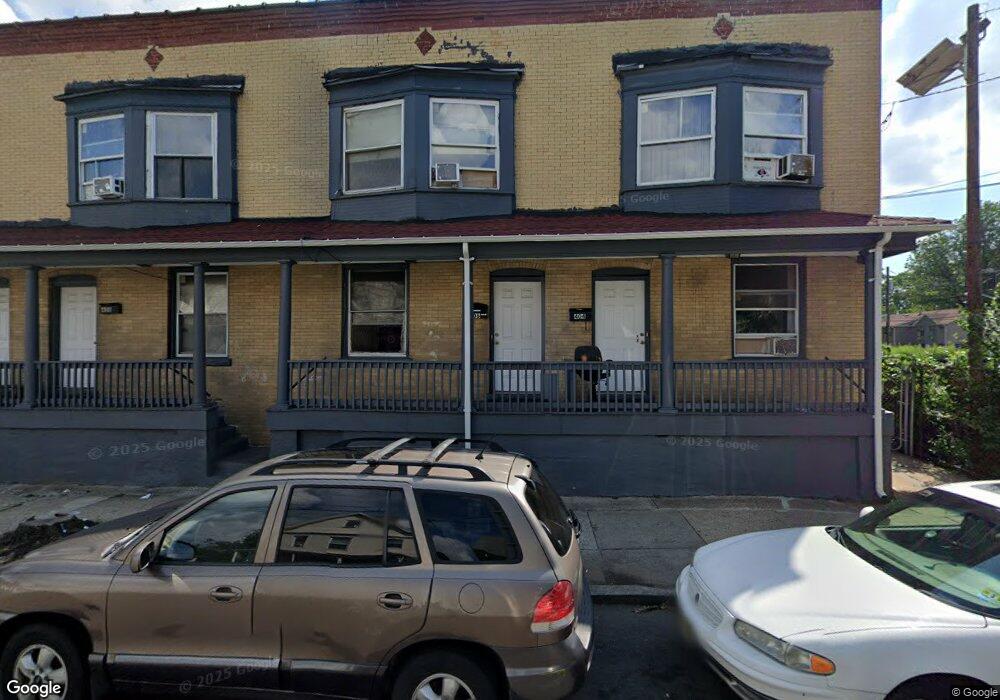

406 New St Unit 10 Plainfield, NJ 07060

Estimated Value: $432,000 - $825,000

--

Bed

--

Bath

4,998

Sq Ft

$130/Sq Ft

Est. Value

About This Home

This home is located at 406 New St Unit 10, Plainfield, NJ 07060 and is currently estimated at $647,900, approximately $129 per square foot. 406 New St Unit 10 is a home located in Union County with nearby schools including Charles H. Stillman Elementary School, Hubbard Middle School, and Plainfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2020

Sold by

406 New Street Llc

Bought by

Dream Properties Trust

Current Estimated Value

Purchase Details

Closed on

May 17, 2018

Sold by

Brobbey Charles

Bought by

406 New St Llc

Purchase Details

Closed on

Apr 1, 2001

Sold by

Chappaqua Development Llc

Bought by

Brobbey Charles

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,500

Interest Rate

6.88%

Purchase Details

Closed on

Dec 28, 2000

Sold by

Chase Manhattan Mtg Corp

Bought by

Chappaqua Development Llc

Purchase Details

Closed on

Dec 14, 2000

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Chase Manhattan Mtg Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dream Properties Trust | -- | Fidelity National Title | |

| Dream Properties Trust | -- | Fidelity National Title | |

| 406 New St Llc | $240,000 | Fidelity Natl Title Ins Co | |

| Brobbey Charles | $125,000 | Chicago Title Insurance Co | |

| Chappaqua Development Llc | $105,000 | First American Title Ins Co | |

| Chase Manhattan Mtg Corp | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brobbey Charles | $87,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,352 | $130,000 | $33,900 | $96,100 |

| 2024 | $11,240 | $130,000 | $33,900 | $96,100 |

| 2023 | $11,240 | $130,000 | $33,900 | $96,100 |

| 2022 | $10,997 | $130,000 | $33,900 | $96,100 |

| 2021 | $10,901 | $130,000 | $33,900 | $96,100 |

| 2020 | $11,923 | $142,600 | $33,900 | $108,700 |

| 2019 | $11,923 | $142,600 | $33,900 | $108,700 |

| 2018 | $11,673 | $142,600 | $33,900 | $108,700 |

| 2017 | $11,388 | $142,600 | $33,900 | $108,700 |

| 2016 | $11,156 | $142,600 | $33,900 | $108,700 |

| 2015 | $10,826 | $142,600 | $33,900 | $108,700 |

| 2014 | $10,532 | $142,600 | $33,900 | $108,700 |

Source: Public Records

Map

Nearby Homes

- 401 S Us Hwy

- 542 W 6th St

- 720 Madison Ave Unit 22

- 409 John St Unit 11

- 429 John St

- 614 W 8th St Unit 10

- 560 W Front St

- 647 S 2nd St

- 946 Central Ave

- 681 W 3rd St Unit 83

- 911 Plainfield Ave Unit 13

- 911 13 Plainfield Ave

- 401 Highway22b21u3ondo

- 401 Highway22b25u4ondo Unit 25D

- 125 Lafayette Place Unit 27

- 29 Pearl St

- 818-20 2nd Place

- 28 Harmony St

- 413 W 8th St

- 37 Harmony St

- 412 New St Unit 16

- 405 New St

- 411 New St Unit 13

- 418 W 5th St Unit 20

- 407 New St Unit 9

- 76-80 Mercer Unit 3

- 422 W 5th St Unit 24

- 422-24 W 5th St Unit 4

- 411-13 New St

- 426-28 W 5th St

- 426 W 5th St Unit 28

- 430 W 5th St

- 432 W 5th St

- 422 W 4th St Unit 24

- 434 W 5th St

- 435-437 W 5th St

- 436 W 5th St

- 414 Central Ave Unit 16

- 418 Central Ave Unit 20

- 438 W 5th St