415 Johnson Ct Alpharetta, GA 30009

Estimated Value: $886,317 - $960,000

3

Beds

3

Baths

2,142

Sq Ft

$426/Sq Ft

Est. Value

About This Home

This home is located at 415 Johnson Ct, Alpharetta, GA 30009 and is currently estimated at $912,579, approximately $426 per square foot. 415 Johnson Ct is a home located in Fulton County with nearby schools including Manning Oaks Elementary School, Northwestern Middle School, and Milton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2022

Sold by

Samartha Properties Llc

Bought by

Johnson Kaley B and Berry Griffin Todd

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$684,000

Outstanding Balance

$663,289

Interest Rate

7.08%

Mortgage Type

New Conventional

Estimated Equity

$249,290

Purchase Details

Closed on

Jun 15, 2020

Sold by

Kadam Raj

Bought by

Kadam Rajendra A and Kadam Sweta R

Purchase Details

Closed on

Mar 15, 2018

Sold by

Providence Grp Of Georgia

Bought by

Kadam Raj and Shinde Sweta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$376,000

Interest Rate

4.38%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Kaley B | $760,000 | -- | |

| Samartha Properties Llc | -- | -- | |

| Kadam Rajendra A | -- | -- | |

| Kadam Raj | $470,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Samartha Properties Llc | $684,000 | |

| Previous Owner | Kadam Raj | $376,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,701 | $331,880 | $50,920 | $280,960 |

| 2023 | $8,350 | $295,840 | $42,360 | $253,480 |

| 2022 | $7,784 | $295,840 | $42,360 | $253,480 |

| 2021 | $1,311 | $227,920 | $29,000 | $198,920 |

| 2020 | $6,680 | $199,160 | $32,880 | $166,280 |

| 2019 | $5,952 | $176,800 | $26,240 | $150,560 |

| 2018 | $4,329 | $153,360 | $25,640 | $127,720 |

Source: Public Records

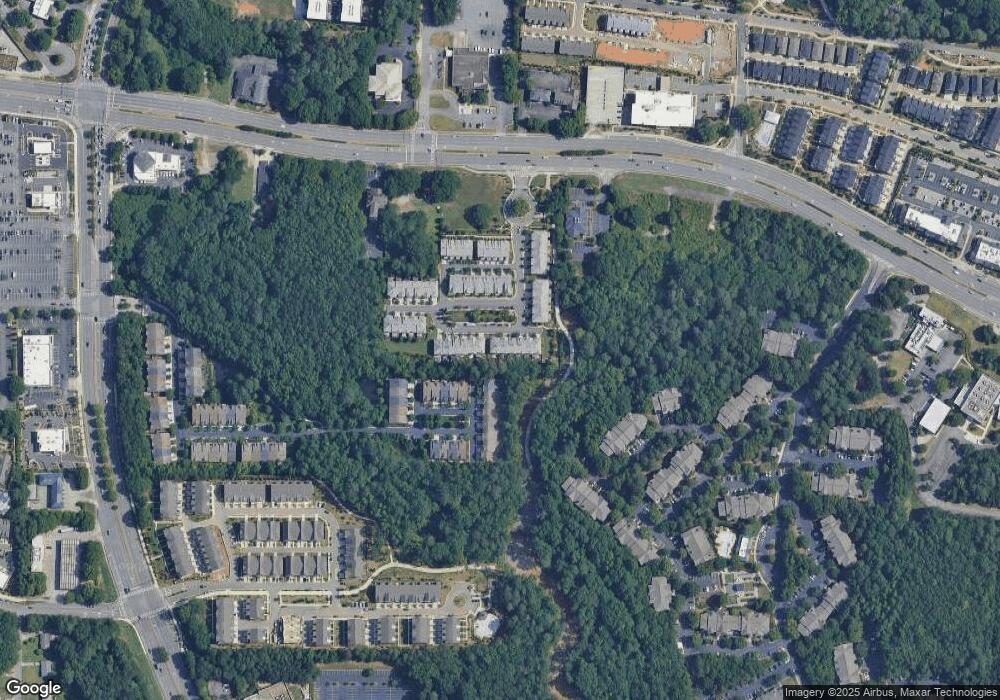

Map

Nearby Homes

- 329 Bailey Walk

- 209 Phillips Ln

- 613 Nottaway Ln

- 219 Phillips Ln

- 300 Crimson Pine Alley N

- 300 Crimson Pine Alley N Unit 9

- 225 Midnight Oak Run

- 225 Midnight Oak Run Unit 7

- 306 Atley Place

- 205 Midnight Oak Run

- 205 Midnight Oak Run Unit 5

- The Childress Plan at Byers Park - Terrace Collection

- The Chamberlain Plan at Byers Park - Brownstone Collection

- 227 Atley Place

- 309 Nottaway Ln

- 195 Briscoe Way

- 160 Briscoe Way

- 310 Crimson Pine Alley

- 330 Crimson Pine Alley

- 235 Midnight Oak Run

- 415 Johnson Ct

- 417 Johnson Ct

- 417 Johnson Ct

- 413 Johnson Ct

- 413 Johnson Ct

- 411 Johnson Ct

- 421 Johnson Ct

- 421 Johnson Ct

- 423 Johnson Ct

- 409 Johnson Ct

- 409 Johnson Ct

- 704 Nottaway Ln

- 704 Nottaway Ln Unit 704

- 704 Nottaway Ln Unit 35

- 407 Johnson Ct

- 218 Phillips Ln

- 218 Phillips Ln Unit 10

- 405 Johnson Ct

- 405 Johnson Ct

- 706 Nottaway Ln Unit 34