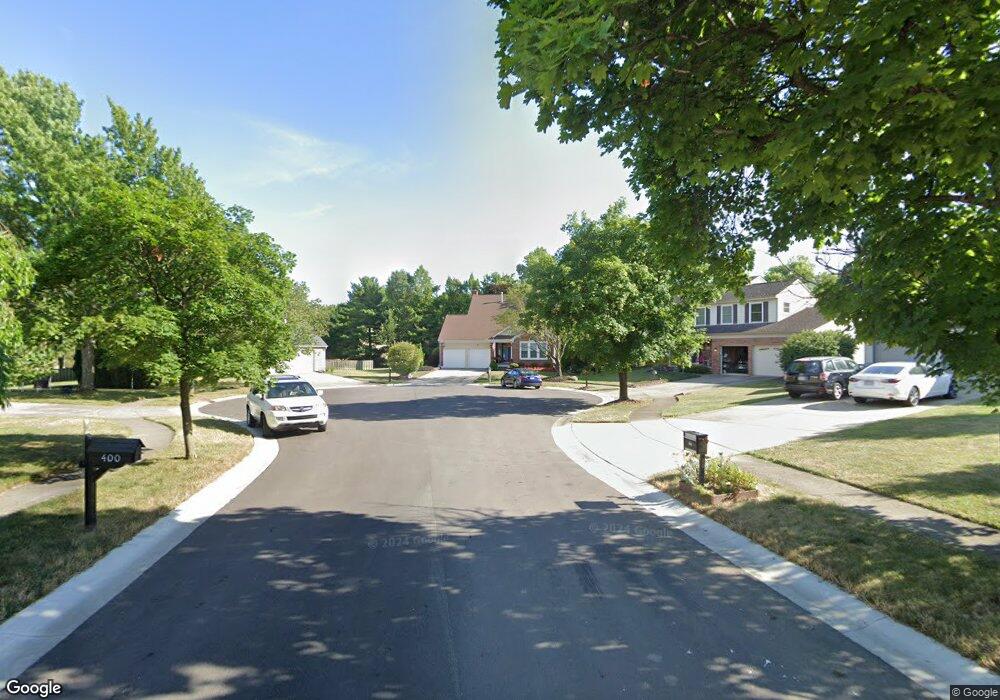

403 Olympia Fields Ct Columbus, OH 43230

Woodside Green NeighborhoodEstimated Value: $390,000 - $459,000

3

Beds

3

Baths

1,804

Sq Ft

$234/Sq Ft

Est. Value

About This Home

This home is located at 403 Olympia Fields Ct, Columbus, OH 43230 and is currently estimated at $422,523, approximately $234 per square foot. 403 Olympia Fields Ct is a home located in Franklin County with nearby schools including Royal Manor Elementary School, Gahanna West Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 29, 2017

Sold by

Stetzer Marc A

Bought by

Cornell Stetzer Angela

Current Estimated Value

Purchase Details

Closed on

Sep 26, 2017

Sold by

Cornell Stetzer Angela and Stetzer Angela R

Bought by

Stetzer Angela R and Angela R Stetzer Trust

Purchase Details

Closed on

Nov 7, 2001

Sold by

Hayes Theodore W and Hayes Lisa K

Bought by

Stetzer Marc A and Cornell Stetzer Angela

Purchase Details

Closed on

Aug 13, 1999

Sold by

Spain Joseph D and Spain Mindy L

Bought by

Hayes Theodore W and Hayes Lisa K

Purchase Details

Closed on

Feb 25, 1998

Sold by

Spain Joseph D

Bought by

Spain Joseph D and Spain Mindy L

Purchase Details

Closed on

Aug 4, 1994

Sold by

Korb Lee A

Bought by

Joseph D Spain

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,400

Interest Rate

8.53%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 30, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cornell Stetzer Angela | -- | None Available | |

| Stetzer Angela R | -- | None Available | |

| Stetzer Marc A | $164,000 | Lawyers Title | |

| Hayes Theodore W | $149,900 | Chicago Title | |

| Spain Joseph D | -- | Chelsea Title | |

| Joseph D Spain | $134,900 | -- | |

| -- | $122,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Joseph D Spain | $121,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,287 | $123,690 | $34,650 | $89,040 |

| 2024 | $7,287 | $123,690 | $34,650 | $89,040 |

| 2023 | $7,195 | $123,690 | $34,650 | $89,040 |

| 2022 | $6,325 | $84,700 | $18,900 | $65,800 |

| 2021 | $6,118 | $84,700 | $18,900 | $65,800 |

| 2020 | $6,066 | $84,700 | $18,900 | $65,800 |

| 2019 | $5,069 | $70,630 | $15,750 | $54,880 |

| 2018 | $4,722 | $70,630 | $15,750 | $54,880 |

| 2017 | $4,653 | $70,630 | $15,750 | $54,880 |

| 2016 | $4,408 | $60,940 | $16,660 | $44,280 |

| 2015 | $4,411 | $60,940 | $16,660 | $44,280 |

| 2014 | $4,377 | $60,940 | $16,660 | $44,280 |

| 2013 | $2,174 | $60,935 | $16,660 | $44,275 |

Source: Public Records

Map

Nearby Homes

- 536 Springwood Lake Dr

- 772 Old Forest Ct

- 420 Denwood Ct

- 482 Baywood Place

- 388 Elkwood Place

- 3877 Hines Rd

- 377 Highbury Crescent

- 855 Humboldt Dr W

- 108 Walcreek Dr W

- 3455 Halpern St

- 111 Nob Hill Dr N

- 2655 Aeden Dr

- 4672 Sperry Ave

- 221 Lincolnshire Rd

- 0 Wendler Blvd

- 3555 Tami Place

- 4083 MacAldus Dr

- 4761 Ransey Ct

- 491 Daventry Ln

- 440 Colony Place

- 407 Olympia Fields Ct

- 402 Woodbrie Ct

- 392 Olympia Fields Ct

- 408 Woodbrie Ct

- 414 Woodbrie Ct

- 411 Olympia Fields Ct

- 396 Woodbrie Ct

- 600 Woodbay Dr

- 396 Olympia Fields Ct

- 606 Woodbay Dr

- 594 Woodbay Dr

- 612 Woodbay Dr

- 415 Olympia Fields Ct

- 400 Olympia Fields Ct

- 419 Olympia Fields Ct

- 3731 N Stygler Rd

- 393 Woodbrie Ct

- 3739 N Stygler Rd

- 411 Woodbrie Ct

- 405 Woodbrie Ct