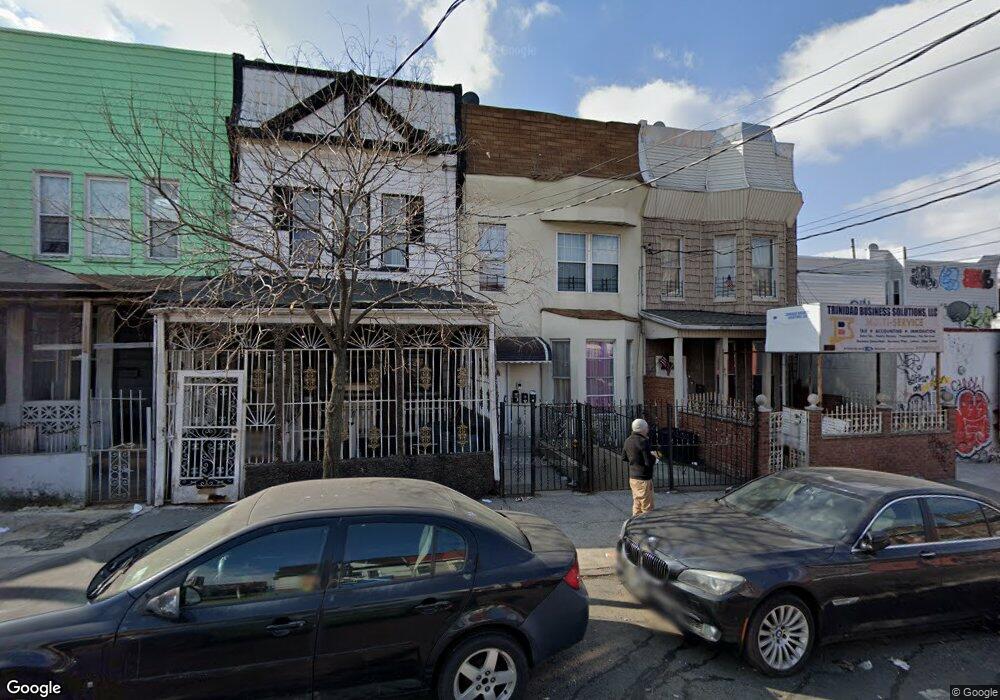

412 E 180th St Bronx, NY 10457

East Tremont NeighborhoodEstimated Value: $603,993 - $873,000

Studio

--

Bath

2,112

Sq Ft

$336/Sq Ft

Est. Value

About This Home

This home is located at 412 E 180th St, Bronx, NY 10457 and is currently estimated at $710,498, approximately $336 per square foot. 412 E 180th St is a home located in Bronx County with nearby schools including P.S. 23 The New Children's School, Jhs 118 William W Niles, and St Simon Stock School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 16, 2010

Sold by

Cipion Miguel

Bought by

Cipion Loren and Cipion Miguel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,100

Outstanding Balance

$163,391

Interest Rate

4.39%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$547,107

Purchase Details

Closed on

Sep 24, 2008

Sold by

Certificateholders Of Cwabs Inc Asset- and The Bank Of New York As Trustee

Bought by

Cipion Miguel

Purchase Details

Closed on

May 29, 2007

Sold by

Levoci Esq Referee Vincent

Bought by

Bank Of New York As Trustee

Purchase Details

Closed on

May 25, 2005

Sold by

Feliciano Freddie

Bought by

Harris Clayton

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,000

Interest Rate

6.07%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 2, 2003

Sold by

Bran-Trav Development Llc

Bought by

Feliciano Freddie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cipion Loren | -- | -- | |

| Cipion Miguel | $75,000 | -- | |

| Bank Of New York As Trustee | $322,148 | -- | |

| Harris Clayton | $392,500 | -- | |

| Feliciano Freddie | $290,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cipion Loren | $247,100 | |

| Previous Owner | Harris Clayton | $314,000 | |

| Closed | Feliciano Freddie | $0 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,770 | $13,973 | $2,985 | $10,988 |

| 2024 | $2,770 | $13,792 | $2,669 | $11,123 |

| 2023 | $2,648 | $13,039 | $2,681 | $10,358 |

| 2022 | $2,460 | $37,860 | $7,920 | $29,940 |

| 2021 | $2,450 | $30,720 | $7,920 | $22,800 |

| 2020 | $2,465 | $31,920 | $7,920 | $24,000 |

| 2019 | $2,404 | $29,400 | $7,920 | $21,480 |

| 2018 | $2,215 | $10,866 | $3,098 | $7,768 |

| 2017 | $2,093 | $10,268 | $3,109 | $7,159 |

| 2016 | $1,940 | $9,703 | $2,938 | $6,765 |

| 2015 | $1,168 | $9,703 | $4,322 | $5,381 |

| 2014 | $1,168 | $9,578 | $4,105 | $5,473 |

Source: Public Records

Map

Nearby Homes

- 2101 Webster Ave

- 2068 Valentine Ave

- 4420 Park Ave

- 2039 Washington Ave

- 2104 Valentine Ave

- 2040 Washington Ave

- 2073 Bathgate Ave

- 2025 Valentine Ave Unit 6B

- 2092 Ryer Ave

- 2064 Bathgate Ave

- 1967 Washington Ave

- 463 E 178 St Unit 4c

- 495 E 178th St Unit 6H

- 495 E 178th St Unit 4F

- 495 E 178th St Unit 2G

- 2253 Tiebout Ave

- 2249 Bassford Ave

- 2255 Bathgate Ave

- 2259 Bassford Ave

- 506 E 183rd St

- 410 E 180th St

- 414 E 180th St

- 418 E 180th St

- 420 E 180th St

- 2092 Webster Ave

- 400 E 180th St

- 2090 Webster Ave

- 413 E 180th St

- 411 E 180th St

- 2044 Webster Ave

- 417 E 180th St

- 415 E 180th St

- 2102 Webster Ave

- 419 E 180th St

- 2087 Webster Ave

- 363 E 180th St

- 2091 Webster Ave

- 2093 Webster Ave

- 2095 Webster Ave

- 2112 Webster Ave

Your Personal Tour Guide

Ask me questions while you tour the home.