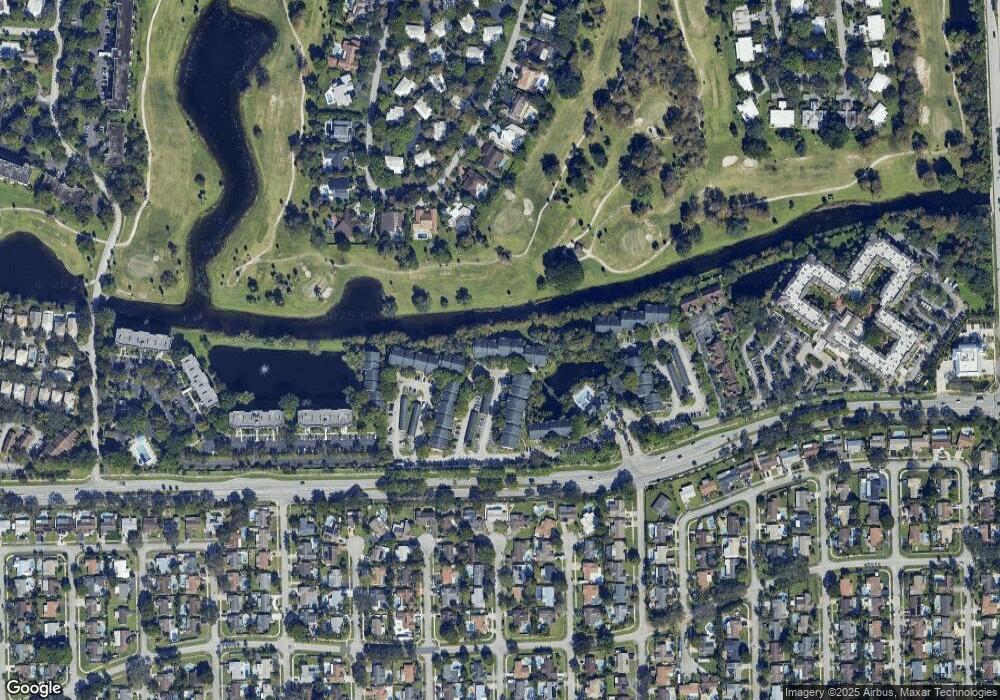

Map

Nearby Homes

- 4025 W Mcnab Rd Unit E208

- 4045 W Mcnab Rd Unit G110

- 4055 W Mcnab Rd Unit H112

- 4055 W Mcnab Rd Unit H303

- 4055 W Mcnab Rd Unit H106

- 3985 W Mcnab Rd Unit A111

- 3995 W Mcnab Rd Unit B105

- 3995 W Mcnab Rd Unit B212

- 6816 NW 26th Ave

- 1128 W Cypress Dr Unit V15

- 1130 W Cypress Dr Unit V16

- 4145 Cypress Reach Ct Unit 505

- 4007 N Cypress Dr Unit 102

- 6711 NW 26th Ave

- 6847 NW 27th Way

- 1443 Banyan Cir

- 808 Cypress Blvd Unit 504

- 808 Cypress Blvd Unit 106

- 821 Cypress Blvd Unit 304

- 2083 W Mcnab Rd

- 4025 W Mcnab Rd Unit F-204

- 4025 W Mcnab Rd

- 4025 W Mcnab Rd Unit E211

- 4025 W Mcnab Rd Unit E212

- 4025 W Mcnab Rd Unit E302

- 4025 W Mcnab Rd Unit E103

- 4025 W Mcnab Rd Unit E312

- 4025 W Mcnab Rd Unit E202

- 4025 W Mcnab Rd Unit E306

- 4025 W Mcnab Rd Unit E109

- 4025 W Mcnab Rd Unit E310

- 4025 W Mcnab Rd Unit E208

- 4025 W Mcnab Rd Unit E101

- 4025 W Mcnab Rd Unit E207

- 4025 W Mcnab Rd Unit E105

- 4025 W Mcnab Rd Unit E107

- 4025 W Mcnab Rd Unit E102

- 4025 W Mcnab Rd Unit E108