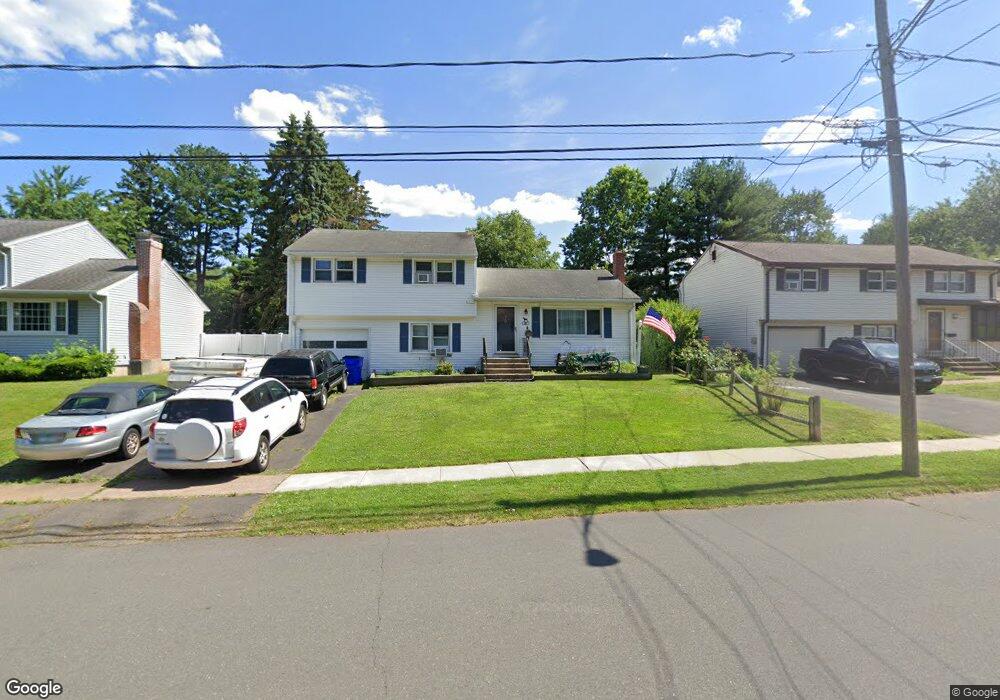

41 Mildred Rd West Hartford, CT 06107

Estimated Value: $373,000 - $441,000

3

Beds

2

Baths

1,225

Sq Ft

$329/Sq Ft

Est. Value

About This Home

This home is located at 41 Mildred Rd, West Hartford, CT 06107 and is currently estimated at $403,066, approximately $329 per square foot. 41 Mildred Rd is a home located in Hartford County with nearby schools including Webster Hill School, Sedgwick Middle School, and Conard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2024

Sold by

Gallagher Barbara W

Bought by

Gallagher Brian M and Gallagher Barbara W

Current Estimated Value

Purchase Details

Closed on

Feb 24, 2016

Sold by

Doran William C

Bought by

Gallagher Barbara W

Purchase Details

Closed on

Feb 13, 2003

Sold by

Donohue Wayne A

Bought by

Moriarty Eileen G and Gallagher Francis X

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,000

Interest Rate

5.88%

Purchase Details

Closed on

Sep 25, 2001

Sold by

Barrett Roslie S and Haraghey Margaret

Bought by

Donohue Wayne A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,400

Interest Rate

6.98%

Purchase Details

Closed on

Aug 16, 1999

Sold by

Scolsky Stephen

Bought by

Haraghey Margaret

Purchase Details

Closed on

Nov 30, 1995

Sold by

Cornerstone Vlg Llc

Bought by

Krasowski Robert and Krasowski Brata

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gallagher Brian M | -- | None Available | |

| Gallagher Barbara W | -- | None Available | |

| Bennett Paula S | -- | None Available | |

| Gallagher Brian M | -- | None Available | |

| Gallagher Barbara W | -- | -- | |

| Doran William C | -- | -- | |

| Moriarty Eileen G | $189,000 | -- | |

| Donohue Wayne A | $189,900 | -- | |

| Haraghey Margaret | $150,000 | -- | |

| Krasowski Robert | $109,900 | -- | |

| Gallagher Barbara W | -- | -- | |

| Moriarty Eileen G | $189,000 | -- | |

| Donohue Wayne A | $189,900 | -- | |

| Haraghey Margaret | $150,000 | -- | |

| Krasowski Robert | $109,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Krasowski Robert | $139,000 | |

| Previous Owner | Krasowski Robert | $180,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,043 | $179,620 | $69,720 | $109,900 |

| 2024 | $7,607 | $179,620 | $69,720 | $109,900 |

| 2023 | $7,350 | $179,620 | $69,720 | $109,900 |

| 2022 | $7,307 | $179,620 | $69,720 | $109,900 |

| 2021 | $6,705 | $158,060 | $65,380 | $92,680 |

| 2020 | $6,259 | $149,730 | $61,250 | $88,480 |

| 2019 | $6,259 | $149,730 | $61,250 | $88,480 |

| 2018 | $6,139 | $149,730 | $61,250 | $88,480 |

| 2017 | $6,145 | $149,730 | $61,250 | $88,480 |

| 2016 | $6,109 | $154,630 | $58,590 | $96,040 |

| 2015 | $5,924 | $154,630 | $58,590 | $96,040 |

| 2014 | $5,535 | $148,120 | $58,590 | $89,530 |

Source: Public Records

Map

Nearby Homes

- 32 Miles Standish Dr

- 1 Valley Crest Dr

- 34 Sandhurst Dr

- 24 Thorne Rd Unit 24

- 25 Fowler Dr

- 236 Ridgewood Rd

- 43 Burnham Dr

- 61 Waterside Ln

- 479 S Main St

- 422 S Main St

- 54 Red Top Dr

- 18 Federal St

- 281 South Rd

- 29 Fairwood Farms Dr

- 11 Fairwood Farms Dr

- 107 Westgate St

- 39 Pheasant Hill Dr

- 96 Bentwood Rd

- 61 Colonial St

- 39 Cortland St