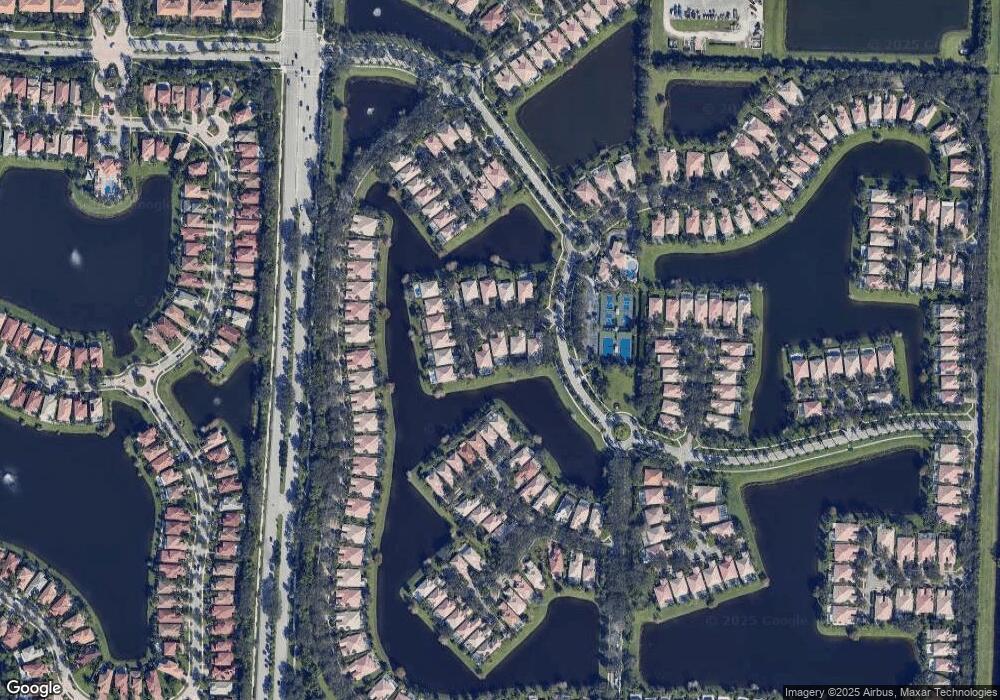

405 Fonseca Way Palm Beach Gardens, FL 33410

Palm Beach Gardens North NeighborhoodEstimated Value: $1,006,000 - $1,106,000

4

Beds

3

Baths

2,493

Sq Ft

$424/Sq Ft

Est. Value

About This Home

This home is located at 405 Fonseca Way, Palm Beach Gardens, FL 33410 and is currently estimated at $1,056,342, approximately $423 per square foot. 405 Fonseca Way is a home located in Palm Beach County with nearby schools including Timber Trace Elementary School, William T. Dwyer High School, and Watson B. Duncan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2011

Sold by

Parrillo Leonard V and Feder Carolyn Z

Bought by

Fredrick William Todd and Fredrick Kimberly R

Current Estimated Value

Purchase Details

Closed on

Nov 23, 2009

Sold by

Scharch Kristin R and Scharch Ted A

Bought by

Parrillo Leonard and Feder Carolyn Z

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

4.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 20, 2002

Sold by

Puya Keith J and Puya Mariann

Bought by

Kutcel Kristin R and Scharch Ted A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,700

Interest Rate

6.3%

Purchase Details

Closed on

May 2, 2002

Sold by

Divosta & Company Inc

Bought by

Puya Keith J and Puya Mariann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$246,300

Interest Rate

7.16%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fredrick William Todd | $522,500 | Clarion Title Company Inc | |

| Parrillo Leonard | $520,000 | Attorney | |

| Kutcel Kristin R | $383,000 | -- | |

| Puya Keith J | $307,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Parrillo Leonard | $275,000 | |

| Previous Owner | Kutcel Kristin R | $300,700 | |

| Previous Owner | Kutcel Kristin R | $35,000 | |

| Previous Owner | Puya Keith J | $246,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,715 | $714,479 | -- | -- |

| 2023 | $13,198 | $649,526 | $0 | $0 |

| 2022 | $11,893 | $590,478 | $0 | $0 |

| 2021 | $10,803 | $536,798 | $184,800 | $351,998 |

| 2020 | $10,427 | $513,581 | $168,300 | $345,281 |

| 2019 | $10,240 | $498,424 | $0 | $498,424 |

| 2018 | $9,943 | $495,604 | $0 | $495,604 |

| 2017 | $10,277 | $503,090 | $0 | $0 |

| 2016 | $10,140 | $484,260 | $0 | $0 |

| 2015 | $10,259 | $475,430 | $0 | $0 |

| 2014 | $9,820 | $446,307 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1364 Saint Lawrence Dr

- 302 Aegean Rd

- 631 Hudson Bay Dr

- 649 Hudson Bay Dr

- 1345 Saint Lawrence Dr

- 12077 Aviles Cir

- 1342 Saint Lawrence Dr

- 12025 Aviles Cir

- 935 Magdalena Rd

- 1323 Saint Lawrence Dr

- 12140 Aviles Cir

- 12157 Aviles Cir

- 815 Niemen Dr

- 215 Danube Way

- 904 Magdalena Rd

- 12491 Aviles Cir

- 12479 Aviles Cir

- 12312 Aviles Cir

- 11924 Banyan St

- 4652 Cadiz Cir

- 407 Fonseca Way

- 403 Fonseca Way

- 401 Fonseca Way

- 409 Fonseca Way

- 411 Fonseca Way

- 413 Fonseca Way

- 404 Fonseca Way

- 402 Fonseca Way

- 400 Fonseca Way

- 406 Fonseca Way

- 415 Fonseca Way

- 549 Grand Banks Rd

- 417 Fonseca Way

- 547 Grand Banks Rd

- 419 Fonseca Way

- 545 Grand Banks Rd

- 543 Grand Banks Rd

- 512 Grand Banks Rd

- 541 Grand Banks Rd

- 510 Grand Banks Rd