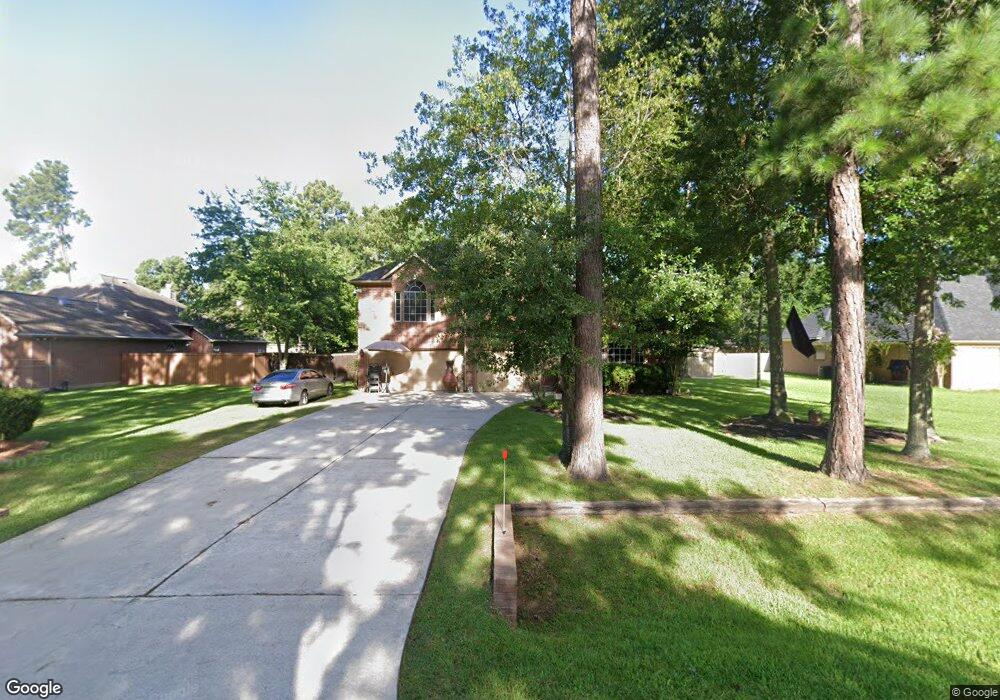

407 Monarch Oak Dr Magnolia, TX 77354

Westwood NeighborhoodEstimated Value: $468,000 - $529,000

4

Beds

3

Baths

2,692

Sq Ft

$187/Sq Ft

Est. Value

About This Home

This home is located at 407 Monarch Oak Dr, Magnolia, TX 77354 and is currently estimated at $504,350, approximately $187 per square foot. 407 Monarch Oak Dr is a home located in Montgomery County with nearby schools including Tom R. Ellisor Elementary School, Bear Branch Junior High School, and Magnolia High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 17, 2014

Sold by

Thornton David R and Thornton Gayle D

Bought by

Wheless Clinton and Wheless Roxanne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,100

Outstanding Balance

$198,305

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$306,045

Purchase Details

Closed on

Nov 15, 2002

Sold by

Supreme Builders Ltd

Bought by

Thornton David R and Thornton Gayle D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,550

Interest Rate

5.89%

Purchase Details

Closed on

Jul 11, 2002

Sold by

Lin Bin Hwang

Bought by

Wheless Clinton and Wheless Roxanne

Purchase Details

Closed on

May 15, 2001

Sold by

Lin Bin Hwang and Lin Hsueh Erh

Bought by

Hudson Mike

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wheless Clinton | -- | Stewart Title Of Montgomery | |

| Thornton David R | -- | -- | |

| Wheless Clinton | -- | -- | |

| Hudson Mike | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wheless Clinton | $264,100 | |

| Previous Owner | Thornton David R | $134,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,110 | $469,980 | $80,000 | $389,980 |

| 2024 | $6,702 | $449,118 | $80,000 | $369,118 |

| 2023 | $6,702 | $424,520 | $80,000 | $344,520 |

| 2022 | $7,484 | $424,140 | $82,650 | $341,490 |

| 2021 | $5,801 | $312,110 | $57,000 | $255,110 |

| 2020 | $5,916 | $292,330 | $57,000 | $235,330 |

| 2019 | $5,800 | $287,980 | $57,000 | $230,980 |

| 2018 | $5,757 | $272,320 | $20,000 | $252,320 |

| 2017 | $5,775 | $272,320 | $20,000 | $252,320 |

| 2016 | $5,532 | $260,860 | $20,000 | $240,860 |

| 2015 | $4,736 | $254,310 | $20,000 | $234,310 |

| 2014 | $4,736 | $230,790 | $20,000 | $210,790 |

Source: Public Records

Map

Nearby Homes

- 502 Garrett Dr

- 5918 Mahogany Way

- 914 Box Elder Dr

- 6107 Cypress Way Dr

- 803 Box Elder Dr

- 5503 Teakwood Ln

- 506 Weeping Willow Way

- 711 Shadberry Dr

- 503 Weisinger Dr

- 906 Weeping Willow Way

- 319 Weisinger Dr

- 902 Mesquite Dr

- 6706 Durango Creek Dr

- 6221 Ranch Lake Dr

- 906 Wiley Dr

- 6718 Durango Creek Dr

- 6422 Sugar Bush Dr

- 33319 Lago Vista

- 81 N Apple Springs Cir

- 6846 Durango Creek Dr

- 403 Monarch Oak Dr

- 410 Garrett Dr

- 402 Garrett Dr

- 0 Monarch Oak Dr

- 406 Monarch Oak Dr

- 5913 Lotus

- 410 Monarch Oak Dr

- 402 Monarch Oak Dr

- 419 Monarch Oak Dr

- 5907 Lotus

- 414 Monarch Oak Dr

- 5903 Lotus

- 5911 Lotus

- 5819 Lotus

- 5915 Lotus

- 418 Monarch Oak Dr

- 503 Monarch Oak Dr

- 5815 Lotus

- 407 Mackintosh Dr

- 403 Garrett Dr