4154 Brandonmore Dr Cincinnati, OH 45255

Estimated Value: $477,000 - $510,000

3

Beds

3

Baths

2,713

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 4154 Brandonmore Dr, Cincinnati, OH 45255 and is currently estimated at $496,778, approximately $183 per square foot. 4154 Brandonmore Dr is a home located in Clermont County with nearby schools including Withamsville-Tobasco Elementary School, West Clermont Middle School, and West Clermont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 20, 2001

Sold by

England Michael S

Bought by

Mcswigan Thomas J and Mcswigan Leslie M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Outstanding Balance

$81,522

Interest Rate

7.06%

Mortgage Type

New Conventional

Estimated Equity

$415,256

Purchase Details

Closed on

May 15, 2000

Sold by

Crable Scott C

Bought by

England Michael S and England Therese

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,000

Interest Rate

8.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 8, 1995

Sold by

Drees Co

Bought by

Crable Scott C and Crable Ann W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

8.26%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 18, 1995

Sold by

Ven Drees Bartlett Joint

Bought by

Drees Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcswigan Thomas J | $260,000 | -- | |

| England Michael S | $240,000 | -- | |

| Crable Scott C | $219,630 | -- | |

| Drees Co | $23,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcswigan Thomas J | $208,000 | |

| Previous Owner | England Michael S | $216,000 | |

| Previous Owner | Crable Scott C | $160,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,793 | $133,110 | $20,300 | $112,810 |

| 2023 | $6,803 | $133,110 | $20,300 | $112,810 |

| 2022 | $6,504 | $110,250 | $16,800 | $93,450 |

| 2021 | $6,532 | $110,250 | $16,800 | $93,450 |

| 2020 | $6,538 | $110,250 | $16,800 | $93,450 |

| 2019 | $5,493 | $107,940 | $16,800 | $91,140 |

| 2018 | $5,549 | $107,940 | $16,800 | $91,140 |

| 2017 | $5,620 | $107,940 | $16,800 | $91,140 |

| 2016 | $5,114 | $89,950 | $14,000 | $75,950 |

| 2015 | $4,887 | $89,950 | $14,000 | $75,950 |

| 2014 | $4,884 | $89,950 | $14,000 | $75,950 |

| 2013 | $4,489 | $81,800 | $15,400 | $66,400 |

Source: Public Records

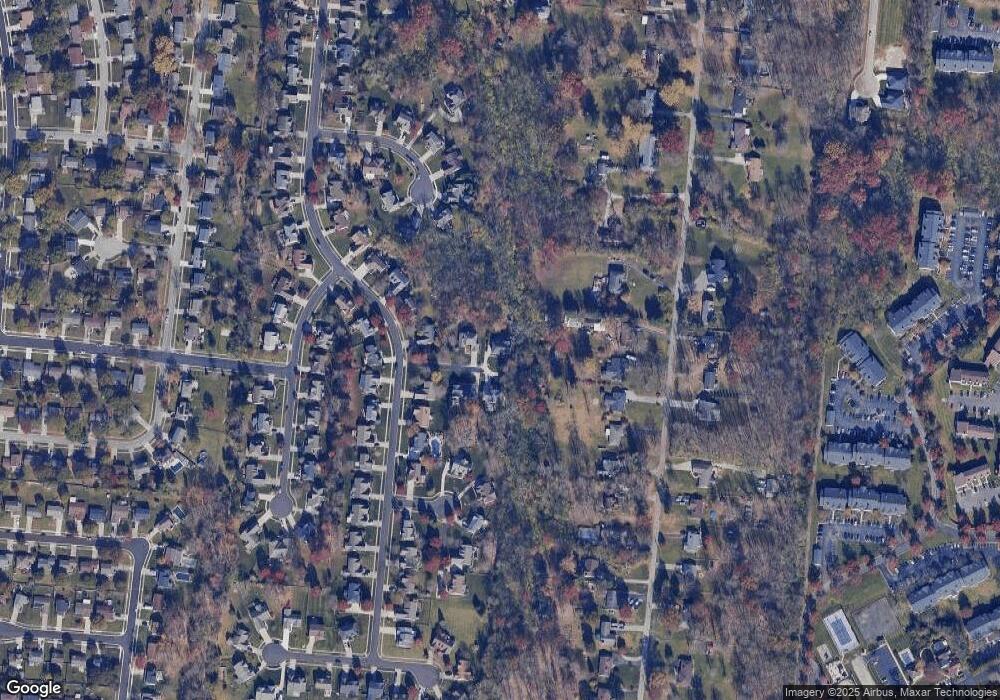

Map

Nearby Homes

- 4133 Brandonmore Dr

- 4077 Mclean Dr

- 4047 Mclean Dr

- 425 Mcintosh Dr Unit 22A

- 1747 Summithills Dr

- 0 Clough Pike Unit 1861584

- 4182 Mount Carmel Tobasco Rd

- 496 Mapleleaf Dr

- 492 Mapleleaf Dr

- 8488 Holiday Hills Dr

- 1333 Eight Mile Rd

- 1251 Eight Mile Rd

- 1472 Sigma Cir

- 8345 Cherry Ln

- 1847 Eight Mile Rd

- 537 Tradition Ridge

- 539 Tradition Ridge

- 535 Tradition Ridge

- 533 Tradition Ridge

- 549 Tradition Ridge

- 4156 Brandonmore Dr

- 4158 Brandonmore Dr

- 4152 Brandonmore Dr

- 4150 Brandonmore Dr

- 4160 Brandonmore Dr

- 4148 Brandonmore Dr

- 4146 Brandonmore Dr

- 4162 Brandonmore Dr

- 4137 Mclean Dr

- 451 Maplecroft Ct

- 453 Maplecroft Ct

- 4125 Mclean Dr

- 4153 Brandonmore Dr

- 4131 Mclean Dr

- 4144 Brandonmore Dr

- 4157 Brandonmore Dr

- 462 Brandsteade Ct

- 4121 Mclean Dr

- 4164 Brandonmore Dr

- 4149 Brandonmore Dr

Your Personal Tour Guide

Ask me questions while you tour the home.