412 N Pointe Dr Archbold, OH 43502

Estimated Value: $278,138 - $386,000

3

Beds

2

Baths

1,750

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 412 N Pointe Dr, Archbold, OH 43502 and is currently estimated at $319,035, approximately $182 per square foot. 412 N Pointe Dr is a home located in Fulton County with nearby schools including Archbold Elementary School, Archbold Middle School, and Archbold High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2010

Sold by

Barton Holly A

Bought by

Kern Gail S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,634

Outstanding Balance

$119,316

Interest Rate

5.25%

Mortgage Type

FHA

Estimated Equity

$199,720

Purchase Details

Closed on

Oct 13, 2004

Sold by

Harry Yoder Construction Inc

Bought by

Barton Richard T and Barton Holly A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,920

Interest Rate

5.85%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 3, 1996

Sold by

Heffelfinger Matthew

Bought by

Harry Yoder Const Inc

Purchase Details

Closed on

Jan 1, 1990

Bought by

Heisler Vance and Heisler Arlene

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kern Gail S | $178,000 | Attorney | |

| Barton Richard T | $179,900 | -- | |

| Harry Yoder Const Inc | $18,000 | -- | |

| Heisler Vance | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kern Gail S | $175,634 | |

| Previous Owner | Barton Richard T | $143,920 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,228 | $82,600 | $10,850 | $71,750 |

| 2023 | $4,268 | $82,600 | $10,850 | $71,750 |

| 2022 | $3,358 | $68,810 | $9,030 | $59,780 |

| 2021 | $3,362 | $68,810 | $9,030 | $59,780 |

| 2020 | $3,346 | $68,810 | $9,030 | $59,780 |

| 2019 | $2,955 | $57,960 | $9,030 | $48,930 |

| 2018 | $2,644 | $57,960 | $9,030 | $48,930 |

| 2017 | $2,512 | $55,690 | $9,030 | $46,660 |

| 2016 | $2,593 | $53,410 | $9,030 | $44,380 |

| 2015 | $2,271 | $53,410 | $9,030 | $44,380 |

| 2014 | $2,271 | $53,410 | $9,030 | $44,380 |

| 2013 | $3,793 | $52,500 | $9,030 | $43,470 |

Source: Public Records

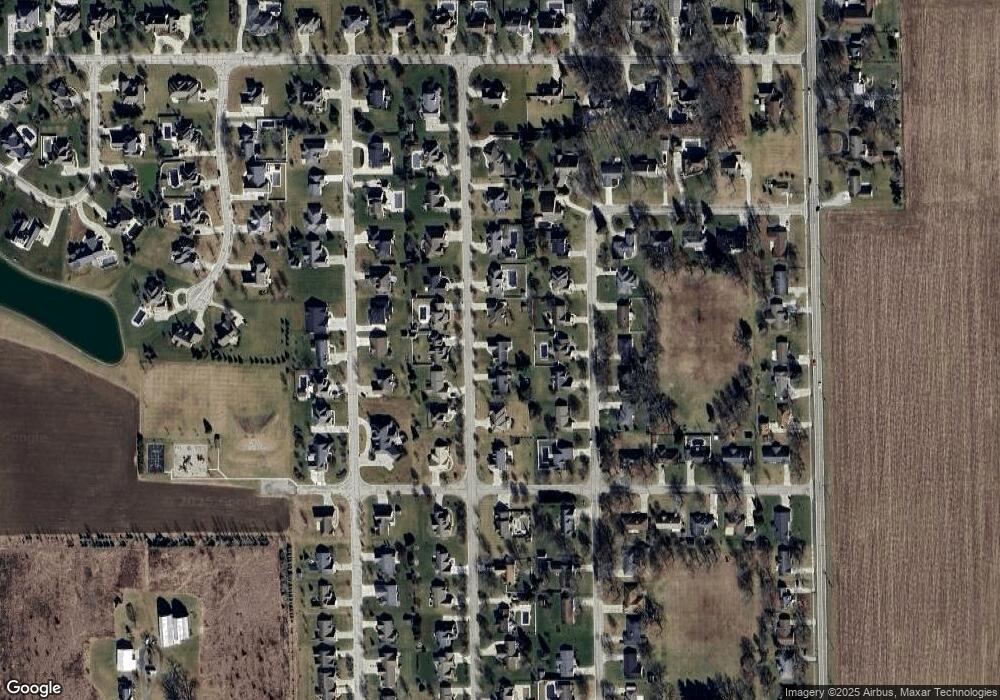

Map

Nearby Homes

- 552 Quail Run

- 301 N Pointe Dr

- 328 W Lutz Rd Unit 328

- 408 Ditto St

- 404 Murbach St

- 219 E Williams St

- 0 Lafayette St

- 808 West St

- 112 Sylvanus St

- 1808 S Defiance St

- 224 Hawthorn Dr

- 3514 Gaslight Dr

- 21530 County Road A

- V-526 Co Rd 25

- 4427 County Road 19

- 8579 County Road 23

- 18857 US Highway 20a

- 17830 County Road C

- 23161 County Road Jk

- 22227 Us Highway 20a

Your Personal Tour Guide

Ask me questions while you tour the home.