Estimated Value: $491,000 - $828,000

2

Beds

3

Baths

1,592

Sq Ft

$391/Sq Ft

Est. Value

About This Home

This home is located at 415 Eagle Rd Unit 8, Wayne, PA 19087 and is currently estimated at $623,240, approximately $391 per square foot. 415 Eagle Rd Unit 8 is a home located in Delaware County with nearby schools including Wayne Elementary School, Radnor Middle School, and Radnor Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 2023

Sold by

Ranney Constance C and Ranney Scott W

Bought by

Ranney Scott W and Ranney Scott W

Current Estimated Value

Purchase Details

Closed on

Sep 6, 2019

Sold by

Ranney Constance C and Estate Of Vincent L Cella

Bought by

Ranney Constance C

Purchase Details

Closed on

Mar 26, 2009

Sold by

Cella Sibyl F and Cella Vincent L

Bought by

Cella Vincent L

Purchase Details

Closed on

Oct 12, 2001

Sold by

Ciccotelli Constance and Ciccotelli Maureen T Mason

Bought by

Cella Sibyl F and Cella Vincent L

Purchase Details

Closed on

Aug 12, 1999

Sold by

Ralph Brooks Kathryn and Ralph Kathryn M

Bought by

Ciccotelli Constance and Mason Maureen T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

6.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ranney Scott W | -- | None Listed On Document | |

| Ranney Constance C | -- | None Available | |

| Cella Vincent L | -- | None Available | |

| Cella Sibyl F | $169,000 | Commonwealth Land Title Ins | |

| Ciccotelli Constance | $148,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ciccotelli Constance | $110,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,627 | $327,780 | $72,150 | $255,630 |

| 2024 | $6,627 | $327,780 | $72,150 | $255,630 |

| 2023 | $6,364 | $327,780 | $72,150 | $255,630 |

| 2022 | $6,295 | $327,780 | $72,150 | $255,630 |

| 2021 | $10,112 | $327,780 | $72,150 | $255,630 |

| 2020 | $4,078 | $117,230 | $32,270 | $84,960 |

| 2019 | $3,963 | $117,230 | $32,270 | $84,960 |

| 2018 | $3,885 | $117,230 | $0 | $0 |

| 2017 | $3,804 | $117,230 | $0 | $0 |

| 2016 | $643 | $117,230 | $0 | $0 |

| 2015 | $656 | $117,230 | $0 | $0 |

| 2014 | $656 | $117,230 | $0 | $0 |

Source: Public Records

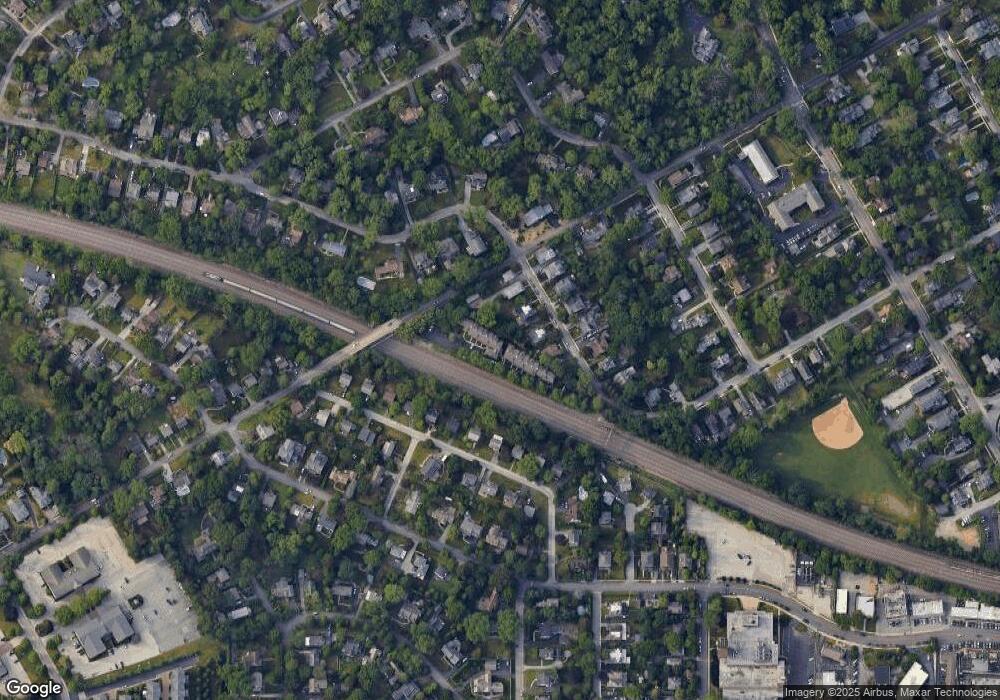

Map

Nearby Homes

- 412 N Wayne Ave Unit 104

- 273 Strafford Ave

- 123 Conestoga Rd

- 50 Fariston Rd

- 207 Willow Ave

- 188 Conestoga Rd

- 232 Conestoga Rd

- 1 Private Way

- 245 Willow Ave

- 443 Homestead Rd

- 412 Fairview Dr

- 203 Church St

- 205 N Aberdeen Ave

- 1052 Eagle Rd

- 317 E Beechtree Ln

- 466 Saint Davids Ave

- 120 Eaton Dr

- 155 Eaton Dr

- 2 Sugartown Rd

- 120 S Devon Ave

- 411 Eagle Rd Unit 6

- 409 Eagle Rd Unit 5

- 417 Eagle Rd Unit 9

- 407 Eagle Rd Unit 4

- 419 Eagle Rd Unit 10

- 405 Eagle Rd Unit 3

- 421 Eagle Rd Unit 11

- 403 Eagle Rd Unit 2

- 423 Eagle Rd Unit 12

- 401 Eagle Rd Unit 1

- 425 Eagle Rd Unit 13

- 427 Eagle Rd Unit 14

- 420 W Beechtree Ln

- 418 W Beechtree Ln

- 422 W Beechtree Ln

- 429 Eagle Rd Unit 15

- 416 W Beechtree Ln

- 414 W Beechtree Ln

- 428 W Beechtree Ln

- 323 Overhill Rd