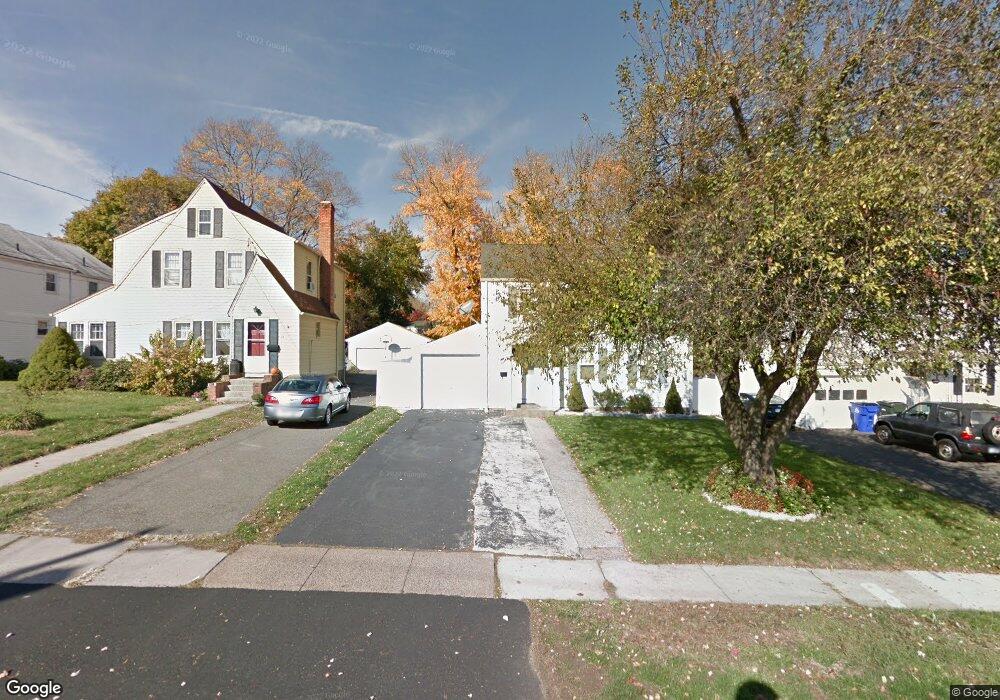

41 Byrd Rd Wethersfield, CT 06109

Estimated Value: $357,000 - $391,000

3

Beds

2

Baths

1,344

Sq Ft

$279/Sq Ft

Est. Value

About This Home

This home is located at 41 Byrd Rd, Wethersfield, CT 06109 and is currently estimated at $374,936, approximately $278 per square foot. 41 Byrd Rd is a home located in Hartford County with nearby schools including Alfred W. Hanmer School, Silas Deane Middle School, and Wethersfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 17, 2010

Sold by

Fnma

Bought by

Santos Leandro and Santos Elisa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,610

Interest Rate

4.23%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 16, 2010

Sold by

Bac Home Loans Svcng

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Aug 17, 2006

Sold by

Champ Daniel

Bought by

Gallo Salvatore

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Santos Leandro | $189,900 | -- | |

| Federal National Mortgage Association | -- | -- | |

| Bac Home Loans Svcng | -- | -- | |

| Gallo Salvatore | $227,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gallo Salvatore | $196,350 | |

| Closed | Gallo Salvatore | $168,610 | |

| Previous Owner | Gallo Salvatore | $30,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,471 | $229,760 | $90,990 | $138,770 |

| 2024 | $6,179 | $142,970 | $65,100 | $77,870 |

| 2023 | $5,973 | $142,970 | $65,100 | $77,870 |

| 2022 | $5,873 | $142,970 | $65,100 | $77,870 |

| 2021 | $5,815 | $142,970 | $65,100 | $77,870 |

| 2020 | $5,817 | $142,970 | $65,100 | $77,870 |

| 2019 | $5,825 | $142,970 | $65,100 | $77,870 |

| 2018 | $6,064 | $148,700 | $62,000 | $86,700 |

| 2017 | $5,914 | $148,700 | $62,000 | $86,700 |

| 2016 | $5,731 | $148,700 | $62,000 | $86,700 |

| 2015 | $5,679 | $148,700 | $62,000 | $86,700 |

| 2014 | $5,463 | $148,700 | $62,000 | $86,700 |

Source: Public Records

Map

Nearby Homes

- 35 Stillwold Dr

- 91 Somerset St

- 108 Chamberlain Rd

- 87 Somerset St

- 119 Coleman Rd

- 195 Middletown Ave

- 38 Wheeler Rd

- 116 Wells Farm Dr

- 18 Avalon Place

- 455 Brimfield Rd

- 89 Merriman Rd

- 493 Main St

- 219 Jordan Ln Unit 221

- 14 Ivy Ln

- 97 Brussels Ave

- 104 Willow St

- 143 Valley Crest Dr

- 20 Forest Dr

- 19 Albert Ave

- 88 Highland St