419 Osprey Rd Jefferson, CO 80456

Estimated Value: $305,000 - $392,000

1

Bed

1

Bath

960

Sq Ft

$377/Sq Ft

Est. Value

About This Home

This home is located at 419 Osprey Rd, Jefferson, CO 80456 and is currently estimated at $362,076, approximately $377 per square foot. 419 Osprey Rd is a home located in Park County with nearby schools including Edith Teter Elementary School, Cienega Elementary School, and South Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2022

Sold by

Egger Beverly K

Bought by

Egger Jennifer Kay

Current Estimated Value

Purchase Details

Closed on

Sep 26, 2019

Sold by

Weiss Robert E

Bought by

Conroy Thomas Francis and Conroy Jennifer Kay

Purchase Details

Closed on

Jul 13, 2010

Sold by

Bock Mary Jo and Heins Mary Jo

Bought by

Weiss Robert E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,000

Interest Rate

4.73%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 31, 2010

Sold by

Bock Gregory L

Bought by

Heins Mary Jo

Purchase Details

Closed on

Jun 23, 2009

Sold by

Bock Gregory L

Bought by

Bock Mary Jo

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Egger Jennifer Kay | -- | -- | |

| Conroy Thomas Francis | $192,000 | Fidelity National Title | |

| Weiss Robert E | $92,000 | Guardian Title | |

| Heins Mary Jo | -- | None Available | |

| Bock Mary Jo | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Weiss Robert E | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,254 | $22,030 | $3,540 | $18,490 |

| 2023 | $1,254 | $22,030 | $3,540 | $18,490 |

| 2022 | $1,095 | $16,842 | $2,647 | $14,195 |

| 2021 | $1,107 | $17,320 | $2,720 | $14,600 |

| 2020 | $485 | $7,390 | $1,920 | $5,470 |

| 2019 | $471 | $7,390 | $1,920 | $5,470 |

| 2018 | $413 | $7,390 | $1,920 | $5,470 |

| 2017 | $356 | $6,350 | $2,000 | $4,350 |

| 2016 | $411 | $7,240 | $2,080 | $5,160 |

| 2015 | $419 | $7,240 | $2,080 | $5,160 |

| 2014 | $459 | $0 | $0 | $0 |

Source: Public Records

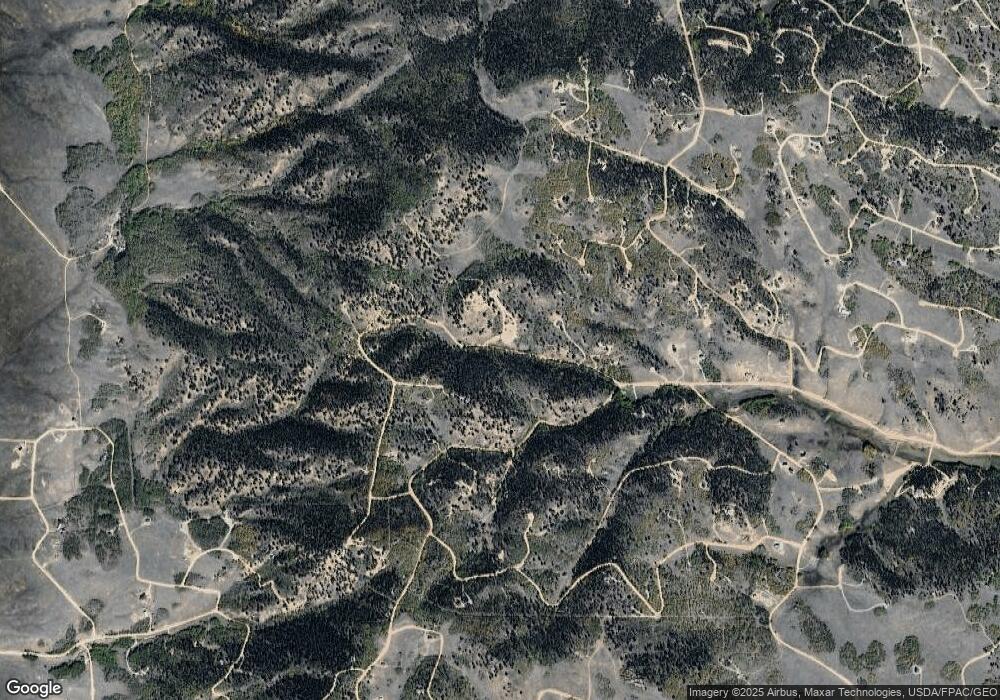

Map

Nearby Homes

- 129 Osprey Rd

- 6325 Remington Rd

- 259 Falcon Rd

- 00 Night Hawk Cir

- 258 Old Squaw Rd

- 1087 Kite Ct

- 513 Night Hawk Cir

- 457 Caracara Ln

- 215 Gadwall Rd

- 28 Old Squaw Rd

- 373 Mockingbird Cir

- 305 Travois Ct

- 53 Anhinga Rd

- 74 Noxibee Ct

- 00 Hornbill Way Unit 8

- TBD Hornbill

- 803 Link Rd

- 735 Link Rd

- 654 Piaute Way

- 654 Piute Way