403 Kings Row Rd Lakemont, GA 30552

Estimated Value: $1,664,000 - $3,060,000

5

Beds

4

Baths

2,248

Sq Ft

$1,018/Sq Ft

Est. Value

About This Home

This home is located at 403 Kings Row Rd, Lakemont, GA 30552 and is currently estimated at $2,287,877, approximately $1,017 per square foot. 403 Kings Row Rd is a home located in Rabun County with nearby schools including Rabun County Primary School and Rabun County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2012

Sold by

The Wire Source Llc

Bought by

Fozzard Peter A and Fozzard Elizabeth T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$735,000

Outstanding Balance

$94,262

Interest Rate

3.9%

Mortgage Type

New Conventional

Estimated Equity

$2,193,615

Purchase Details

Closed on

Jun 28, 2005

Sold by

Leslie Sandra M

Bought by

The Wire Source Llc

Purchase Details

Closed on

Jan 1, 1993

Purchase Details

Closed on

Oct 1, 1992

Purchase Details

Closed on

Aug 1, 1987

Bought by

The Wire Source Llc

Purchase Details

Closed on

Dec 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fozzard Peter A | $980,000 | -- | |

| Fozzard Peter A | $980,000 | -- | |

| The Wire Source Llc | $1,570,000 | -- | |

| The Wire Source Llc | $1,570,000 | -- | |

| -- | $237,500 | -- | |

| -- | $237,500 | -- | |

| -- | -- | -- | |

| -- | -- | -- | |

| The Wire Source Llc | $142,500 | -- | |

| The Wire Source Llc | $142,500 | -- | |

| -- | -- | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fozzard Peter A | $735,000 | |

| Closed | Fozzard Peter A | $735,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,640 | $538,321 | $250,000 | $288,321 |

| 2024 | $8,410 | $523,989 | $250,000 | $273,989 |

| 2023 | $8,256 | $451,061 | $220,000 | $231,061 |

| 2022 | $8,060 | $440,372 | $220,000 | $220,372 |

| 2021 | $7,498 | $399,878 | $200,000 | $199,878 |

| 2020 | $7,457 | $384,476 | $200,000 | $184,476 |

| 2019 | $7,510 | $384,476 | $200,000 | $184,476 |

| 2018 | $7,537 | $384,476 | $200,000 | $184,476 |

| 2017 | $7,192 | $382,562 | $200,000 | $182,562 |

| 2016 | $7,212 | $382,562 | $200,000 | $182,562 |

| 2015 | $7,081 | $367,714 | $200,000 | $167,714 |

| 2014 | $7,119 | $367,714 | $200,000 | $167,714 |

Source: Public Records

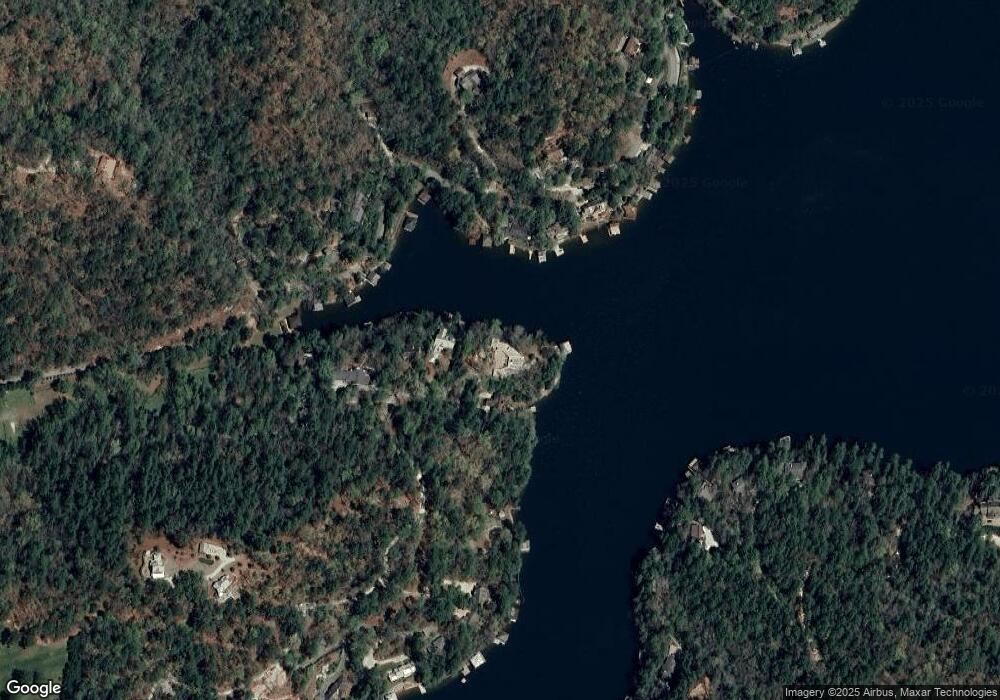

Map

Nearby Homes

- 120 Pinto Ln

- 32 Light House Ln

- 0 Rabun Bluffs Dr Unit LOT 1 10487540

- 768 Wexford Way

- 513 Georgia Ln

- 1007 Bear Gap Rd Unit L

- 1095 Rabun Bluffs Dr

- 49 Richmond Ln

- 0 Brenary Ln Unit 10442041

- 224 Dragon Tree Ln

- 916 Arbor Dr

- 31 Barn Inn Rd

- 518 Grizzly Ridge Rd

- LOT 36 Whispering Dale Dr

- LOT 37 Whispering Dale

- 135 (LOT 5) Whispering Dale Rd

- 0 Grizzly Ridge Rd Unit 10536009

- 249 Spruce Creek Rd

- 1502 Raspberry Ln

- 0 Golden Delicious Unit 10520461

- 403 Kings Row Rd

- 401 Kings Row Rd

- 76 Dana Place

- 347 Kings Row Rd

- 44 Dana Place

- 51 Pinto Ln

- 475 Kings Row Rd

- 987 Kings Row

- 54 Pinto Ln

- 4226 Brandon Mill Rd

- 4228 Brandon Mill Rd Unit L

- 75 Lily Ln

- 4570 Brandon Mill Rd

- 37 Enfield Ln

- 129 Lily Ln

- 4590 Brandon Mill Rd

- 107 Lily Ln Unit L

- 4642 Brandon Mill Rd

- 345 Kings Row Rd

- 885 Kings Row Rd