413 E Mile 12 N Weslaco, TX 78599

Estimated Value: $229,000 - $343,000

--

Bed

7

Baths

2,772

Sq Ft

$99/Sq Ft

Est. Value

About This Home

This home is located at 413 E Mile 12 N, Weslaco, TX 78599 and is currently estimated at $274,756, approximately $99 per square foot. 413 E Mile 12 N is a home located in Hidalgo County with nearby schools including Raul A Gonzalez Jr Elementary School, Mary Hoge Middle School, and Weslaco East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 3, 2014

Sold by

Stonehaven Development Inc

Bought by

Salinas Ochoa Sr Herman Phillip and Salinas Ochoa Odelia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$35,400

Outstanding Balance

$27,107

Interest Rate

4.38%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$247,649

Purchase Details

Closed on

Mar 3, 1997

Sold by

Barnes Land & Citrus Inc

Bought by

Ochoa Herman Phillip and Ochoa Odelia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$13,050

Interest Rate

7.88%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Salinas Ochoa Sr Herman Phillip | -- | None Available | |

| Ochoa Herman Phillip | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Salinas Ochoa Sr Herman Phillip | $35,400 | |

| Previous Owner | Ochoa Herman Phillip | $13,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $741 | $191,390 | -- | -- |

| 2024 | $741 | $157,163 | -- | -- |

| 2023 | $2,736 | $147,304 | $0 | $0 |

| 2022 | $2,514 | $133,562 | $0 | $0 |

| 2021 | $2,274 | $118,300 | $31,422 | $87,383 |

| 2020 | $2,088 | $104,861 | $31,422 | $73,439 |

| 2019 | $2,035 | $97,751 | $31,422 | $66,329 |

| 2018 | $2,059 | $98,684 | $31,422 | $67,262 |

| 2017 | $2,076 | $99,836 | $31,422 | $68,414 |

| 2016 | $1,986 | $95,508 | $31,422 | $64,086 |

| 2015 | $1,739 | $96,028 | $31,422 | $64,606 |

Source: Public Records

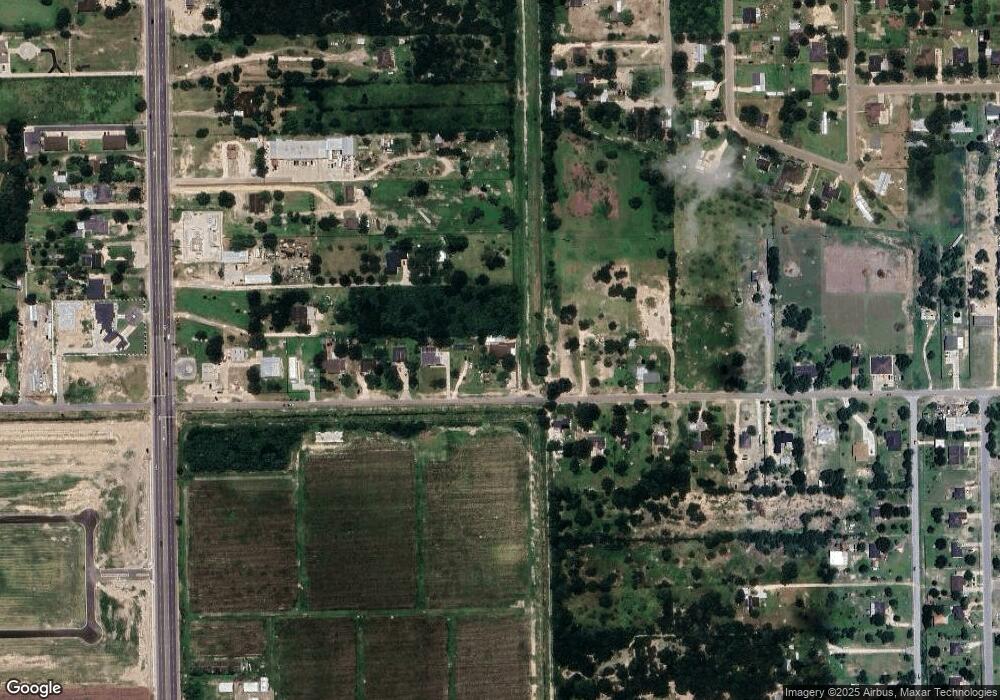

Map

Nearby Homes

- 3408 Emma Dr

- 3507 Emma Dr

- 3405 Emma Dr

- 1301 Fairway Dr

- 3404 Emma Dr

- 3406 Emma Dr

- 3402 Emma Dr

- 7511 Big Valley Dr Unit 13

- 7125 N Mile 4 1/2 W

- 7514 Shilo Dr

- 305 Sonoma St

- 208 Napa St

- 7054 Oakville St

- 7909 Big Valley Dr

- 305 Tahiti Dr

- 605 Juan Seguin St

- 1946 E Mile 12 N

- 705 Palo Verde St

- 607 Palos Altos St

- 10.00 Acres N Mile 4 W

- 307 E Mile 12 N

- 15804 N Mile 4 W

- 221 E Mile 12 N

- 707 E Mile 12 N

- 608 E Mile 12 N

- 612 E Mile 12 N

- 901 Pleasant View Dr Unit C

- 901 Pleasant View Dr Unit B

- 3410 Emma Dr

- 3400 Emma Dr

- 3403 Emma Dr

- 3401 Emma Dr

- 3501 Emma Dr

- 3413 Emma Dr

- 3505 Emma Dr

- 3509 Emma Dr

- 1302 Fairway Dr

- LOT 21 Pleasant View Dr

- LOT 23 Pleasant View Dr

- None Pleasant View Dr