Estimated Value: $806,000 - $927,000

4

Beds

3

Baths

3,444

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 415 W 4050 N Unit 103, Lehi, UT 84043 and is currently estimated at $857,358, approximately $248 per square foot. 415 W 4050 N Unit 103 is a home located in Utah County with nearby schools including Belmont Elementary, Skyridge High School, and Ignite Entrepreneurship Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2022

Sold by

Jason Kitchen

Bought by

Ahlander Robert M and Ahlander Brooke M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$782,913

Outstanding Balance

$744,852

Interest Rate

5.09%

Mortgage Type

New Conventional

Estimated Equity

$112,506

Purchase Details

Closed on

Dec 1, 2014

Sold by

Wasatch Land Co

Bought by

Kitchen Jason and Kitchen Maegan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,000

Interest Rate

3.92%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ahlander Robert M | -- | Old Republic Title | |

| Kitchen Jason | -- | Affiliated First Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ahlander Robert M | $782,913 | |

| Previous Owner | Kitchen Jason | $283,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,219 | $400,785 | $254,200 | $474,500 |

| 2024 | $3,018 | $376,695 | $0 | $0 |

| 2023 | $3,018 | $383,515 | $0 | $0 |

| 2022 | $2,834 | $349,140 | $0 | $0 |

| 2021 | $2,684 | $499,900 | $174,400 | $325,500 |

| 2020 | $2,530 | $465,700 | $161,500 | $304,200 |

| 2019 | $2,263 | $433,000 | $161,500 | $271,500 |

| 2018 | $2,357 | $426,500 | $155,000 | $271,500 |

| 2017 | $2,199 | $211,475 | $0 | $0 |

| 2016 | $2,145 | $191,455 | $0 | $0 |

| 2015 | $1,884 | $159,610 | $0 | $0 |

Source: Public Records

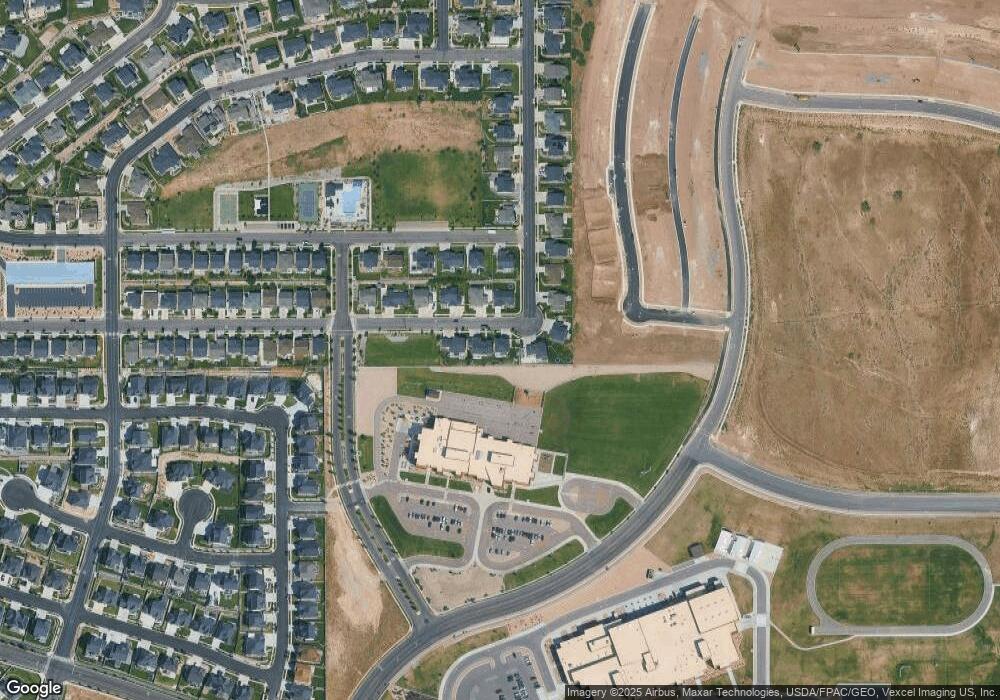

Map

Nearby Homes

- Oakridge Plan at Inverness

- Harmony Plan at Inverness

- Timberlake Plan at Inverness

- Kirkhill Plan at Inverness

- Hamilton Plan at Inverness

- Sydney Plan at Inverness

- Beechwood Plan at Inverness

- Oakley Plan at Inverness

- Dalton Plan at Inverness

- Maclean Plan at Inverness

- Elgin Plan at Inverness

- Overton Plan at Inverness

- Monroe Plan at Inverness

- Broadford Plan at Inverness

- Cullin Plan at Inverness

- Dunbar Plan at Inverness

- Aviemore Plan at Inverness

- Irvine Plan at Inverness

- Mckenzie Plan at Inverness

- Dogwood Plan at Inverness

- 415 W 4050 N

- 437 W 4050 N Unit 102

- 401 W 4050 N Unit 104

- 457 W 4050 N Unit 101

- 457 W 4050 N

- 418 W 4050 N Unit 112

- 4052 N 400 W Unit 105

- 436 W 4050 N Unit 113

- 4068 N 400 W Unit 106

- 454 W 4050 N Unit 114

- 454 W 4050 N

- 413 W 4100 N Unit 111

- 4082 N 400 W Unit 107

- 435 W 4100 N Unit 229

- 472 W 4050 N Unit 115

- 453 W 4100 N Unit 228

- 4096 N 400 W

- 4096 N 400 W Unit 108

- 471 W 4100 N Unit 227

- 490 W 4050 N Unit 116