4113 Cimmaron Trail Granbury, TX 76049

Estimated Value: $301,000 - $333,000

3

Beds

2

Baths

1,836

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 4113 Cimmaron Trail, Granbury, TX 76049 and is currently estimated at $310,149, approximately $168 per square foot. 4113 Cimmaron Trail is a home located in Hood County with nearby schools including Acton Elementary School, Acton Middle School, and Granbury High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2016

Sold by

Proctor Adam R and Proctor Christina L

Bought by

Newton Sidney D and Newton Linda M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Outstanding Balance

$85,779

Interest Rate

3.59%

Mortgage Type

New Conventional

Estimated Equity

$224,370

Purchase Details

Closed on

Aug 11, 2006

Sold by

Lee Rowena P

Bought by

Proctor Adam R and Proctor Christina L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,400

Interest Rate

6.78%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 23, 1980

Bought by

Newton Sidney D Et Ux Linda M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newton Sidney D | -- | Central Texas Title Luton | |

| Proctor Adam R | -- | Central Texas Title | |

| Newton Sidney D Et Ux Linda M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Newton Sidney D | $108,000 | |

| Previous Owner | Proctor Adam R | $100,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $447 | $228,880 | $40,000 | $188,880 |

| 2024 | $496 | $214,236 | $40,000 | $192,190 |

| 2023 | $2,370 | $238,820 | $40,000 | $198,820 |

| 2022 | $719 | $204,740 | $40,000 | $164,740 |

| 2021 | $2,471 | $160,960 | $20,000 | $140,960 |

| 2020 | $2,351 | $151,360 | $20,000 | $131,360 |

| 2019 | $2,327 | $143,150 | $20,000 | $123,150 |

| 2018 | $2,211 | $135,970 | $20,000 | $115,970 |

| 2017 | $2,250 | $134,560 | $20,000 | $114,560 |

| 2016 | $2,000 | $119,610 | $20,000 | $99,610 |

| 2015 | $1,926 | $111,440 | $20,000 | $91,440 |

| 2014 | $1,926 | $116,250 | $20,000 | $96,250 |

Source: Public Records

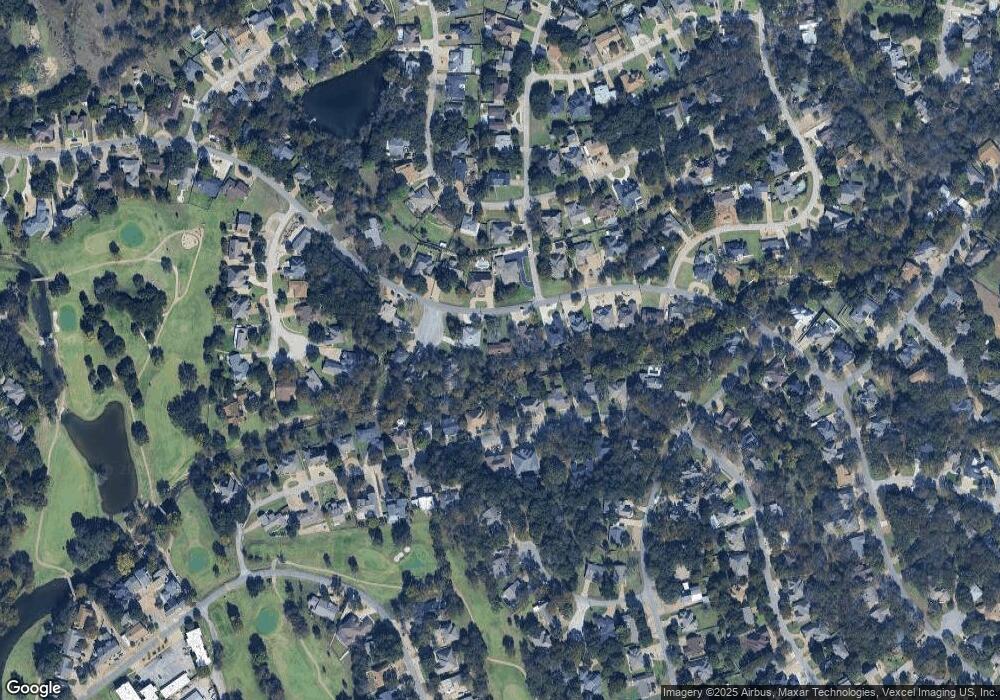

Map

Nearby Homes

- 4112 Cimmaron Trail

- 6118 Laredo Ct

- 4116 Fairway Dr

- 4904 Fairway Place Ct

- 5408 Cortez Dr

- 6301 Sonora Dr

- 5710 Cortez Dr

- 5411 Corto Dr

- 5506 Cortez Dr

- 4009 Scenic Way

- 6318 Sonora Dr

- 6101 W Choctaw Ct

- 6325 Sonora Dr

- 5515 Club Cove Ct

- 4017 Fairway Dr

- 5128 Country Club Dr

- 5200 Country Club Dr

- 4000 Fairway Dr

- 5102 Largo Dr

- 3304 White Horse Dr

- 4111 Cimmaron Trail

- 4115 Cimmaron Trail

- 4212 Mojave Dr

- 4117 Cimmaron Trail

- 4210 Mojave Dr

- 4109 Cimmaron Trail

- 4214 Mojave Dr

- 4208 Mojave Dr

- 4114 Cimmaron Trail

- 4107 Cimmaron Trail

- 4116 Cimmaron Trail

- 4216 Mojave Dr

- 4119 Cimmaron Trail

- 4206 Mojave Dr

- 4121 Cimmaron Trail

- 4108 Cimmaron Trail

- 4218 Mojave Dr

- 4105 Cimmaron Trail

- 4122 Cimmaron Trail

- 4211 Mojave Dr