Estimated Value: $240,095 - $253,000

--

Bed

2

Baths

1,401

Sq Ft

$176/Sq Ft

Est. Value

About This Home

This home is located at 411 Amberwood Cir, Tyler, TX 75701 and is currently estimated at $246,274, approximately $175 per square foot. 411 Amberwood Cir is a home located in Smith County with nearby schools including Woods Elementary School, Hubbard Middle School, and Tyler Legacy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2018

Sold by

Debenport Magaret Hood and Hood Ralph Scott

Bought by

Cravens Pamela K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,809

Outstanding Balance

$129,796

Interest Rate

5.62%

Mortgage Type

FHA

Estimated Equity

$116,478

Purchase Details

Closed on

Aug 8, 2008

Sold by

Davis Virginia S and Davis Claudia

Bought by

Hood Ladonna June

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,500

Interest Rate

6.47%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cravens Pamela K | -- | None Available | |

| Hood Ladonna June | -- | Ctc | |

| Hood Ladonna June | -- | Ctc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cravens Pamela K | $145,809 | |

| Previous Owner | Hood Ladonna June | $127,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,396 | $196,058 | $14,558 | $181,500 |

| 2024 | $1,396 | $210,484 | $33,015 | $195,702 |

| 2023 | $3,336 | $204,373 | $33,015 | $171,358 |

| 2022 | $3,408 | $179,980 | $22,010 | $157,970 |

| 2021 | $3,318 | $158,140 | $22,010 | $136,130 |

| 2020 | $3,123 | $145,966 | $22,010 | $123,956 |

| 2019 | $3,111 | $142,277 | $22,010 | $120,267 |

| 2018 | $2,946 | $135,462 | $22,010 | $113,452 |

| 2017 | $2,892 | $135,462 | $22,010 | $113,452 |

| 2016 | $2,803 | $131,313 | $22,010 | $109,303 |

| 2015 | $753 | $126,823 | $22,010 | $104,813 |

| 2014 | $753 | $123,488 | $22,010 | $101,478 |

Source: Public Records

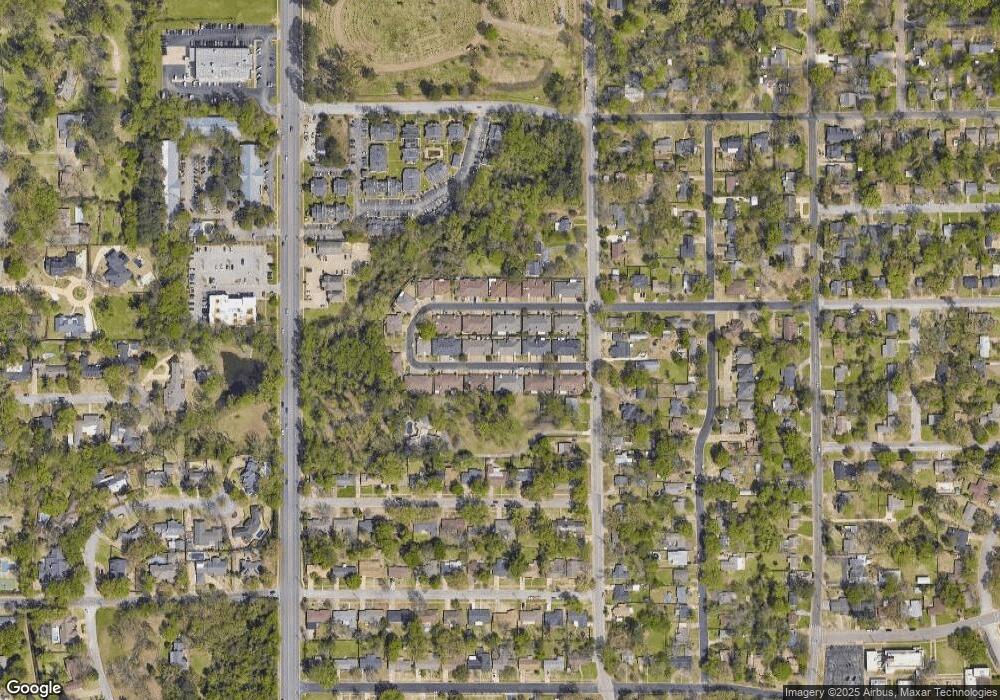

Map

Nearby Homes

- 317 Amberwood Cir

- 2835 S Broadway Ave

- 315 Ridgecrest Dr

- 2736 Old Bullard Rd

- 611 E Watkins St

- 121 Fair Ln

- 309 Glenhaven Dr

- 3202 S Donnybrook Ave

- 3210 S Donnybrook Ave

- 904 E Dulse St

- 905 E Watkins St

- 2917 Sunnybrook Dr

- 1102 S Peach Ave S

- 515 & 517 Charnwood St

- 3922 & 3928 McDonald Rd

- 2319 Pollard Dr

- 403 Beechwood Dr

- 3300 Old Bullard Rd

- 2108 S Wall Ave

- 2521 Pounds Ave

- 411 411 Amberwood

- 413 Amberwood Cir

- 409 Amberwood Cir

- 310 Amberwood Cir

- 310 310 Amberwood

- 312 Amberwood Cir

- 407 407 Amberwood Cir

- 407 Amberwood Cir

- 410 Amberwood Cir

- 312 312 Amberwood Cir

- 412 Amberwood Cir

- 408 Amberwood Cir

- 408 408 Amberwood

- 314 Amberwood Cir

- 306 Amberwood Cir

- 414 Amberwood Cir

- 417 Amberwood Cir

- 417 417 Amberwood Cir

- 405 Amberwood Cir

- 406 Amberwood Cir