4150 Cascada Piazza Ln Unit 10 Las Vegas, NV 89135

South Summerlin NeighborhoodEstimated Value: $557,000 - $632,000

2

Beds

2

Baths

1,621

Sq Ft

$361/Sq Ft

Est. Value

About This Home

This home is located at 4150 Cascada Piazza Ln Unit 10, Las Vegas, NV 89135 and is currently estimated at $584,641, approximately $360 per square foot. 4150 Cascada Piazza Ln Unit 10 is a home located in Clark County with nearby schools including Sandra B Abston Elementary School, Victoria Fertitta Middle School, and Durango High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2012

Sold by

Campbell Roy C and Campbell Linda A

Bought by

Campbell Roy Cyril and Campbell Linda A

Current Estimated Value

Purchase Details

Closed on

Nov 14, 2002

Sold by

Sun Colony Summerlin Homes Llc

Bought by

Campbell Roy C and Campbell Linda A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,391

Outstanding Balance

$71,418

Interest Rate

5.95%

Estimated Equity

$513,223

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Campbell Roy Cyril | -- | None Available | |

| Campbell Roy C | $217,239 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Campbell Roy C | $171,391 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,661 | $142,947 | $65,450 | $77,497 |

| 2024 | $3,391 | $142,947 | $65,450 | $77,497 |

| 2023 | $3,391 | $120,296 | $46,900 | $73,396 |

| 2022 | $3,140 | $106,948 | $39,900 | $67,048 |

| 2021 | $2,913 | $100,744 | $37,100 | $63,644 |

| 2020 | $2,702 | $96,661 | $33,600 | $63,061 |

| 2019 | $2,532 | $93,435 | $31,500 | $61,935 |

| 2018 | $2,416 | $86,136 | $26,250 | $59,886 |

| 2017 | $2,513 | $84,255 | $24,938 | $59,317 |

| 2016 | $2,262 | $88,948 | $29,925 | $59,023 |

| 2015 | $2,257 | $76,484 | $18,288 | $58,196 |

| 2014 | $2,187 | $72,694 | $16,625 | $56,069 |

Source: Public Records

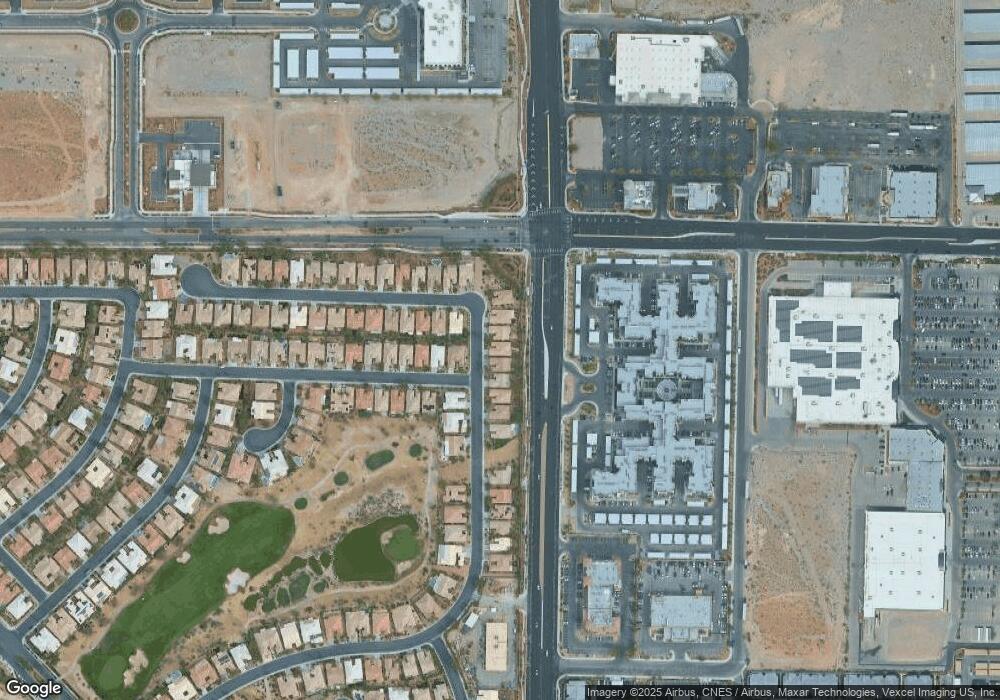

Map

Nearby Homes

- 4174 Cascada Piazza Ln Unit 10

- 4126 Cascada Piazza Ln

- 4134 Riva de Tierra Ln Unit 12

- 10248 Andante Ct

- 4286 Pacifico Ln

- 4438 Regalo Bello St Unit 8

- 4208 Agosta Luna Place Unit 14

- 4311 Fiore Bella Blvd

- 10494 Melodia Magico Ave

- 10358 Riva Largo Ave

- 4508 Regalo Bello St Unit 6

- 10531 Riva Grande Ct

- 10532 Riva Grande Ct

- 10534 Mandarino Ave

- 10550 Mandarino Ave

- 4549 Largo Cantata St

- 10059 Oak Creek Canyon Ave

- 10001 Peace Way Unit 2309

- 10001 Peace Way Unit 2276

- 10001 Peace Way Unit 2322

- 4142 Cascada Piazza Ln

- 4158 Cascada Piazza Ln

- 4166 Cascada Piazza Ln Unit 10

- 4134 Cascada Piazza Ln

- 10220 Riva de Destino Ave

- 10221 Profeta Ct

- 10221 Profeta Ct

- 10221 Profeta Ct

- 4182 Cascada Piazza Ln

- 10228 Riva de Destino Ave

- 10228 Riva de Destino Ave Unit 5130

- 10229 Profeta Ct

- 10229 Profeta Ct Unit 5130

- 4173 Cascada Piazza Ln

- 10236 Riva de Destino Ave

- 10218 Profeta Ct Unit 10

- 10237 Profeta Ct

- 4190 Cascada Piazza Ln

- 4183 Cascada Piazza Ln

- 10233 Riva de Destino Ave