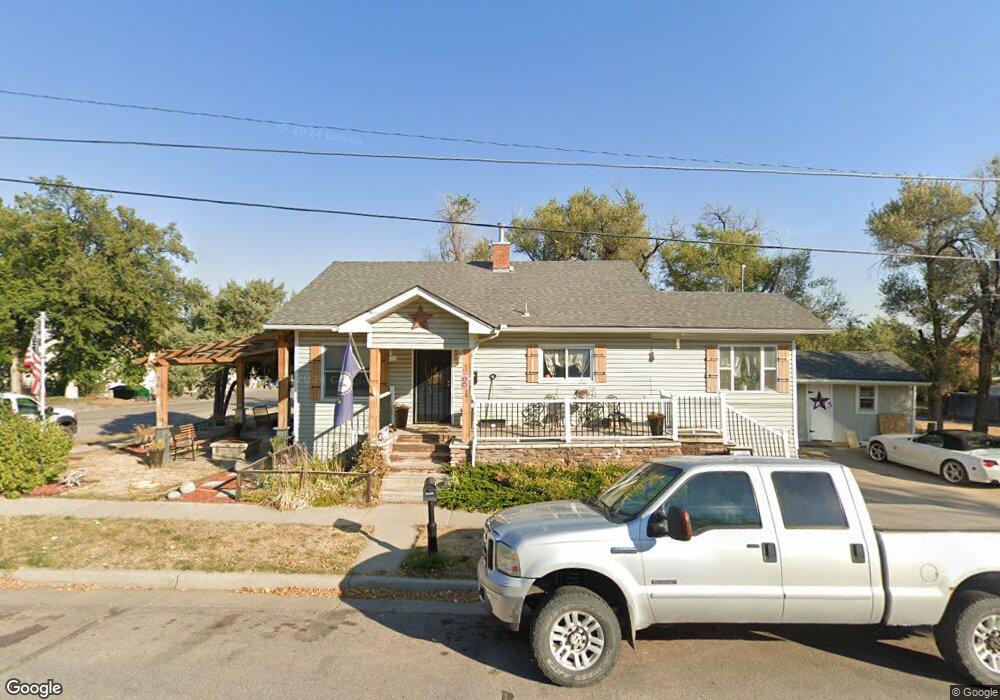

410 W 3rd St Gillette, WY 82716

Estimated Value: $209,000 - $309,000

4

Beds

2

Baths

1,404

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 410 W 3rd St, Gillette, WY 82716 and is currently estimated at $256,971, approximately $183 per square foot. 410 W 3rd St is a home located in Campbell County with nearby schools including Westwood High School, Stocktrail Elementary School, and Prairie Wind Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 26, 2013

Sold by

Jpmorgan Chase Bank Na

Bought by

Hutton Kenneth

Current Estimated Value

Purchase Details

Closed on

Aug 2, 2013

Sold by

Meritt Brandon M

Bought by

J P Morgan Chase Bank N A

Purchase Details

Closed on

Jan 24, 2011

Sold by

Secretary Of Hud

Bought by

Meritt Brandon M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,800

Interest Rate

4.86%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 6, 2010

Sold by

Rauch Ruth and Coor Houston

Bought by

The Secretary Of Hud

Purchase Details

Closed on

Sep 28, 2007

Sold by

Ellis Brian J and Ellis Stephanie L

Bought by

Rauch Ruth and Coor Houston

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,848

Interest Rate

6.48%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 3, 2006

Sold by

Gerlach Arlene D

Bought by

Ellis Brian J and Ellis Stephanie L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hutton Kenneth | -- | None Available | |

| J P Morgan Chase Bank N A | $148,750 | None Available | |

| Meritt Brandon M | -- | None Available | |

| The Secretary Of Hud | $206,950 | None Available | |

| Rauch Ruth | -- | Stewart Title Company Of Gil | |

| Ellis Brian J | -- | Stewart Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Meritt Brandon M | $152,800 | |

| Previous Owner | Rauch Ruth | $200,848 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,430 | $15,863 | $2,500 | $13,363 |

| 2024 | $1,430 | $20,336 | $3,608 | $16,728 |

| 2023 | $1,386 | $19,693 | $3,608 | $16,085 |

| 2022 | $1,244 | $17,636 | $3,133 | $14,503 |

| 2021 | $1,136 | $16,657 | $3,133 | $13,524 |

| 2020 | $1,119 | $16,435 | $3,133 | $13,302 |

| 2019 | $1,079 | $15,889 | $3,133 | $12,756 |

| 2018 | $983 | $14,544 | $3,133 | $11,411 |

| 2017 | $1,023 | $15,168 | $2,550 | $12,618 |

| 2016 | $1,052 | $15,574 | $2,550 | $13,024 |

| 2015 | -- | $14,773 | $2,550 | $12,223 |

| 2014 | -- | $14,138 | $2,550 | $11,588 |

Source: Public Records

Map

Nearby Homes

- 309 Rockpile Blvd

- 706 S Gillette Ave

- 702 W 9th St

- 206 E Laramie St

- 808 S Gillette Ave

- 306 S Emerson Ave

- 911 S Warren Ave

- 103 E Valley Dr

- 409 S Emerson Ave

- 100 W Hogeye Dr

- 1406 W 4th St

- 700 S Brooks Ave

- 410 N Osborne Ave

- 829 & 849 Burma Ave S

- 814 E 3rd St

- 207 N Bundy Ave

- 204 W Juniper Ln

- 9 Highland Ct

- 1801 S Gillette Ave

- 905 S Gurley Ave

- 303 Rockpile Blvd -

- 303 Rockpile Blvd

- 210 Richards Ave

- 210 Rockpile Blvd

- 208 Richards Ave

- 206 Richards Ave

- 300 Richards Ave

- 305 Rockpile Blvd

- 300 Rockpile Blvd

- 300 S Richards Ave

- 204 Richards Ave

- 302 Richards Ave

- 302 Rockpile Blvd

- 307 Rockpile Blvd

- 202 Richards Ave

- 304 Richards Ave

- 304 Rockpile Blvd

- 306 Richards Ave

- 306 Rockpile Blvd

- 303 S 4-J Rd