411 Detrick Dr Grants Pass, OR 97527

New Hope NeighborhoodEstimated Value: $588,764 - $595,000

2

Beds

2

Baths

1,760

Sq Ft

$336/Sq Ft

Est. Value

About This Home

This home is located at 411 Detrick Dr, Grants Pass, OR 97527 and is currently estimated at $591,882, approximately $336 per square foot. 411 Detrick Dr is a home located in Josephine County with nearby schools including Madrona Elementary School, Lincoln Savage Middle School, and Hidden Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2018

Sold by

Jackson James

Bought by

Jackson James and Cortese Jessica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,000

Interest Rate

4.44%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 4, 2014

Sold by

Mclean John Michael and Mclean John M

Bought by

Jackson James

Purchase Details

Closed on

Oct 22, 2009

Sold by

Mclean Violet Eileen

Bought by

Mclean John Michael

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jackson James | -- | First American Title | |

| Jackson James | $280,000 | First American Title | |

| Jackson James | $280,000 | None Available | |

| Jackson James | $280,000 | Fa | |

| Mclean John Michael | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Jackson James | $235,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,243 | $309,090 | -- | -- |

| 2024 | $2,243 | $300,090 | -- | -- |

| 2023 | $1,892 | $291,350 | $0 | $0 |

| 2022 | $1,675 | $262,820 | $0 | $0 |

| 2021 | $1,619 | $255,170 | $0 | $0 |

| 2020 | $1,687 | $247,740 | $0 | $0 |

| 2019 | $1,621 | $240,530 | $0 | $0 |

| 2018 | $1,643 | $233,530 | $0 | $0 |

| 2017 | $1,643 | $226,730 | $0 | $0 |

| 2016 | $1,395 | $220,130 | $0 | $0 |

| 2015 | $1,347 | $213,720 | $0 | $0 |

| 2014 | $1,313 | $207,500 | $0 | $0 |

Source: Public Records

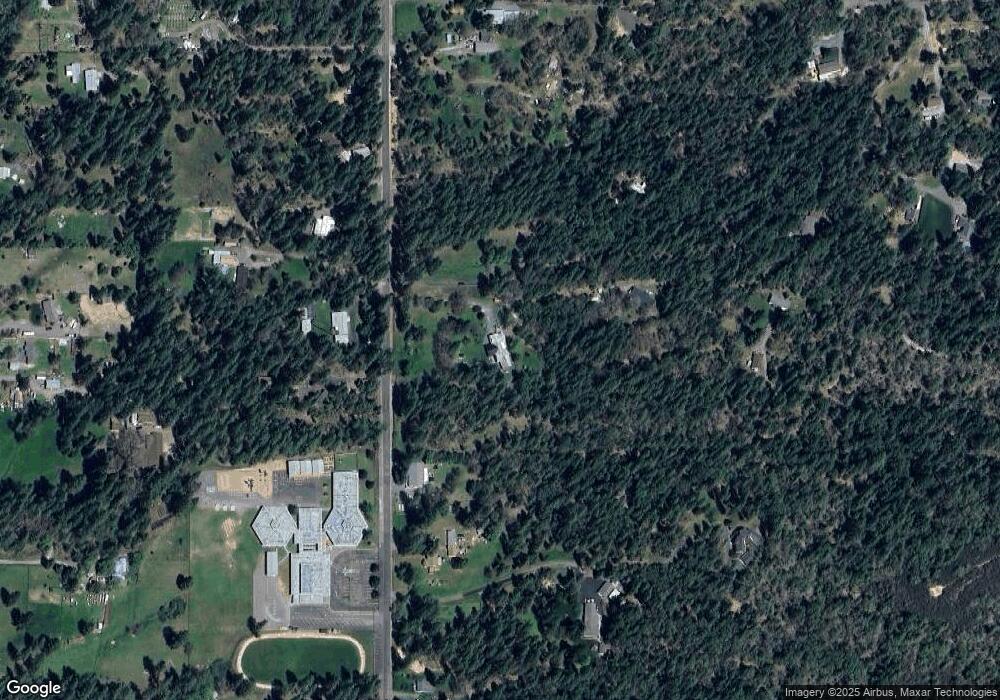

Map

Nearby Homes

- 469 Detrick Dr

- 5181 New Hope Rd

- 163 Genverna Glen

- 697 Jaynes Dr

- 703 Jaynes Dr

- 543 Hidden Valley Rd

- 548 Moonbeam Ln

- 219 Pearl Dr

- 442 Honeylynn Ln

- 300 Work Ln

- 500 Cumberland Dr

- 240 Homewood Rd

- 4810 Williams Hwy

- 5118 Williams Hwy

- 157 Cheslock Rd

- 355 Cheslock Rd Unit 6405

- 4650 Williams Hwy

- 7342 New Hope Rd

- 5960 Cloverlawn Dr

- 8122 New Hope Rd