415 S 1800 E Kaysville, UT 84037

Estimated Value: $724,000 - $998,000

5

Beds

4

Baths

3,886

Sq Ft

$212/Sq Ft

Est. Value

About This Home

This home is located at 415 S 1800 E, Kaysville, UT 84037 and is currently estimated at $825,741, approximately $212 per square foot. 415 S 1800 E is a home located in Davis County with nearby schools including Morgan Elementary School, Fairfield Junior High School, and Davis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2024

Sold by

Soutor Todd and Soutor Danielle

Bought by

Soutor Family Revocable Living Trust and Soutor

Current Estimated Value

Purchase Details

Closed on

Nov 30, 2009

Sold by

Jones Kyle and Jones Sydney

Bought by

Soutor Todd and Soutor Danielle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

4.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 16, 1999

Sold by

Beagley David and Beagley Bonnie

Bought by

Jones Kyle and Jones Sydney

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

6.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Soutor Family Revocable Living Trust | -- | None Listed On Document | |

| Soutor Todd | -- | Hickman Land Title Co | |

| Jones Kyle | -- | Us Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Soutor Todd | $260,000 | |

| Previous Owner | Jones Kyle | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,575 | $366,300 | $187,800 | $178,500 |

| 2023 | $3,500 | $650,000 | $224,853 | $425,147 |

| 2022 | $3,705 | $375,650 | $124,339 | $251,311 |

| 2021 | $3,152 | $483,000 | $183,593 | $299,407 |

| 2020 | $2,823 | $419,000 | $155,731 | $263,269 |

| 2019 | $2,675 | $392,000 | $152,327 | $239,673 |

| 2018 | $2,519 | $364,000 | $144,306 | $219,694 |

| 2016 | $2,303 | $173,360 | $62,396 | $110,964 |

| 2015 | $2,301 | $164,670 | $62,396 | $102,274 |

| 2014 | $1,955 | $148,317 | $61,827 | $86,490 |

| 2013 | -- | $158,417 | $55,228 | $103,189 |

Source: Public Records

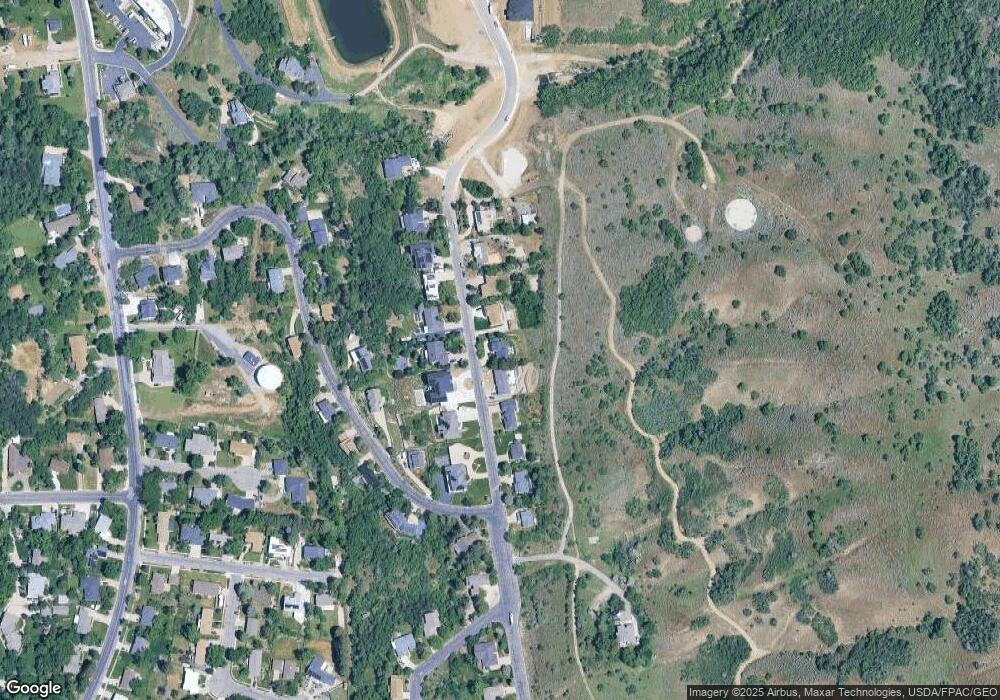

Map

Nearby Homes

- 358 S Eastoaks Dr

- 570 S 1800 E

- 362 Glen Cir

- 1644 E Old Lake Ln

- 399 Stirling Dr E

- 1351 E 400 S

- 1419 E Heights Way Unit 15

- 1543 Mirabella Way Unit 21

- 1425 250 N

- 1730 250 N Unit 23-R

- 1616 250 N Unit 26-R

- 1779 250 N Unit 29-R

- 1053 Sage Ln

- 2076 Summerwood Dr

- 998 E Country Rd

- 947 E Green Rd

- 1043 S Oxford Cir

- 1347 E 650 N Unit 1

- 1370 Oakmont Ln

- 960 E Par Three Cir

- 389 S 1800 E

- 433 S 1800 E

- 377 S 1800 E

- 457 S 1800 E

- 430 S 1800 E Unit 56

- 406 S 1800 E

- 353 S 1800 E

- 368 S 1800 E

- 471 S 1800 E

- 454 S 1800 E Unit 57

- 382 S 1800 E

- 331 S 1800 E

- 487 S 1800 E

- 482 S 1800 E

- 378 Eastoaks Dr

- 344 S 1800 E

- 344 S 1800 E Unit 52

- 415 Eastoaks Dr

- 441 S Eastoaks Dr Unit 2

- 441 S Eastoaks Dr