Estimated Value: $1,957,000 - $8,378,000

3

Beds

3

Baths

1,790

Sq Ft

$2,887/Sq Ft

Est. Value

About This Home

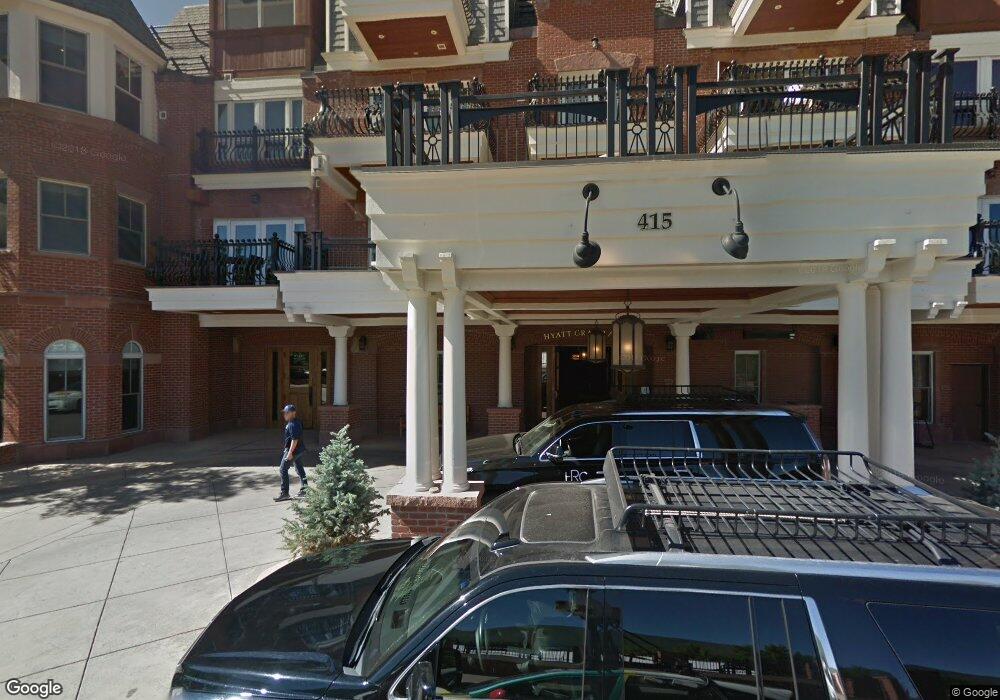

This home is located at 415 E Dean Unit 2 Week 52, Aspen, CO 81611 and is currently estimated at $5,167,500, approximately $2,886 per square foot. 415 E Dean Unit 2 Week 52 is a home located in Pitkin County with nearby schools including Aspen Elementary School, Aspen Middle School, and Aspen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2025

Sold by

Marker Holdings Ii Llc

Bought by

Marc And Jorine Campopiano Family Trust

Current Estimated Value

Purchase Details

Closed on

Jan 21, 2025

Sold by

Elk Camp Gp Llc

Bought by

Elk Camp Lp

Purchase Details

Closed on

Nov 19, 2024

Sold by

Pinkert Dale R and Pinkert Betsey N

Bought by

Pinkert Family 2024 Gift Trust

Purchase Details

Closed on

Aug 15, 2019

Sold by

Linhart Samuel Wilfred and Linhart Judy

Bought by

Mckernan Gordon and Mckernan Shannon Field

Purchase Details

Closed on

Jan 11, 2018

Sold by

Lopes Jennifer J and Lopes Jennifer

Bought by

Lopes Jennifer J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marc And Jorine Campopiano Family Trust | $260,000 | Title Company Of The Rockies | |

| Elk Camp Lp | -- | Title Company Of The Rockies | |

| Elk Camp Gp Llc | $270,000 | Title Company Of The Rockies | |

| Pinkert Family 2024 Gift Trust | -- | None Listed On Document | |

| Pinkert Family 2024 Gift Trust | -- | None Listed On Document | |

| Mckernan Gordon | -- | None Available | |

| Lopes Jennifer J | -- | First Amer Title Ins Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $14,131 | $429,850 | $0 | $429,850 |

| 2023 | $14,131 | $819,570 | $0 | $819,570 |

| 2022 | $16,487 | $449,710 | $0 | $449,710 |

| 2021 | $16,416 | $462,650 | $0 | $462,650 |

| 2020 | $15,154 | $424,170 | $0 | $424,170 |

| 2019 | $15,154 | $424,170 | $0 | $424,170 |

| 2018 | $15,397 | $446,510 | $0 | $446,510 |

| 2017 | $13,585 | $427,130 | $0 | $427,130 |

| 2016 | $13,933 | $429,060 | $0 | $429,060 |

| 2015 | $13,753 | $429,060 | $0 | $429,060 |

| 2014 | $12,150 | $362,240 | $0 | $362,240 |

Source: Public Records

Map

Nearby Homes

- 415 E Dean St Unit 44b Week 5

- 415 E Dean St Unit 44a Week 9

- 415 E Dean St Unit 37 Week 6

- 415 E Dean St Unit 37 Weeks 51&52

- 415 E

- 415 E Dean St Unit 38 Week 33

- 415 E Dean St Unit 50 Week 35

- 415 E Dean St #25 Week 6

- 415 E Dean St Unit 32- wk 6

- 415 E Dean St Unit 44C - WK 11

- 415 E Dean St Unit 23A and 23B Wee

- 415 E Dean St Unit 23B week 11

- 415 E Dean St #7 Week 6

- 415 E Dean St #7 Weeks 31 & 32

- 415 E

- 415 E Dean St Unit 22 Week 32

- 415 E Dean St Unit 36 Weeks 5 & 6

- 415 E Dean St Unit 22 Week 6

- 731 S Mill St Unit 2C

- 415 E Dean St Unit 4 Week 32

- 415 E Dean St Unit 45 Wk 34

- 400 E Dean #45 Week 8 St

- 415 E Dean Unit 45 Week 10

- 415 E Dean Unit 44a Week 8 St

- 415 E Dean Street Unit 44-A Week 5

- 415 E Dean Street Unit 44a Week 32 Unit 44a, Week 32

- 415 E Dean Unit 44c Week 33 St

- 415 E Dean Unit 44c Week 34 St

- 415 E Dean Unit 43 Wk 26 St

- 415 E Dean Street Unit 9 Week 33

- 415 E Dean St Unit 8 Week 30

- 415 E

- 415 E Dean Unit 42 Week 30

- 415 E Dean St Unit 24 Week 7

- 415 E Dean St Unit 42 Week 27

- 415 E Dean Unit 42 Week 12

- 415 E Dean Street Unit #40 Week 9

- 415 E Dean Street #25 Week 6

- 415 E Dean St Unit 25 Week 6

- 415 E Dean St Unit 25 Week 31