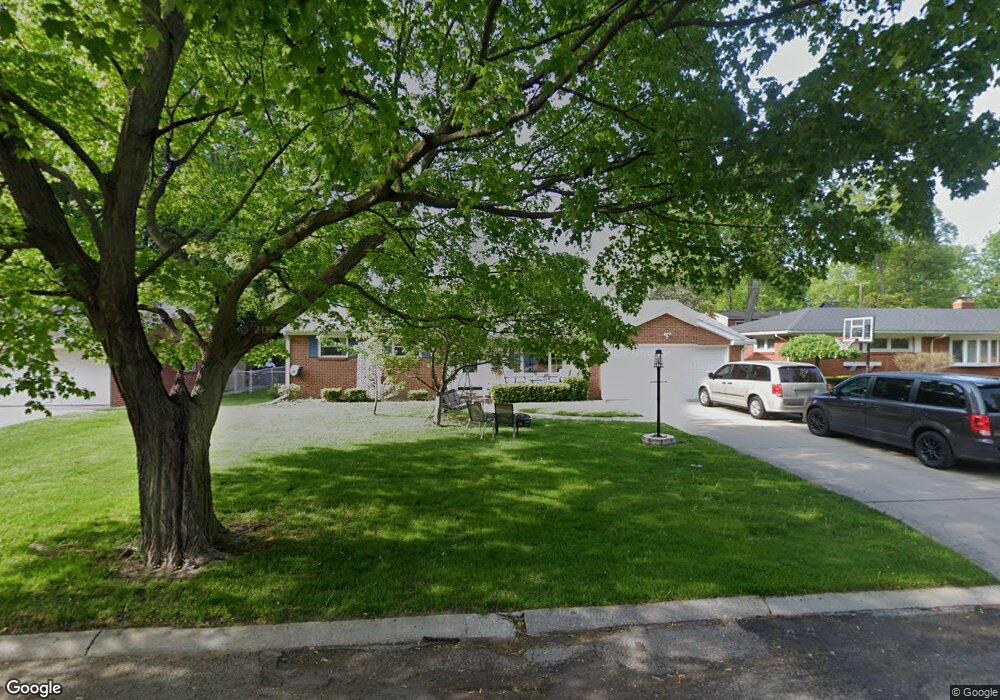

4102 Briarcrest Rd Toledo, OH 43623

Franklin Park NeighborhoodEstimated Value: $212,770 - $240,000

3

Beds

2

Baths

1,544

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 4102 Briarcrest Rd, Toledo, OH 43623 and is currently estimated at $228,443, approximately $147 per square foot. 4102 Briarcrest Rd is a home located in Lucas County with nearby schools including Monac Elementary School, Jefferson Junior High School, and Washington Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2017

Sold by

Janowiecki Paul

Bought by

Hughes Kevin L and Hughes Lisa D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,700

Interest Rate

3.95%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 22, 2016

Sold by

Janowiecki Norman J

Bought by

Jasnowieski Paul and Jasnowieski Residence Trust

Purchase Details

Closed on

Sep 15, 1998

Sold by

Schneider John N

Bought by

Janowiecki Norman J and Janowiecki Irene H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,000

Interest Rate

6.98%

Purchase Details

Closed on

Apr 11, 1988

Sold by

Huebner Roy O and Huebner Virginia A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hughes Kevin L | $126,000 | None Available | |

| Jasnowieski Paul | -- | None Available | |

| Janowiecki Norman J | $128,900 | -- | |

| -- | $93,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hughes Kevin L | $119,700 | |

| Previous Owner | Janowiecki Norman J | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,653 | $52,955 | $8,190 | $44,765 |

| 2023 | $3,013 | $41,055 | $6,790 | $34,265 |

| 2022 | $3,007 | $41,055 | $6,790 | $34,265 |

| 2021 | $3,062 | $41,055 | $6,790 | $34,265 |

| 2020 | $3,377 | $39,235 | $5,320 | $33,915 |

| 2019 | $3,281 | $39,235 | $5,320 | $33,915 |

| 2018 | $2,706 | $39,235 | $5,320 | $33,915 |

| 2017 | $2,403 | $38,360 | $5,215 | $33,145 |

| 2016 | $2,407 | $109,600 | $14,900 | $94,700 |

| 2015 | $2,401 | $109,600 | $14,900 | $94,700 |

| 2014 | $2,018 | $38,370 | $5,220 | $33,150 |

| 2013 | $2,018 | $38,370 | $5,220 | $33,150 |

Source: Public Records

Map

Nearby Homes

- 4122 Briarcrest Rd

- 5104 Tillimon Trail

- 5344 Talmadge Rd

- 5404 Harschel Dr

- 4714 Naomi Dr

- 4504 Sulgrave Dr

- 5415 Fenwick Dr

- 5565 Steffens Ave

- 4647 Harvest Ln

- 5447 Harvest Ln

- 5563 Harschel Dr

- 3527 Cedardale Ct

- 5523 Fenwick Dr

- 3513 Cedardale Ct

- 4647 Hannaford Dr

- 5240 Rambo Ln

- 5539 Ginger Tree Ln

- 4420 Rose Garden Dr

- 4943 Flanders Rd

- 4733 High Oaks Blvd

- 4110 Briarcrest Rd

- 4050 Briarcrest Rd

- 4057 Pinecrest Dr

- 4051 Pinecrest Dr

- 4063 Pinecrest Dr

- 4045 Pinecrest Dr

- 4055 Briarcrest Rd

- 4043 Briarcrest Rd

- 4109 Briarcrest Rd

- 4039 Pinecrest Dr

- 4128 Briarcrest Rd

- 4111 Briarcrest Rd

- 4030 Briarcrest Rd

- 5137 Bridlington Dr

- 4002 Gilhouse Rd

- 4113 Briarcrest Rd

- 4033 Pinecrest Dr

- 5140 Bridlington Dr

- 4048 Gilhouse Rd

- 5124 Avonhurst Rd