416 Fullers Cir Unit 704 Pickerington, OH 43147

Estimated Value: $235,000 - $250,837

2

Beds

3

Baths

1,522

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 416 Fullers Cir Unit 704, Pickerington, OH 43147 and is currently estimated at $242,959, approximately $159 per square foot. 416 Fullers Cir Unit 704 is a home located in Fairfield County with nearby schools including Pickerington Elementary School, Pickerington Ridgeview Junior High School, and Diley Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2015

Sold by

Osborne Robert L and Osborne Debbie S

Bought by

Dearing Charles S and Dearing Manju T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,500

Interest Rate

3.97%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 20, 2008

Sold by

Portrait Homes Pickerington Pointe Llc

Bought by

Osborne Robert L and Osborne Debbie S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,200

Interest Rate

5.51%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dearing Charles S | $78,500 | First Ohio Title Ins Box | |

| Osborne Robert L | $119,100 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Dearing Charles S | $58,500 | |

| Closed | Osborne Robert L | $95,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,793 | $55,180 | $4,200 | $50,980 |

| 2023 | $2,665 | $55,180 | $4,200 | $50,980 |

| 2022 | $2,674 | $55,180 | $4,200 | $50,980 |

| 2021 | $2,398 | $42,120 | $3,500 | $38,620 |

| 2020 | $2,424 | $42,120 | $3,500 | $38,620 |

| 2019 | $2,440 | $42,120 | $3,500 | $38,620 |

| 2018 | $2,186 | $36,410 | $3,500 | $32,910 |

| 2017 | $2,189 | $32,880 | $3,500 | $29,380 |

| 2016 | $2,179 | $32,880 | $3,500 | $29,380 |

| 2015 | $2,177 | $31,870 | $3,500 | $28,370 |

| 2014 | $2,151 | $31,870 | $3,500 | $28,370 |

| 2013 | $2,151 | $31,870 | $3,500 | $28,370 |

Source: Public Records

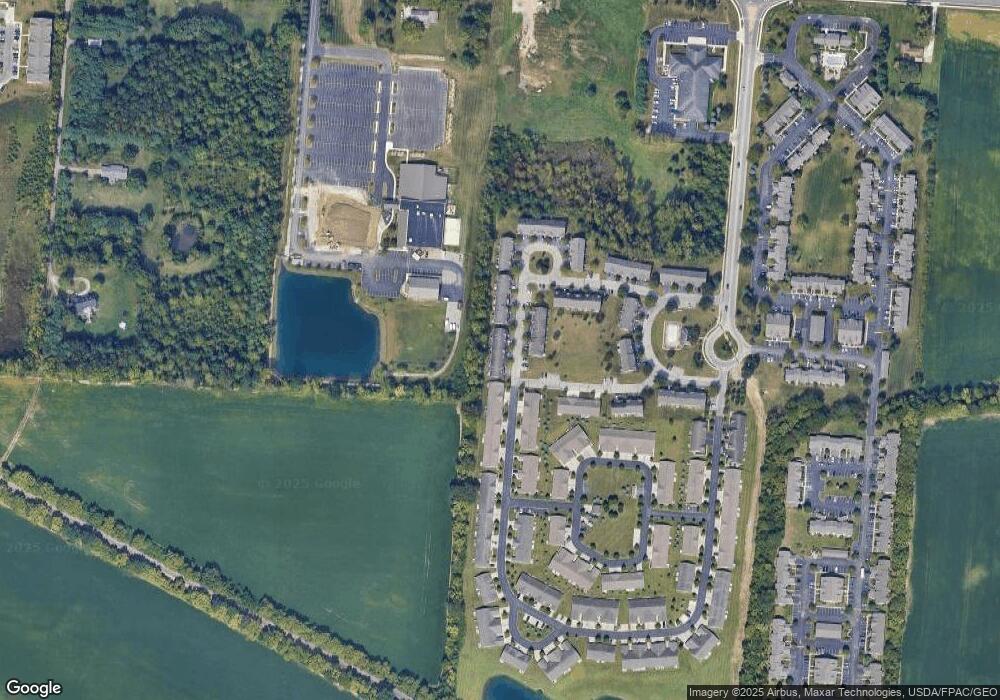

Map

Nearby Homes

- 0 Refugee Rd

- 3535 Wheatfield Dr

- 3878 Willow Branch Dr

- 165 Norland Dr

- 3682 Winding Path Dr

- 7505 Winding Path Ct

- 7490 Sugarbark Ct

- 7449 Sugarbark Ct

- 937 McMunn St

- 7287 Candlestone Dr

- 3266 Tumwater Valley Dr

- 7673 Harbour Town Dr

- 0 Windmiller Dr

- 165 Lorrimore Dr

- 250 Sterndale Dr

- 3233 Mahaffey Ct

- 908 Washington St

- 3205 Mahaffey Ct

- 307 Belstone St Unit 307

- 7801 Cedar Ridge Dr

- 420 Fullers Cir Unit 705

- 412 Fullers Cir Unit 703

- 424 Fullers Cir Unit 706

- 408 Fullers Cir Unit 702

- 408 Fullers Cir

- 404 Fullers Cir Unit 701

- 404 Fuller's Cir

- 428 Fuller's Cir

- 428 Fullers Cir Unit 601

- 432 Fullers Cir Unit 602

- 415 Fullers Cir Unit 806

- 419 Fullers Cir Unit 805

- 423 Fullers Cir Unit 804

- 436 Fullers Cir Unit 603

- 427 Fullers Cir Unit 803

- 431 Fullers Cir Unit 802

- 440 Fullers Cir Unit 604

- 444 Fullers Cir Unit 605

- 448 Fullers Cir Unit 606

- 491 Fullers Cir Unit 906