4143 Briar Ln Unit 2 Weston, FL 33332

The Ridges NeighborhoodEstimated Value: $496,000 - $560,000

3

Beds

2

Baths

1,605

Sq Ft

$329/Sq Ft

Est. Value

About This Home

This home is located at 4143 Briar Ln Unit 2, Weston, FL 33332 and is currently estimated at $527,261, approximately $328 per square foot. 4143 Briar Ln Unit 2 is a home located in Broward County with nearby schools including Manatee Bay Elementary School, Falcon Cove Middle School, and Cypress Bay High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2004

Sold by

Alvarez Jose Agustin

Bought by

Anton Mariangela Alvarez

Current Estimated Value

Purchase Details

Closed on

May 18, 2004

Sold by

Guttman Mark and Guttman Laya

Bought by

Alvarez Jose Agustin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,800

Outstanding Balance

$81,200

Interest Rate

4.75%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$446,061

Purchase Details

Closed on

Jul 17, 2002

Sold by

Arvida/Jmb Partners

Bought by

Munoz Tebar Ricardo and Macauda Carmen Maria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,642

Interest Rate

6.67%

Purchase Details

Closed on

Jul 8, 2002

Sold by

Munoz Tebar Ricardo and Macauda Carmen Maria

Bought by

Guttman Mark and Guttman Laya

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,642

Interest Rate

6.67%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anton Mariangela Alvarez | -- | Town & Country Title Guarant | |

| Alvarez Jose Agustin | $236,000 | Town & Country Title Guarant | |

| Munoz Tebar Ricardo | $157,500 | -- | |

| Guttman Mark | $177,400 | Gold Coast Title West |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alvarez Jose Agustin | $188,800 | |

| Previous Owner | Guttman Mark | $159,642 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $9,133 | $485,220 | -- | -- |

| 2025 | $8,827 | $485,220 | -- | -- |

| 2024 | $8,573 | $471,550 | $32,200 | $425,620 |

| 2023 | $8,573 | $457,820 | $32,200 | $425,620 |

| 2022 | $7,164 | $339,740 | $0 | $0 |

| 2021 | $6,566 | $308,860 | $32,200 | $276,660 |

| 2020 | $6,376 | $301,050 | $32,200 | $268,850 |

| 2019 | $6,253 | $297,140 | $32,200 | $264,940 |

| 2018 | $5,851 | $285,260 | $32,200 | $253,060 |

| 2017 | $5,490 | $277,940 | $0 | $0 |

| 2016 | $5,428 | $264,740 | $0 | $0 |

| 2015 | $5,253 | $240,680 | $0 | $0 |

| 2014 | $4,904 | $218,800 | $0 | $0 |

| 2013 | -- | $202,800 | $32,220 | $170,580 |

Source: Public Records

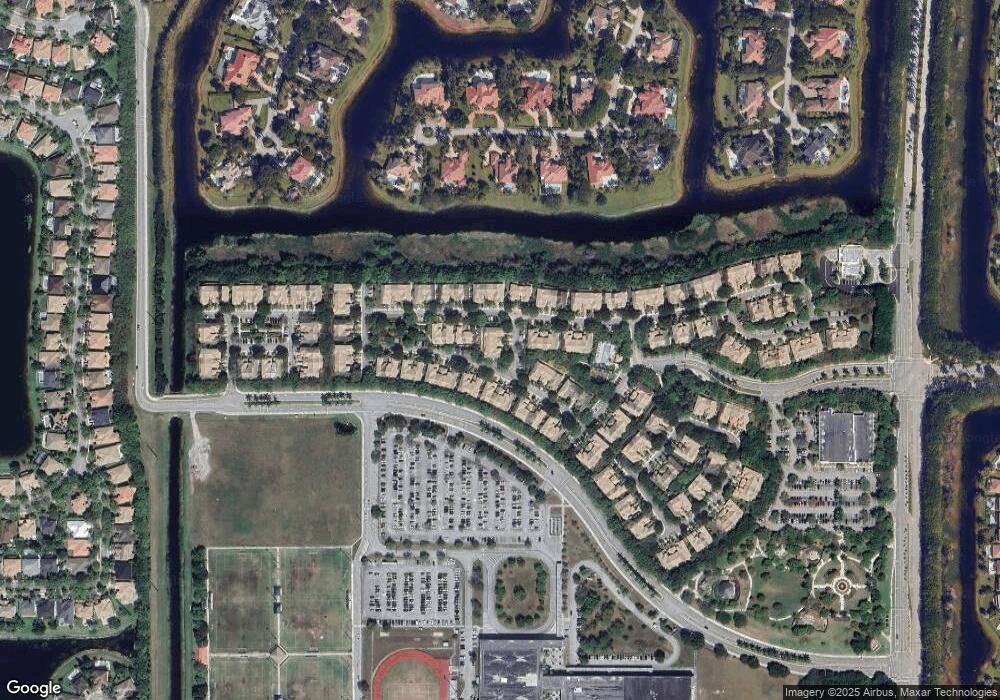

Map

Nearby Homes

- 3889 Tree Top Dr Unit 3889

- 3855 Windmill Lakes Rd

- 3815 Tree Top Dr Unit 1

- 3828 Pine Lake Dr

- 3739 Oak Ridge Cir

- 3872 W Hibiscus St

- 4209 Pinewood Ln

- 4042 Pinewood Ln

- 4032 Pinewood Ln

- 4491 Foxtail Ln

- 19068 Park Ridge St

- 19138 Stonebrook St

- 3846 W Gardenia Ave

- 3852 Oak Ridge Cir

- 19044 Park Ridge St

- 3843 Oak Ridge Cir

- 19222 Crystal St

- 4020 Staghorn Ln

- 4375 Foxtail Ln

- 3837 E Coquina Way

- 4145 Briar Ln Unit 4145

- 4145 Briar Ln Unit 1

- 4141 Briar Ln

- 4139 Briar Ln

- 4139 Briar Ln

- 4137 Briar Ln

- 4135 Briar Ln

- 4135 Briar Ln Unit 6

- 3912 Tree Top Dr Unit 1

- 3914 Tree Top Dr

- 3914 Tree Top Dr Unit 3914

- 3894 3894 Tree Top Dr # 0

- 3894 Tree Top Dr Unit 6

- 4132 Forest Dr Unit 1

- 4130 Forest Dr Unit 4130

- 4130 Forest Dr Unit 6

- 4134 Forest Dr

- 4128 Forest Dr Unit 4128

- 4128 Forest Dr

Your Personal Tour Guide

Ask me questions while you tour the home.