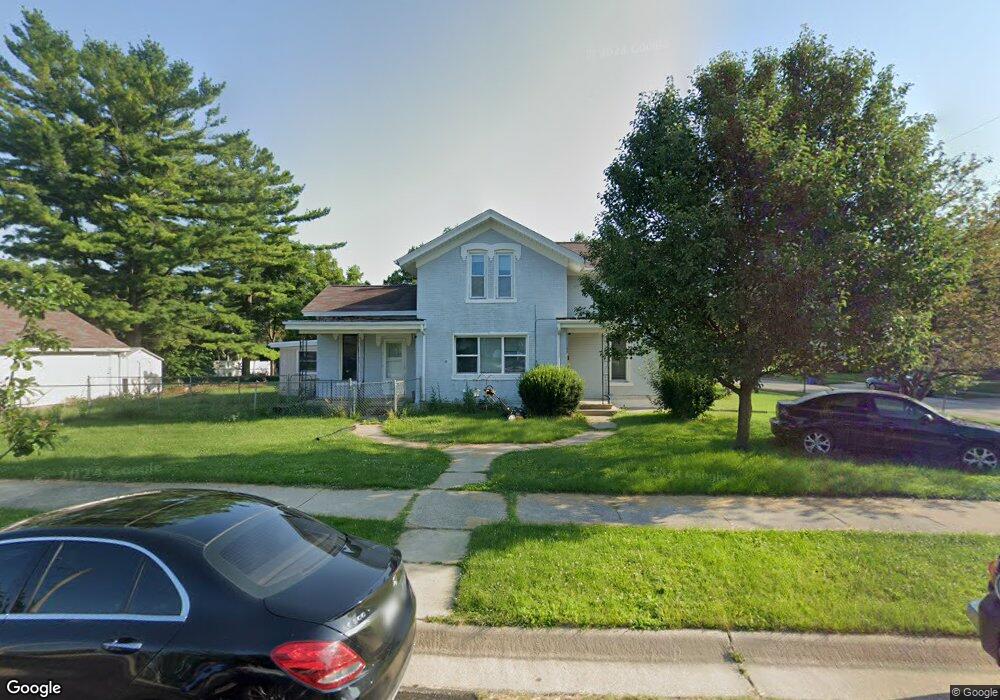

410 S 7th St Watertown, WI 53094

Estimated Value: $245,000 - $288,000

--

Bed

--

Bath

--

Sq Ft

0.32

Acres

About This Home

This home is located at 410 S 7th St, Watertown, WI 53094 and is currently estimated at $261,510. 410 S 7th St is a home located in Jefferson County with nearby schools including Watertown High School, eCampus Academy Charter School, and Trinity-St. Luke's Lutheran Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 9, 2011

Sold by

Loring Patrick B and Loring Karen M

Bought by

Loring Nathan E and Loring Crystal L

Current Estimated Value

Purchase Details

Closed on

May 16, 2011

Sold by

Wisconsin Housing And Economic Developme

Bought by

Loring Partick B and Loring Karen M

Purchase Details

Closed on

Feb 11, 2011

Sold by

Leal Valenten

Bought by

Wisconsin Housing & Economic Development

Purchase Details

Closed on

Aug 23, 2007

Sold by

Kloman Mark R L and Maas Joan E

Bought by

Leal Valenten

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,000

Interest Rate

6.27%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Loring Nathan E | -- | None Available | |

| Loring Partick B | $62,566 | None Available | |

| Wisconsin Housing & Economic Development | $56,250 | None Available | |

| Leal Valenten | $138,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Leal Valenten | $138,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,263 | $219,700 | $53,000 | $166,700 |

| 2023 | $3,144 | $178,100 | $47,000 | $131,100 |

| 2022 | $3,175 | $178,100 | $47,000 | $131,100 |

| 2021 | $2,808 | $119,700 | $32,000 | $87,700 |

| 2020 | $2,854 | $119,700 | $32,000 | $87,700 |

| 2019 | $2,763 | $119,700 | $32,000 | $87,700 |

| 2018 | $2,707 | $119,700 | $32,000 | $87,700 |

| 2017 | $2,610 | $119,700 | $32,000 | $87,700 |

| 2016 | $2,569 | $119,700 | $32,000 | $87,700 |

| 2015 | $2,650 | $119,700 | $32,000 | $87,700 |

| 2014 | $2,687 | $119,700 | $32,000 | $87,700 |

| 2013 | $2,737 | $119,700 | $32,000 | $87,700 |

Source: Public Records

Map

Nearby Homes