415 Laurel Green Way Alpharetta, GA 30022

Estimated Value: $796,000 - $845,000

5

Beds

5

Baths

3,680

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 415 Laurel Green Way, Alpharetta, GA 30022 and is currently estimated at $824,718, approximately $224 per square foot. 415 Laurel Green Way is a home located in Fulton County with nearby schools including State Bridge Crossing Elementary School, Taylor Road Middle School, and Chattahoochee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 1, 2003

Sold by

Hankins Patrick E and Hankins Helen W

Bought by

Scott Claude V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,000

Interest Rate

5.52%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 15, 1999

Sold by

Foster Carol R and Foster Jerry E

Bought by

Hankins Patrick E and Hankins Helen W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,920

Interest Rate

7.04%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scott Claude V | $311,000 | -- | |

| Hankins Patrick E | $254,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Scott Claude V | $248,000 | |

| Previous Owner | Hankins Patrick E | $203,920 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,273 | $271,880 | $51,600 | $220,280 |

| 2023 | $6,837 | $242,240 | $44,240 | $198,000 |

| 2022 | $1,468 | $192,560 | $37,520 | $155,040 |

| 2021 | $1,403 | $194,840 | $29,720 | $165,120 |

| 2020 | $4,220 | $163,160 | $28,600 | $134,560 |

| 2019 | $503 | $160,320 | $28,120 | $132,200 |

| 2018 | $4,526 | $156,520 | $27,440 | $129,080 |

| 2017 | $4,127 | $133,400 | $25,480 | $107,920 |

| 2016 | $4,059 | $133,400 | $25,480 | $107,920 |

| 2015 | $4,103 | $133,400 | $25,480 | $107,920 |

| 2014 | $3,549 | $113,680 | $22,320 | $91,360 |

Source: Public Records

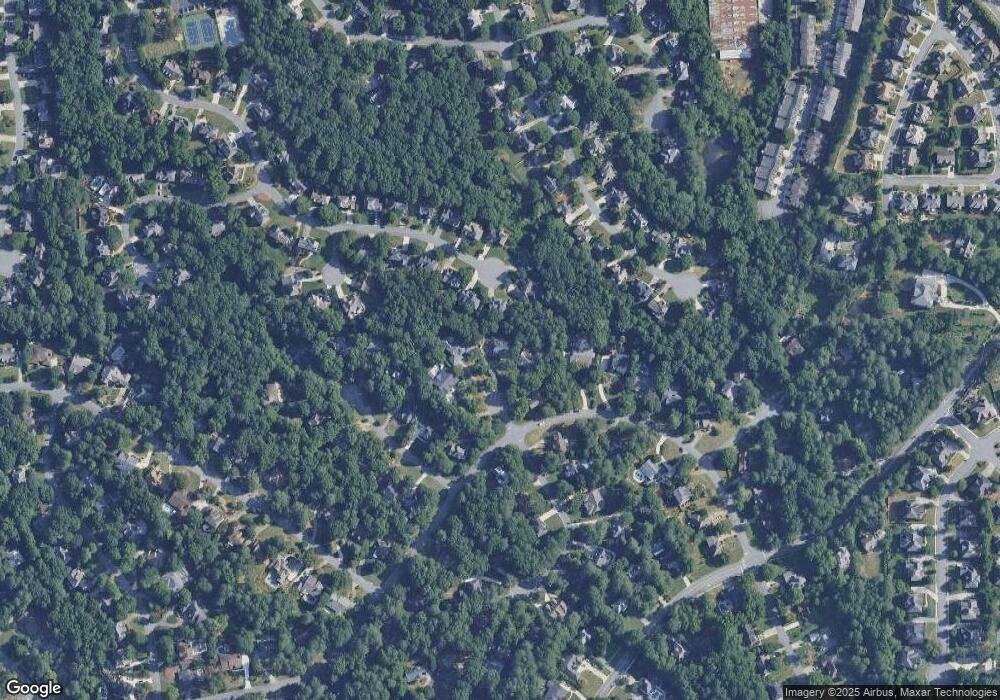

Map

Nearby Homes

- 5170 Cameron Forest Pkwy

- 10296 Quadrant Ct Unit 76

- 10281 Midway Ave

- 10265 Minion Ct Unit 27

- 220 Magnolia Tree Ct

- 230 Pinebridge Ct

- 230 Skidaway Ct

- 10570 Bridgemor Dr

- 5640 Sandown Way

- 465 Mikasa Dr

- 10275 Groomsbridge Rd

- 10285 Groomsbridge Rd Unit 5

- 5425 Taylor Rd Unit 2

- 10840 Mortons Crossing

- 225 Morton Creek Cir

- 512 Winston Croft Cir Unit 57

- 510 Winston Croft Cir Unit 56

- 504 Winston Croft Cir Unit 54

- 390 Laurel Green Way Unit LL 222 1st

- 390 Laurel Green Way

- 405 Laurel Green Way

- 4910 Red Robin Ridge

- 380 Laurel Green Way

- 4920 Red Robin Ridge

- 5245 Cameron Forest Pkwy Unit V

- 4945 Red Robin Ridge

- 4930 Red Robin Ridge

- 5255 Cameron Forest Pkwy

- 4955 Red Robin Ridge

- 10445 Saint Simonds Ct

- 10455 Saint Simonds Ct

- 10465 Saint Simonds Ct Unit III

- 10435 Saint Simonds Ct

- 4940 Red Robin Ridge

- 4965 Red Robin Ridge

- 375 Laurel Green Way

- 5265 Cameron Forest Pkwy

- 10475 Saint Simonds Ct