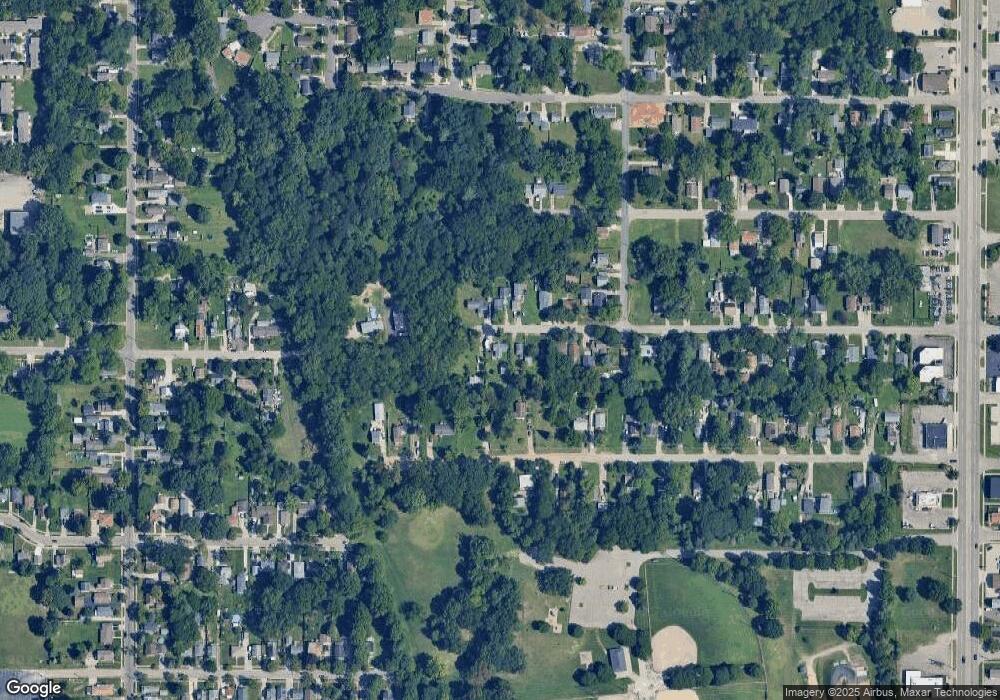

410 E Howe Ave Lansing, MI 48906

Creston NeighborhoodEstimated Value: $120,000 - $133,000

2

Beds

1

Bath

969

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 410 E Howe Ave, Lansing, MI 48906 and is currently estimated at $124,945, approximately $128 per square foot. 410 E Howe Ave is a home located in Ingham County with nearby schools including Gier Park School, Pattengill Academy, and Eastern High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 8, 2022

Sold by

Huerta Celina

Bought by

Huerta Freddy

Current Estimated Value

Purchase Details

Closed on

Mar 11, 2010

Sold by

Parish Patricia Marie

Bought by

Us Bank National Association

Purchase Details

Closed on

Sep 13, 2006

Sold by

Parish Frank N

Bought by

Parish Patricia Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,000

Interest Rate

9.6%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 22, 1998

Sold by

Sibley Patrick A and Sibley Christian

Bought by

Parish Frank N

Purchase Details

Closed on

Aug 1, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Huerta Freddy | -- | -- | |

| Us Bank National Association | $24,300 | None Available | |

| Parish Patricia Marie | $70,000 | Capitol City Title Agency Ll | |

| Parish Frank N | $49,000 | -- | |

| -- | $37,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Parish Patricia Marie | $63,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,250 | $53,600 | $12,000 | $41,600 |

| 2024 | $18 | $50,900 | $12,000 | $38,900 |

| 2023 | $2,111 | $46,700 | $12,000 | $34,700 |

| 2022 | $2,443 | $41,300 | $10,800 | $30,500 |

| 2021 | $1,866 | $37,100 | $8,200 | $28,900 |

| 2020 | $1,854 | $34,500 | $8,200 | $26,300 |

| 2019 | $1,776 | $31,200 | $8,200 | $23,000 |

| 2018 | $1,666 | $28,300 | $8,200 | $20,100 |

| 2017 | $1,595 | $28,300 | $8,200 | $20,100 |

| 2016 | $1,685 | $27,800 | $8,200 | $19,600 |

| 2015 | $1,685 | $27,000 | $16,474 | $10,526 |

| 2014 | $1,685 | $26,600 | $20,181 | $6,419 |

Source: Public Records

Map

Nearby Homes

- 533 Community St

- 2508 Gary Ave

- 213 E Thomas St

- 801 Banghart St

- 816 Orchard Glen Ave

- 712 Sanford St

- 310 W Frederick Ave

- 3425 Turner Rd

- 415 Filley St

- 1919 N East St

- 2318 N High St

- 109 Desander Dr Unit 109

- 152 Donald Ave Unit 152

- 117 Desander Dr Unit 117

- 627 W Frederick Ave

- 85 Nettie Ave Unit 85

- 151 Donald Ave Unit 151

- 1016 Lake Lansing Rd

- 0 Lake Lansing Rd Unit 289258

- 1810 N High St