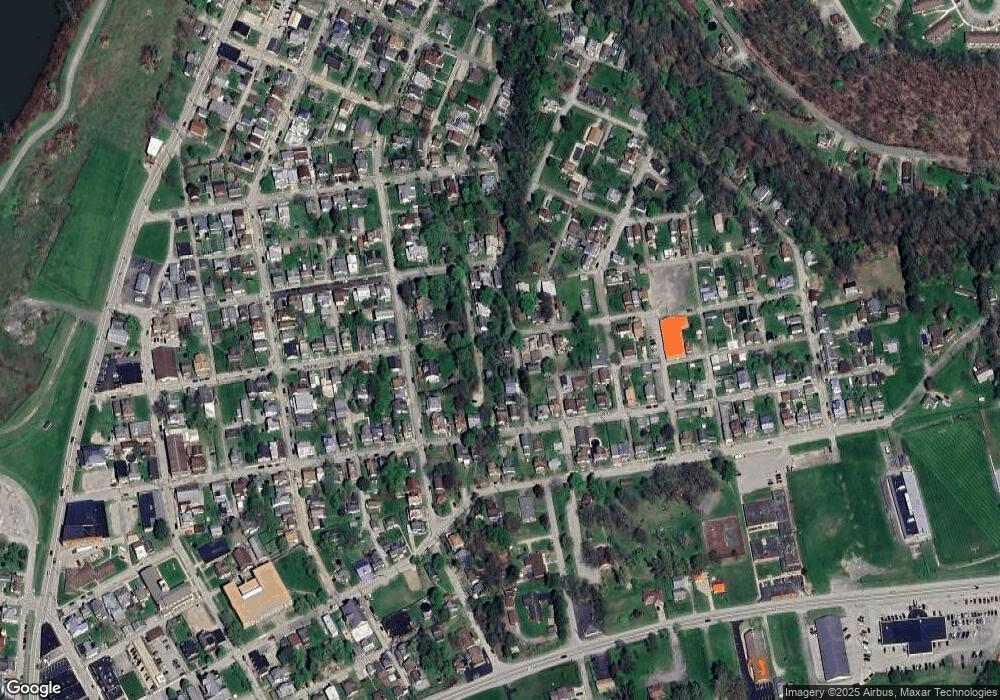

415 Crowe St Apollo, PA 15613

Estimated Value: $73,000 - $103,203

2

Beds

1

Bath

--

Sq Ft

3,790

Sq Ft Lot

About This Home

This home is located at 415 Crowe St, Apollo, PA 15613 and is currently estimated at $88,102. 415 Crowe St is a home located in Armstrong County with nearby schools including Apollo-Ridge Elementary School, Apollo-Ridge Middle School, and Apollo-Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 15, 2015

Bought by

Patrisa Corporation

Current Estimated Value

Purchase Details

Closed on

Jun 24, 2010

Sold by

Bremar Real Estate Lp

Bought by

Workman Larry

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,275

Interest Rate

4.78%

Mortgage Type

Construction

Purchase Details

Closed on

Apr 6, 2006

Sold by

Mtglq Investors Lp

Bought by

Bremar Real Estate Lp

Purchase Details

Closed on

Dec 28, 2005

Sold by

Green Tree Consumer Discount Co

Bought by

Mtglq Investors Lp

Purchase Details

Closed on

Jul 14, 2005

Sold by

Comroe David B

Bought by

Green Tree Consumer Discount Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patrisa Corporation | -- | -- | |

| Patrisa Corp | -- | None Available | |

| Workman Larry | $55,000 | None Available | |

| Bremar Real Estate Lp | $13,300 | None Available | |

| Mtglq Investors Lp | $13,300 | None Available | |

| Green Tree Consumer Discount Co | $8,633 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Workman Larry | $58,275 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $390 | $3,740 | $3,740 | $0 |

| 2024 | $364 | $3,740 | $3,740 | $0 |

| 2023 | $518 | $3,740 | $3,740 | $0 |

| 2022 | $518 | $3,740 | $3,740 | $0 |

| 2021 | $510 | $3,740 | $3,740 | $0 |

| 2020 | $509 | $3,740 | $3,740 | $0 |

| 2019 | $509 | $3,740 | $3,740 | $0 |

| 2018 | $493 | $5,345 | $5,345 | $0 |

| 2017 | $496 | $3,740 | $3,740 | $0 |

| 2016 | $496 | $3,740 | $3,740 | $0 |

| 2015 | $1,168 | $15,140 | $9,440 | $5,700 |

| 2014 | $1,168 | $15,140 | $9,440 | $5,700 |

Source: Public Records

Map

Nearby Homes

- 212 Terrace Ave

- 307 Wilson Way

- 411a N Pennsylvania Ave

- 404-406 N Pennsylvania Ave

- 322 N 4th St

- 726 N 4th St

- 715 1/2 Armstrong Ave Unit 1/2

- 316 S Fourth St

- 402 N 10th St

- 404 N 10th St

- 303 S 3rd St

- 100 Grace St

- 105 Owens View Ave

- 1206 Wysocki Ave

- 625 Rose St Unit 276

- 1312 Birch Ave

- 712 16th St

- 810 16th St

- 135 Thorn St

- 185 Thorn St