4149 Weeping Willow Ct Chantilly, VA 20151

Estimated Value: $447,000 - $470,000

3

Beds

3

Baths

1,294

Sq Ft

$353/Sq Ft

Est. Value

About This Home

This home is located at 4149 Weeping Willow Ct, Chantilly, VA 20151 and is currently estimated at $456,367, approximately $352 per square foot. 4149 Weeping Willow Ct is a home located in Fairfax County with nearby schools including Brookfield Elementary, Franklin Middle, and Chantilly High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2020

Sold by

Wilson Andrew

Bought by

Connor Daniel O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$310,500

Outstanding Balance

$275,234

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$181,133

Purchase Details

Closed on

Jan 20, 2015

Sold by

Lassiter Jonsetta

Bought by

Wilson Andrew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,100

Interest Rate

3.81%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 25, 1996

Sold by

Ragusa Leonard C

Bought by

Lasiter Jonesetta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,800

Interest Rate

8.22%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Connor Daniel O | $345,000 | Psr Title Llc | |

| Wilson Andrew | $258,000 | -- | |

| Lasiter Jonesetta | $97,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Connor Daniel O | $310,500 | |

| Previous Owner | Wilson Andrew | $245,100 | |

| Previous Owner | Lasiter Jonesetta | $94,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,404 | $406,730 | $81,000 | $325,730 |

| 2024 | $4,404 | $380,120 | $76,000 | $304,120 |

| 2023 | $4,165 | $369,050 | $74,000 | $295,050 |

| 2022 | $4,137 | $361,810 | $72,000 | $289,810 |

| 2021 | $3,757 | $320,190 | $64,000 | $256,190 |

| 2020 | $3,609 | $304,940 | $61,000 | $243,940 |

| 2019 | $3,291 | $278,080 | $55,000 | $223,080 |

| 2018 | $3,018 | $262,450 | $52,000 | $210,450 |

| 2017 | $2,845 | $245,040 | $49,000 | $196,040 |

| 2016 | $2,839 | $245,040 | $49,000 | $196,040 |

| 2015 | $2,442 | $218,790 | $44,000 | $174,790 |

| 2014 | $2,436 | $218,790 | $44,000 | $174,790 |

Source: Public Records

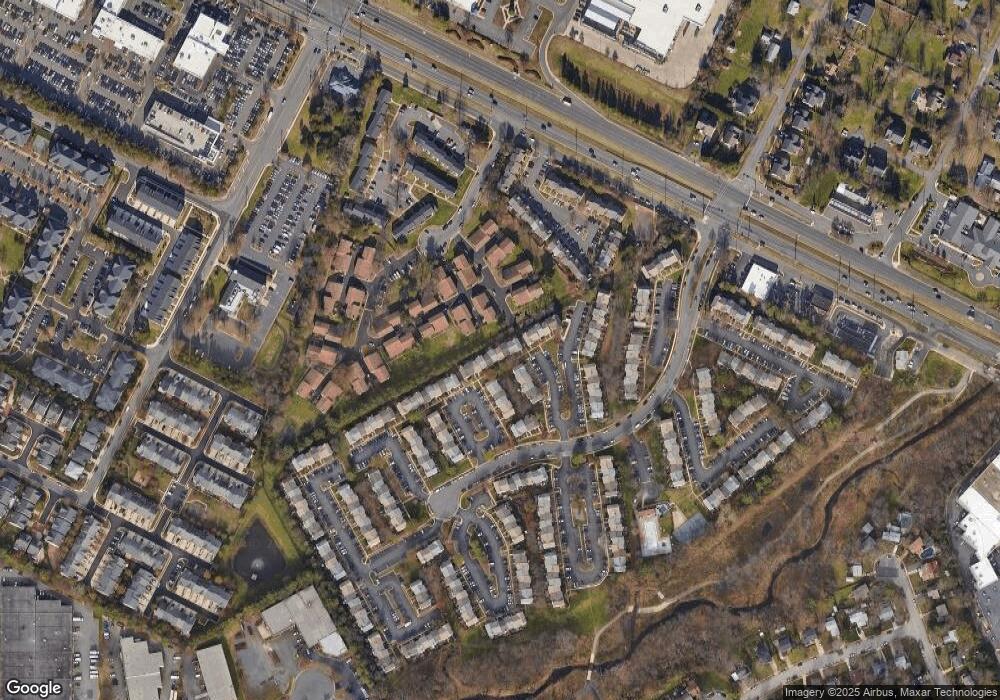

Map

Nearby Homes

- 4157 Weeping Willow Ct Unit 147A

- 4127 Weeping Willow Ct Unit 142-A

- 4019 Kimberley Glen Ct

- 4158 Pleasant Meadow Ct Unit 108D

- 4180 Pleasant Meadow Ct Unit 104A

- 13713 Autumn Vale Ct Unit 30B

- 13838 Beaujolais Ct

- 13807 Sauterne Way

- 3841 Beech Down Dr

- 13715 Pennsboro Dr

- 3840 Lightfoot St Unit 249

- 3830 Lightfoot St Unit 135

- 13501 King Charles Dr

- 3820 Lightfoot St Unit 214

- 3809 Foxfield Ln

- 13622 Ellendale Dr

- 4309 Willoughby Ct

- 4528 Waverly Crossing Ln

- 13515 Tabscott Dr

- 3613 Great Laurel Ln

- 4151 Weeping Willow Ct

- 4153 Weeping Willow Ct Unit 146G

- 4153 Weeping Willow Ct

- 4151 Weeping Willow Ct Unit 146F

- 4149 Weeping Willow Ct Unit 146B

- 4143 Weeping Willow Ct

- 4145 Weeping Willow Ct

- 4145 Weeping Willow Ct Unit 145F

- 4145 Weeping Willow Ct

- 4147 Weeping Willow Ct Unit 145D

- 4147 Weeping Willow Ct

- 4159 Weeping Willow Ct

- 4157 Weeping Willow Ct

- 4155 Weeping Willow Ct

- 4155 Weeping Willow Ct Unit 147B

- 4155 Weeping Willow Ct Unit 4155

- 4139 Weeping Willow Ct Unit 144F

- 4139 Weeping Willow Ct

- 4141 Weeping Willow Ct

- 4137 Weeping Willow Ct